- United States

- /

- Luxury

- /

- NasdaqGS:LULU

Lululemon Athletica (NasdaqGS:LULU) Shares Drop 13% in a Week Despite Strong Earnings

Reviewed by Simply Wall St

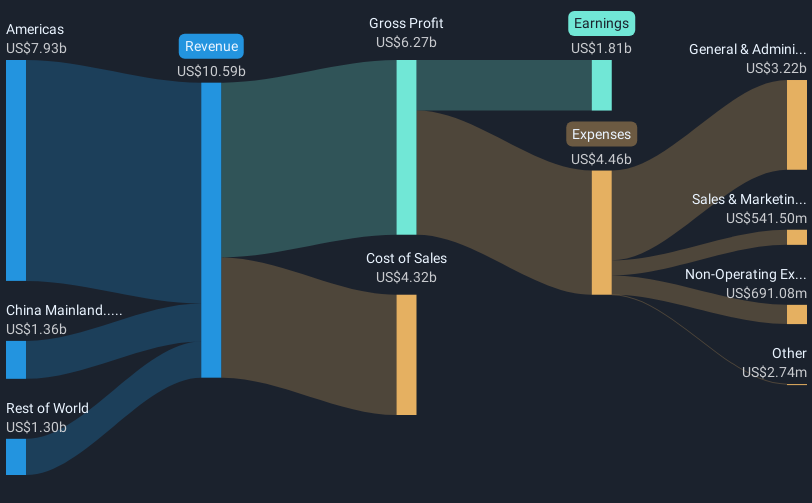

Lululemon Athletica (NasdaqGS:LULU) reported strong financial results for the fiscal year and fourth quarter, with significant improvements in sales and net income compared to the previous year. Despite these positive earnings announcements, the company's share price fell 13% over the past week. Contributing to the decline could be the broader market turbulence, as the major stock indices, such as the S&P 500 and Nasdaq, experienced notable losses amid renewed concerns over tariffs and economic health, alongside weak consumer sentiment data. This market environment has put pressure on many stocks, including LULU.

Over the past five years, Lululemon Athletica achieved a total return of 50.33%, reflecting substantial growth amid various operational changes and market conditions. This period was marked by aggressive international expansion, particularly in the Chinese market, which significantly bolstered the company's international revenue. The integration of merchandising and brand teams streamlined operations, enhancing efficiency and innovation in product assortments, ultimately driving customer engagement and revenue growth.

During this time, Lululemon also initiated strategic share repurchases, executing a buyback of 5,268,122 shares for US$1.66 billion. This move aimed to strengthen earnings per share and showcased management's confidence in the company's trajectory. However, LULU underperformed against the US Luxury industry and the broader market over the past year, with a 19.3% return decline versus a 5.8% market return. Despite short-term challenges, these initiatives positioned Lululemon for sustained long-term growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade lululemon athletica, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if lululemon athletica might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LULU

lululemon athletica

Designs, distributes, and retails technical athletic apparel, footwear, and accessories for women and men under the lululemon brand in the United States, Canada, Mexico, China Mainland, Hong Kong, Taiwan, Macau, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives