- United States

- /

- Leisure

- /

- NasdaqGS:MAT

What Mattel (MAT)'s Audi Hot Wheels Partnership Means for Shareholders

Reviewed by Sasha Jovanovic

- Mattel, Inc. recently announced a partnership with quattro GmbH and Auto Union GmbH, subsidiaries of AUDI AG, to launch new Hot Wheels building sets featuring the Audi Avant RS2 and Audi R8 LMS, now available for pre-sale at major retailers ahead of their fall release.

- This collaboration blends a leading toy brand with iconic automotive heritage, introducing collectible sets tailored to both enthusiasts and adult collectors.

- We'll explore how the introduction of customized, collectible automotive sets could influence Mattel's growth strategy and brand expansion.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Mattel Investment Narrative Recap

To be a Mattel shareholder, you have to believe the company can evolve its core brands and ignite new sources of growth, especially with innovative products that capture both traditional and adult collectors. While the new Hot Wheels x Audi building sets may reinforce brand appeal and broaden Mattel's adult collector reach, this launch is unlikely to materially shift the most important near-term catalyst, which remains meaningful progress in digital content and play experiences; the biggest risk continues to be heavy dependence on a handful of legacy franchises and shifting consumer trends. Mattel’s recently announced collaboration with OpenAI, aimed at delivering AI-powered products based on iconic properties, is arguably more significant for future catalysts than the Audi partnership. Leveraging digital innovation could address long-term risks tied to product relevance and evolving entertainment habits, a theme increasingly critical as consumers migrate away from classic toys toward digital and cross-platform experiences. Yet, keep in mind that despite these innovations, Mattel's focus on a few core brands could still expose investors to...

Read the full narrative on Mattel (it's free!)

Mattel's narrative projects $5.8 billion revenue and $533.3 million earnings by 2028. This requires 2.7% yearly revenue growth and a $7 million earnings increase from $526.3 million.

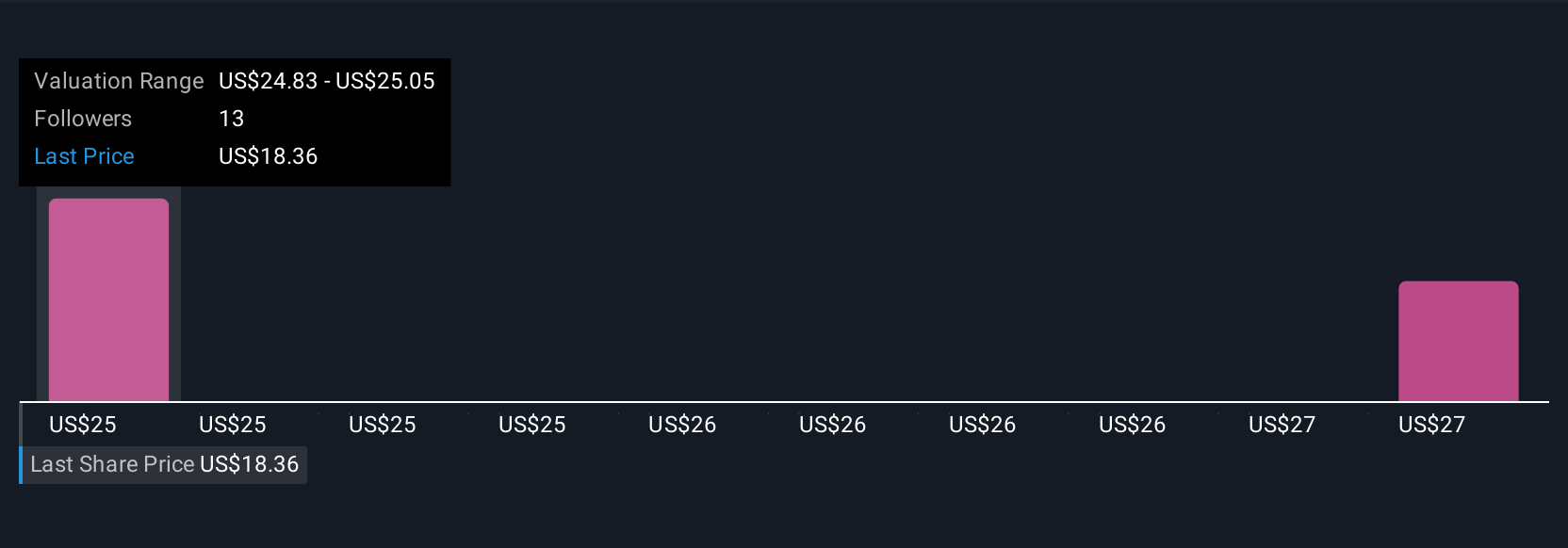

Uncover how Mattel's forecasts yield a $24.83 fair value, a 44% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community members estimate Mattel’s fair value between US$21.29 and US$26.11 per share, suggesting varied views on potential upside. Some see fresh digital initiatives as key for Mattel to overcome traditional toy market pressures, making it important to consider several perspectives before your next step.

Explore 3 other fair value estimates on Mattel - why the stock might be worth as much as 52% more than the current price!

Build Your Own Mattel Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mattel research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Mattel research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mattel's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MAT

Mattel

A toy and family entertainment company, designs, manufactures, and markets toys and consumer products in North America, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives