- United States

- /

- Luxury

- /

- NasdaqGS:LULU

Lululemon Athletica (NasdaqGS:LULU) Reports Strong Earnings Growth And Completes Share Buyback

Reviewed by Simply Wall St

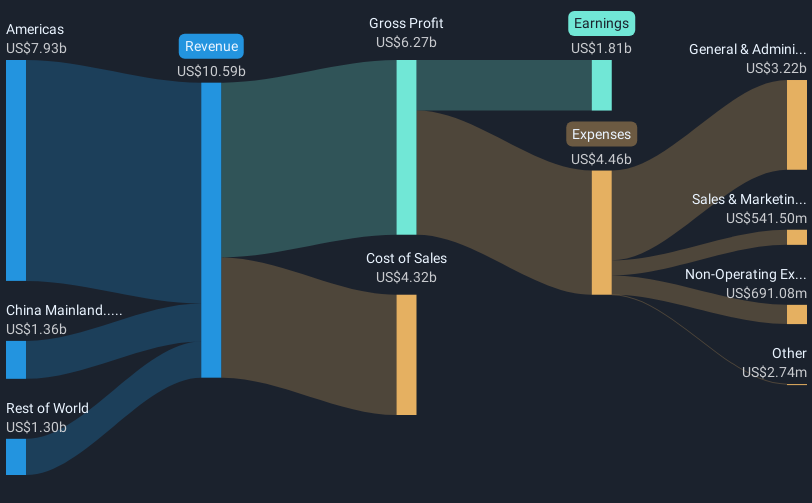

Lululemon Athletica (NasdaqGS:LULU) recently announced strong full-year and fourth-quarter earnings, with notable increases in sales and net income despite challenging economic conditions. However, the company's soft outlook, attributed to weaker consumer spending and inflation concerns, might have caused the 5% price decrease in its stock over the past week. This decline occurred even as Lululemon engaged in a share buyback program, repurchasing over 1.5 million shares. These developments came amid broader market pressures, with major indexes experiencing losses due to hot inflation readings and negative consumer sentiment, which have weighed on tech stocks significantly.

Lululemon Athletica's total shareholder returns amounted to 84.12% over the five-year period, illustrating a robust performance despite recent volatility. Key factors contributing to this growth include their aggressive global expansion, particularly in China, and an increased focus on community-driven brand engagement. Lululemon also strategically reinforced its brand through collaborations, such as the partnership with Peloton in 2023, enhancing its digital fitness offerings. The company's membership program expansion to 24 million members further increased customer retention.

Additionally, Lululemon's ongoing share repurchase program, which included buying back over 5.26 million shares for US$1.66 billion, helped boost shareholder value. In the past year, Lululemon outperformed the US Luxury industry following a decline of 15.8% in the industry. The company's high-quality earnings and impressive earnings growth of 73.4% in the last year underscore its competitive positioning, though challenges remain with sluggish growth in the Americas and inventory management risks.

Our expertly prepared valuation report Lululemon Athletica implies its share price may be too high.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if lululemon athletica might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LULU

lululemon athletica

Designs, distributes, and retails technical athletic apparel, footwear, and accessories for women and men under the lululemon brand in the United States, Canada, Mexico, China Mainland, Hong Kong, Taiwan, Macau, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives