- United States

- /

- Leisure

- /

- NasdaqGS:MAT

Mattel (MAT) Margin Decline Reinforces Market’s Cautious Narrative Despite Strong Valuation

Reviewed by Simply Wall St

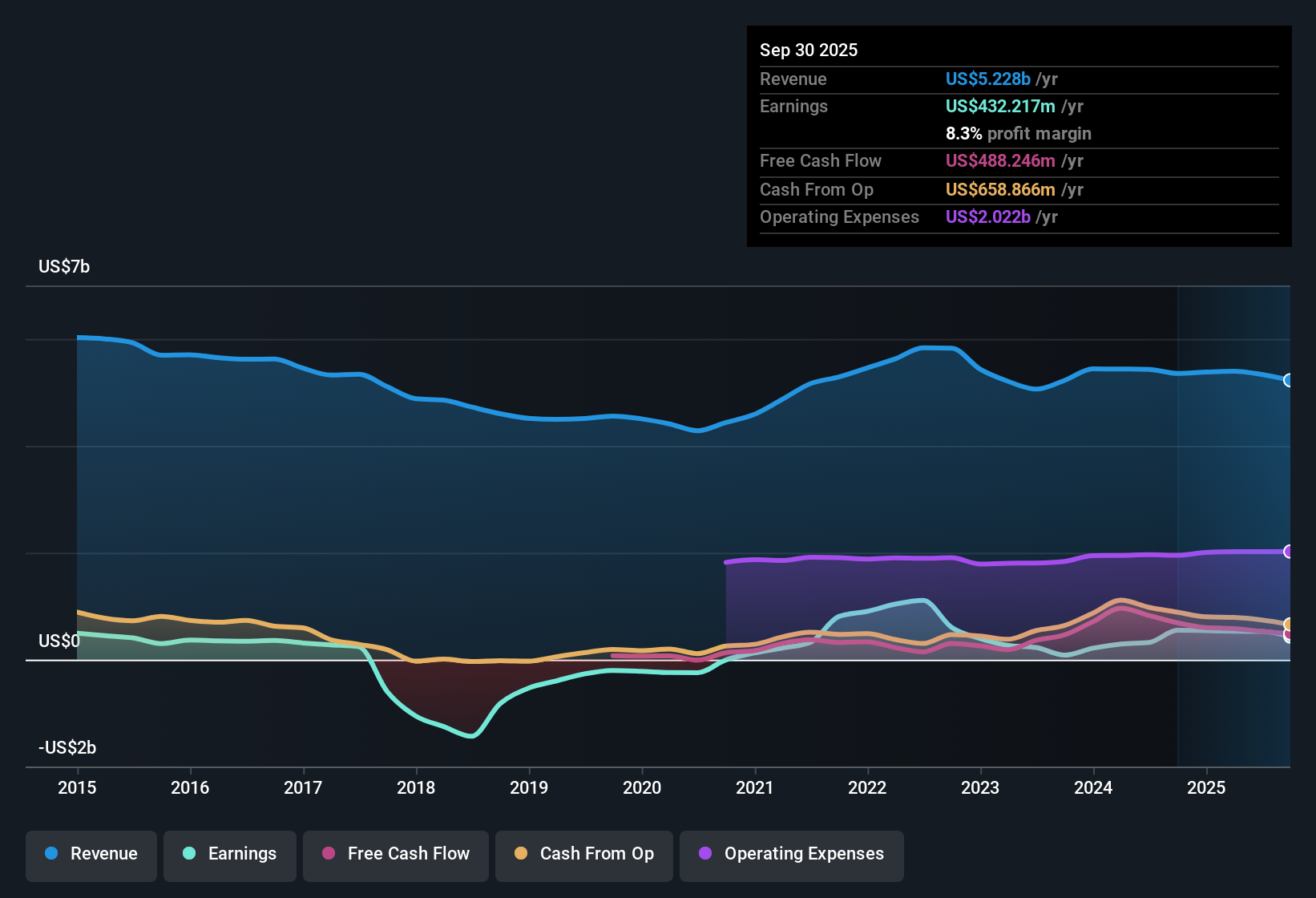

Mattel (MAT) posted an annual earnings forecast of 5.9% growth, with revenues expected to rise by 3.2% per year. Both figures lag significantly behind the broader US market’s average forecasts of 15.5% for earnings and 10.1% for revenue. The company’s net profit margin slipped to 8.3% from last year’s 10.2%, reflecting negative earnings growth over the past year. Still, investors saw positives in Mattel’s valuation, as its shares trade at a notably lower Price-to-Earnings Ratio (13.6x) compared to peers and below recent fair value estimates, suggesting strong value despite margin pressures.

See our full analysis for Mattel.Next, we will compare the latest results with the most popular market narratives to see where Mattel’s story aligns with the numbers and where expectations might shift.

See what the community is saying about Mattel

Analyst Price Target Sits 32.6% Above Share Price

- With Mattel shares trading at $18.30, analysts have set a consensus price target of $24.27, representing an upside of 32.6% from current levels.

- Analysts' consensus view sees this target as achievable if Mattel delivers $5.8 billion in revenue, $533.3 million in earnings, and maintains a future PE of 16.6x.

- This projected PE is still below both the current US leisure industry average (24.0x) and Mattel’s present peer group (59.6x).

- The consensus acknowledges that while estimates require execution on several fronts, most analysts are in agreement about Mattel’s steady, if unspectacular, earnings path.

See how this outlook matches up with the latest consensus narrative for Mattel. 📊 Read the full Mattel Consensus Narrative.

DCF Fair Value Implies Deeper Discount

- The DCF fair value calculation places Mattel at $27.02 per share, making its current price an even steeper discount compared to analyst targets.

- According to the consensus narrative, this disconnect reflects the market’s skepticism about Mattel’s ability to hit growth and profitability benchmarks, but the strong margin of safety is hard to ignore.

- Mattel’s price-to-earnings ratio of 13.6x is well below the peer average (59.6x) and industry average (20.6x), aligning with the view that shares are attractively valued as long as forecasts are met.

- The relatively low level of flagged risks, with just one minor note about the financial position, supports the idea that downside appears limited if management delivers on plans.

Margin Pressure Offsets Top-Line Gains

- Mattel’s net profit margin slipped to 8.3% this year, down from 10.2% last year, signaling margin compression despite rising revenues.

- Analysts' consensus narrative highlights how ongoing cost controls, product innovation, and international growth remain core to offsetting input cost pressures.

- The company has already achieved $126 million in savings toward a $200 million target by 2026, aiming to stabilize margins over the next several years.

- However, continued softness in legacy categories and risks tied to media ventures mean that pressure on margins could persist unless new initiatives outperform expectations.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Mattel on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Want to interpret the figures your way? Shape your take on Mattel’s story in just a few minutes. Do it your way.

A great starting point for your Mattel research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Mattel’s sluggish profit growth and ongoing margin compression highlight the challenges of achieving consistent earnings despite modest gains in revenue.

If you want to focus on companies with more reliable bottom-line performance, use stable growth stocks screener (2093 results) to find those delivering steady revenue and consistent earnings expansion through changing market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MAT

Mattel

A toy and family entertainment company, designs, manufactures, and markets toys and consumer products in North America, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives