- United States

- /

- Leisure

- /

- NasdaqGS:MAT

Could Mattel’s (MAT) MoMA Partnership Reflect a Broader Shift in Brand Positioning Strategy?

Reviewed by Sasha Jovanovic

- Mattel, Inc. and The Museum of Modern Art (MoMA) recently announced a five-year global partnership, launching a capsule collection inspired by MoMA’s art and bringing Mattel’s brands to MoMA stores in New York and Japan.

- This collaboration blends iconic toys like Barbie and Hot Wheels with masterpieces from the art world, highlighting Mattel’s ongoing push for creative partnerships and cultural relevance.

- We’ll explore how Mattel’s MoMA partnership could reinforce its efforts to expand brand reach and deepen consumer engagement.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Mattel Investment Narrative Recap

Being a shareholder in Mattel today means believing the company can evolve its iconic brands through fresh partnerships and cultural relevance, while broadening its global reach. The new MoMA capsule collection supports this vision, but its short-term impact on Mattel’s key catalysts, entertainment releases, product innovation, and expansion in digital play, is likely immaterial; instead, the biggest immediate risk remains Mattel’s heavy reliance on core brands like Barbie and Hot Wheels, which could amplify volatility if demand wanes.

Among Mattel’s recent announcements, the Team Barbie initiative for International Day of the Girl stands out for its alignment with the brand’s push for inclusivity and ongoing product refresh. This complements the MoMA partnership’s strategy to deepen cultural engagement and attract both new and returning consumers, supporting efforts to revitalize core franchises and foster resilience amid evolving toy industry trends.

But while brand collaborations may attract attention, investors should also note the potential impact if core brands...

Read the full narrative on Mattel (it's free!)

Mattel's outlook anticipates $5.8 billion in revenue and $533.3 million in earnings by 2028. This is based on a 2.7% annual revenue growth rate and a $7 million increase in earnings from the current $526.3 million.

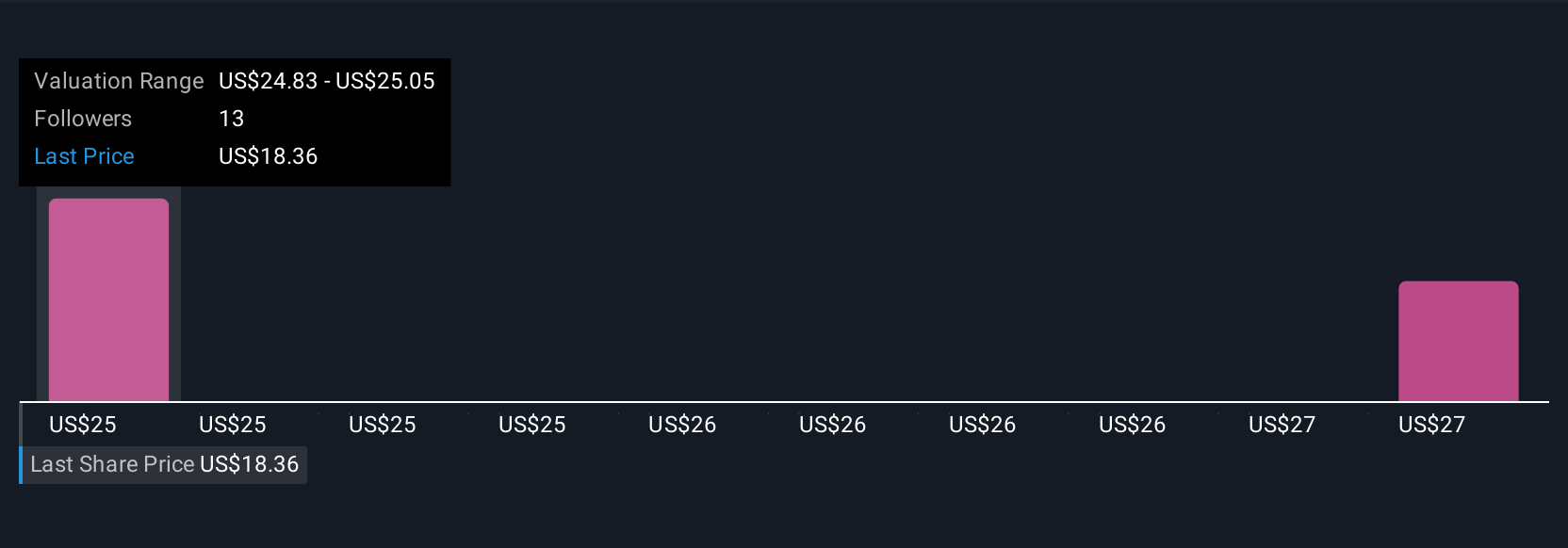

Uncover how Mattel's forecasts yield a $24.83 fair value, a 45% upside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community range between US$21.29 and US$26.28. Despite this diversity, the company’s continued reliance on lead brands remains a point of focus for many weighing future opportunities versus risks.

Explore 3 other fair value estimates on Mattel - why the stock might be worth as much as 54% more than the current price!

Build Your Own Mattel Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mattel research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Mattel research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mattel's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MAT

Mattel

A toy and family entertainment company, designs, manufactures, and markets toys and consumer products in North America, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives