- United States

- /

- Luxury

- /

- NasdaqGS:LULU

lululemon athletica (NasdaqGS:LULU) Sees 19% Stock Price Surge Over Last Month

Reviewed by Simply Wall St

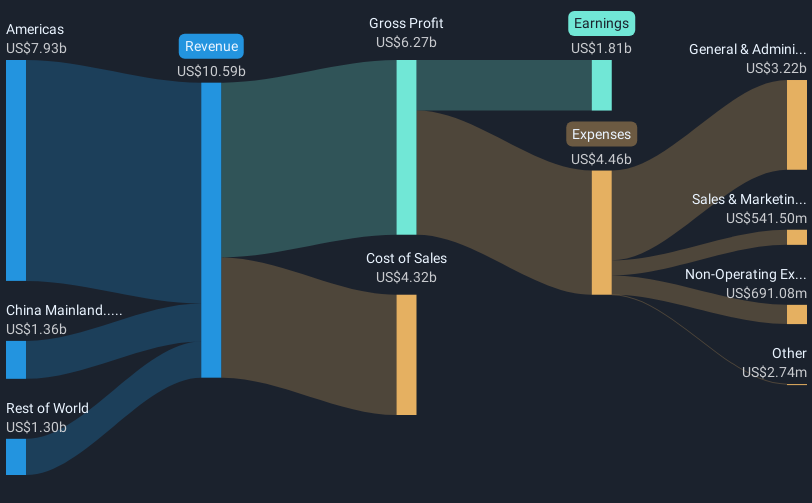

Last month, lululemon athletica (NasdaqGS:LULU) experienced significant investor interest, as its stock price surged by 19%. While specific catalysts for this notable performance remain unclear, the movement aligns with broader positive trends in the market, which saw a 3.9% rise over the last seven days and a 12% increase over the year. Expected earnings growth also paints a positive backdrop for future investor sentiment. While no specific events were directly linked to the price jump, the overall market optimism likely played a crucial role in supporting lululemon's upward momentum during this period.

The recent interest in lululemon athletica's stock, marked by a 19% surge, might enhance the company's future outlook, supporting its growth narrative centered on global expansion and product innovation. This investor enthusiasm could translate into higher revenue and earnings forecasts as anticipated new product lines and store expansions gain traction. Analysts project revenue growth of 6.5% annually over the next three years, though macroeconomic challenges could impact these numbers.

Looking at the broader performance, lululemon shares have seen a total return of 23.55% over the past five years, indicating robust long-term gains. However, over the last year, the company's return lagged behind the US Market, which increased by 11.6%. Despite this, the recent share price rise is important in relation to the analysts' average price target of $332.59, which is currently 18.6% above the latest closing price of $270.8.

Learn about lululemon athletica's future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade lululemon athletica, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if lululemon athletica might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LULU

lululemon athletica

Designs, distributes, and retails technical athletic apparel, footwear, and accessories for women and men under the lululemon brand in the United States, Canada, Mexico, China Mainland, Hong Kong, Taiwan, Macau, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives