- United States

- /

- Consumer Durables

- /

- NasdaqGS:PRPL

Purple Innovation, Inc. (NASDAQ:PRPL) Looks Inexpensive But Perhaps Not Attractive Enough

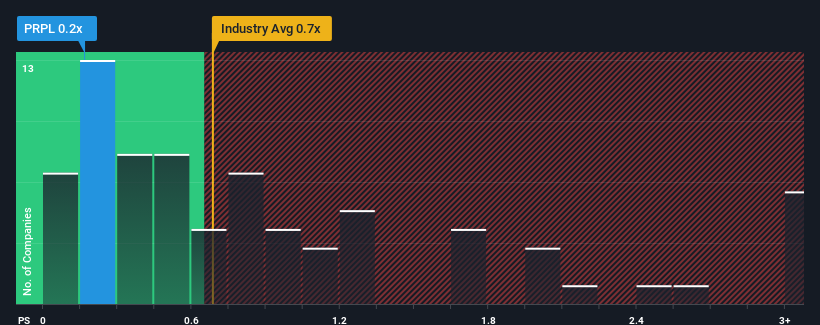

Purple Innovation, Inc.'s (NASDAQ:PRPL) price-to-sales (or "P/S") ratio of 0.2x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Consumer Durables industry in the United States have P/S ratios greater than 0.7x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Purple Innovation

What Does Purple Innovation's Recent Performance Look Like?

Purple Innovation hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Purple Innovation will help you uncover what's on the horizon.How Is Purple Innovation's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Purple Innovation's is when the company's growth is on track to lag the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 29% drop in revenue. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 2.8% per year during the coming three years according to the eight analysts following the company. With the industry predicted to deliver 6.0% growth per annum, the company is positioned for a weaker revenue result.

With this information, we can see why Purple Innovation is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does Purple Innovation's P/S Mean For Investors?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Purple Innovation maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Purple Innovation that you should be aware of.

If these risks are making you reconsider your opinion on Purple Innovation, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:PRPL

Purple Innovation

Designs, manufactures, and sells sleep and other products in the United States and internationally.

Slight risk and fair value.

Similar Companies

Market Insights

Community Narratives