- United States

- /

- Leisure

- /

- NasdaqGS:MAT

Could Mattel’s (MAT) Latest Debt Move Reveal Shifts in Its Long-Term Capital Strategy?

Reviewed by Sasha Jovanovic

- Mattel, Inc. completed a fixed-income offering, raising US$598.24 million through 5% senior unsecured notes due November 17, 2030, at a price of 99.707% of par.

- This move underscores Mattel's intention to access additional capital while balancing financial flexibility and long-term capital structure considerations.

- We'll explore how Mattel's issuance of callable senior unsecured notes could shape its investment narrative around liquidity and debt management.

The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

What Is Mattel's Investment Narrative?

For those considering Mattel as a long-term holding, the investment story centers around its ability to sustain brand relevance through collaborations with pop culture icons, expansion into emerging toy segments, and digital initiatives such as the Roblox and OpenAI partnerships. While the company’s pipeline of product launches and licensing deals remains a steady catalyst, the recent US$598.24 million fixed-income offering brings balance sheet decisions into sharper focus. This influx of capital via 5% senior unsecured notes looks to support operational flexibility, but with debt levels already high and recent earnings showing a year-on-year decline, the move could adjust near-term risk perceptions around leverage and interest costs. At the same time, Mattel’s reaffirmed guidance and buyback activity indicate management’s commitment to shareholder value, but the rising debt warrants continued attention alongside performance in core franchises and execution on upcoming launches.

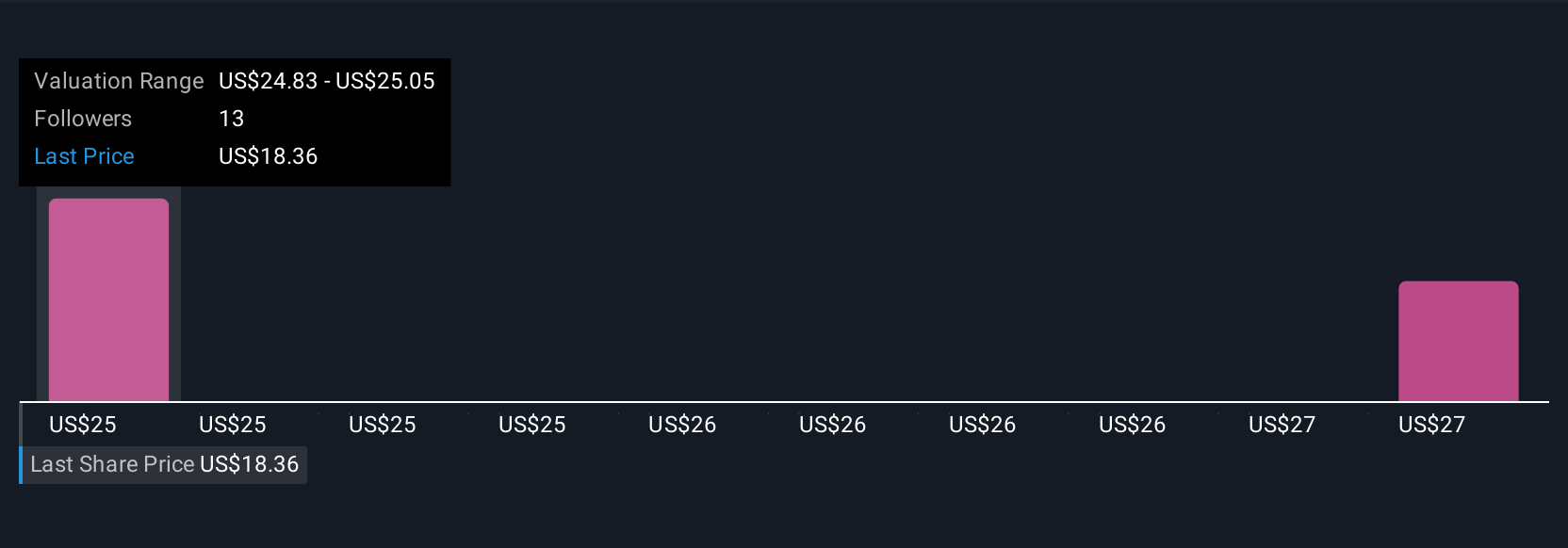

But amidst these growth opportunities, increasing debt remains a risk investors should watch closely. Mattel's shares have been on the rise but are still potentially undervalued by 40%. Find out what it's worth.Exploring Other Perspectives

Explore 3 other fair value estimates on Mattel - why the stock might be worth as much as 67% more than the current price!

Build Your Own Mattel Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mattel research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Mattel research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mattel's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MAT

Mattel

A toy and family entertainment company, designs, manufactures, and markets toys and consumer products in North America, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives