- United States

- /

- Luxury

- /

- NasdaqGS:VRA

AMMO And 2 Other Promising US Penny Stocks To Consider

Reviewed by Simply Wall St

As the U.S. equities market experiences a year-end slump, with major indices like the S&P 500 and Dow Jones Industrial Average facing their largest monthly losses since April, investors are seeking opportunities that may not be as affected by broader market trends. Penny stocks, often associated with smaller or newer companies, still hold potential for those willing to explore beyond traditional large-cap investments. Despite being considered a relic of past trading days, penny stocks can offer significant opportunities when supported by strong financials and growth prospects.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.8301 | $6.25M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.19 | $1.87B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $104.78M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.285 | $9.2M | ★★★★★★ |

| Tantech Holdings (NasdaqCM:TANH) | $0.23 | $1.59M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $3.07 | $87.96M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.50 | $44.07M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.39 | $25.72M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.08 | $96.23M | ★★★★★☆ |

Click here to see the full list of 737 stocks from our US Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

AMMO (NasdaqCM:POWW)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: AMMO, Inc. designs, produces, and markets ammunition and related products for various customers including sports shooters, hunters, and law enforcement agencies with a market cap of $125.88 million.

Operations: The company's revenue is derived from two main segments: Ammunition, generating $89.44 million, and Marketplace, contributing $52.31 million.

Market Cap: $125.88M

AMMO, Inc. faces challenges as it works to regain compliance with Nasdaq listing requirements due to delayed SEC filings amid an ongoing investigation. Despite being unprofitable, the company maintains a strong liquidity position with short-term assets of US$134 million exceeding liabilities and more cash than total debt. While AMMO has reduced its debt-to-equity ratio significantly over five years, it remains embroiled in legal issues, including a class action lawsuit alleging inadequate financial disclosures. Investors should note the company's stable weekly volatility and sufficient cash runway extending beyond three years despite current profitability concerns.

- Dive into the specifics of AMMO here with our thorough balance sheet health report.

- Explore AMMO's analyst forecasts in our growth report.

QuantaSing Group (NasdaqGM:QSG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: QuantaSing Group Limited offers online learning services in the People's Republic of China and has a market cap of approximately $104.78 million.

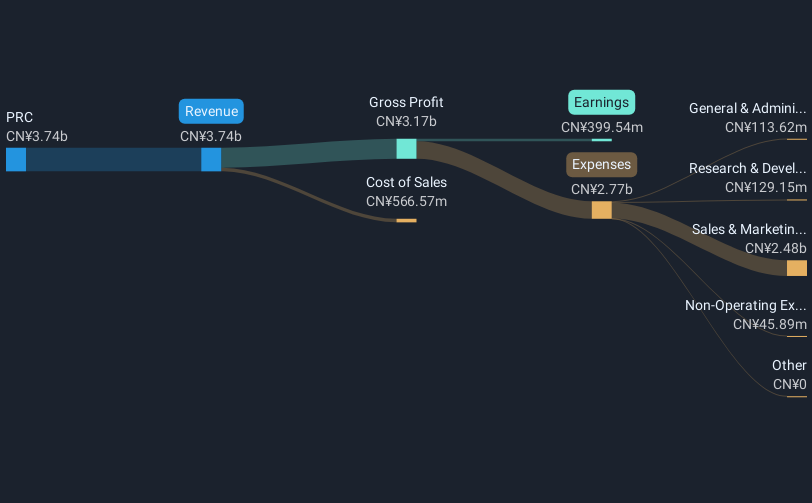

Operations: The company generates revenue of CN¥3.74 billion from its operations in the People's Republic of China.

Market Cap: $104.78M

QuantaSing Group Limited, with a market cap of approximately US$104.78 million, has demonstrated robust earnings growth, surging by 839.8% over the past year and achieving profitability over five years with an average annual growth rate of 108%. Despite earnings being forecasted to decline by an average of 25.6% annually for the next three years, the company trades at a significant discount to its estimated fair value and maintains strong financial health with no debt and short-term assets exceeding liabilities. Recent activities include share buybacks and a special dividend distribution, reflecting strategic capital management efforts amidst high share price volatility.

- Click here and access our complete financial health analysis report to understand the dynamics of QuantaSing Group.

- Examine QuantaSing Group's earnings growth report to understand how analysts expect it to perform.

Vera Bradley (NasdaqGS:VRA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Vera Bradley, Inc. designs, manufactures, and sells women's handbags, luggage and travel items, fashion and home accessories, and gifts with a market cap of $99.82 million.

Operations: The company's revenue is generated from three segments: Pura Vida at $63.76 million, Vera Bradley Direct at $274.13 million, and Vera Bradley Indirect at $67.38 million.

Market Cap: $99.82M

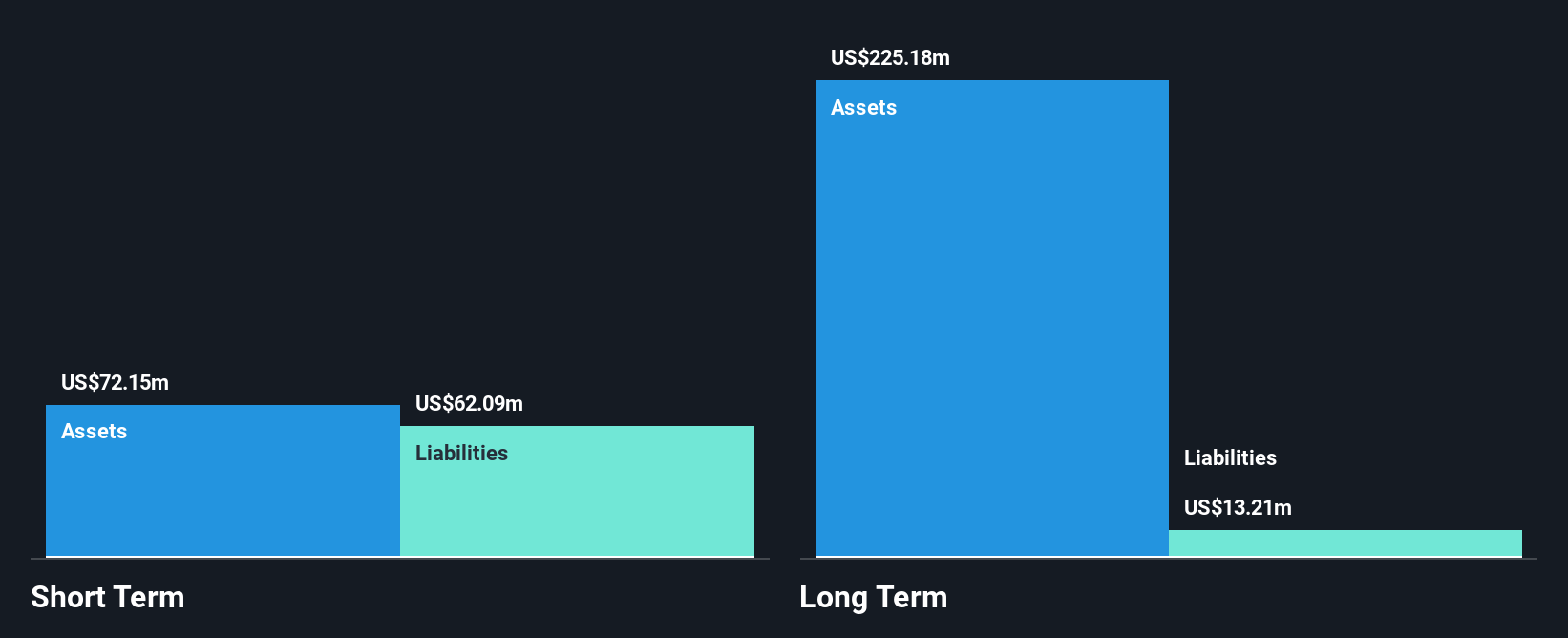

Vera Bradley, Inc., with a market cap of US$99.82 million, is navigating challenges as it remains unprofitable with increasing losses over the past five years. Despite this, the company is debt-free and its short-term assets significantly exceed liabilities, indicating solid financial health. Recent earnings guidance suggests expected consolidated net revenues of approximately US$385 million for fiscal year ending February 2025. The company has initiated a share repurchase program worth up to US$30 million, highlighting strategic capital management efforts. The board and management team are experienced, potentially aiding in future growth initiatives amidst current volatility in earnings performance.

- Click to explore a detailed breakdown of our findings in Vera Bradley's financial health report.

- Learn about Vera Bradley's future growth trajectory here.

Next Steps

- Reveal the 737 hidden gems among our US Penny Stocks screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VRA

Vera Bradley

Designs, manufactures, and sells women’s handbags, luggage and travel items, fashion and home accessories, and gifts.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives