- United States

- /

- Consumer Durables

- /

- NasdaqGS:LGIH

Will LGIH’s Latest Community Launches Reveal a Shift in Its Long-Term Market Expansion Strategy?

Reviewed by Sasha Jovanovic

- LGI Homes recently announced the opening of Fulton Meadows in Florida and Orchard Park in California, two new residential communities featuring upgraded, move-in-ready single-family homes in well-connected locations.

- These launches showcase LGI Homes’ focus on entering growing markets with high-quality amenities, highlighting its commitment to meeting ongoing demand for accessible and modern housing options.

- We’ll examine how the addition of these upgraded communities in Florida and California could impact LGI Homes’ investment narrative.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

LGI Homes Investment Narrative Recap

To believe in LGI Homes as a shareholder, you need confidence that demand from entry-level and first-time buyers will remain resilient despite ongoing affordability pressures. The recent introduction of upgraded communities in Florida and California helps strengthen LGI’s reach in attractive regions, but given persistent headwinds, like high cancellation rates and softening margins, the immediate impact of these launches on the most pressing risks and short-term catalysts appears limited.

Among recent announcements, the grand opening of Stables at Cary Forest in Florida is particularly relevant, showing LGI’s commitment to expanding in markets with robust population growth. However, similar new launches have not yet alleviated concerns around absorption rates and revenue volatility, especially as buyers face elevated rates and stricter lending conditions.

By contrast, one issue investors should keep top of mind is the effect of declining lot inventory on the company’s future growth pipeline and...

Read the full narrative on LGI Homes (it's free!)

LGI Homes' narrative projects $2.8 billion in revenue and $178.8 million in earnings by 2028. This requires 10.5% yearly revenue growth and a $22.8 million earnings increase from the current earnings of $156.0 million.

Uncover how LGI Homes' forecasts yield a $75.67 fair value, a 45% upside to its current price.

Exploring Other Perspectives

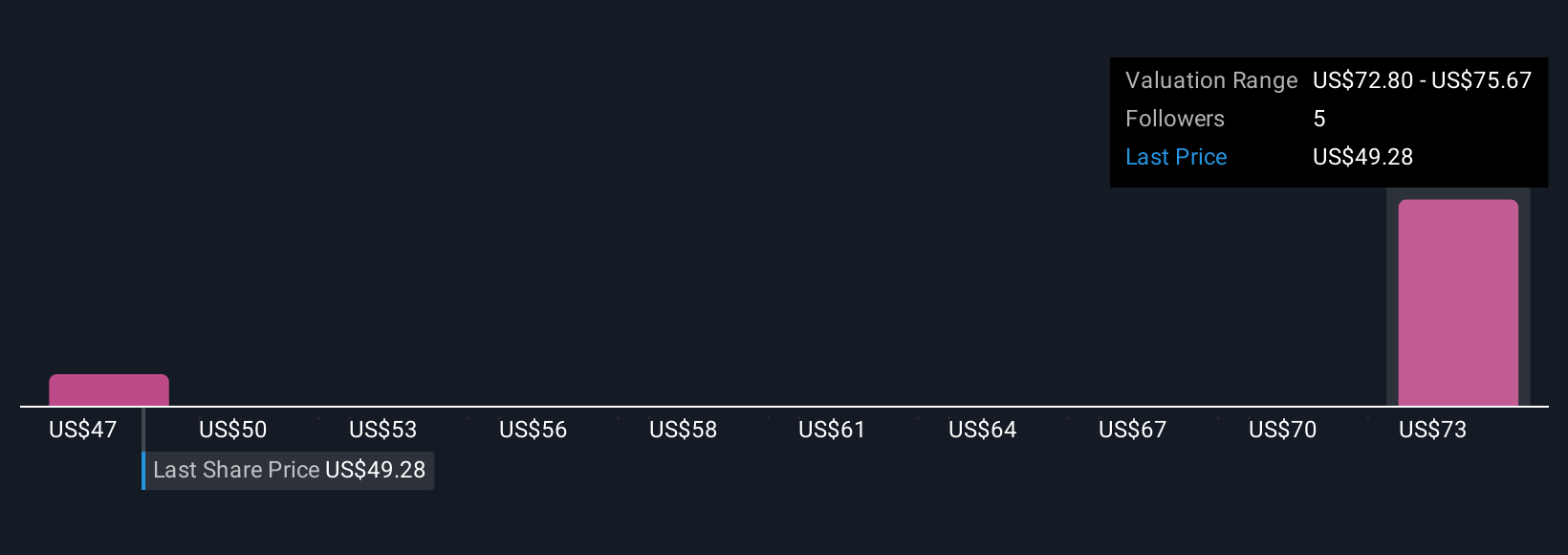

Two fair value estimates from the Simply Wall St Community range widely from US$47.00 to US$75.67 per share. As many see opportunity in LGI’s structural housing demand, others flag supply limitations as a threat to long-term performance, explore the varied views to broaden your outlook.

Explore 2 other fair value estimates on LGI Homes - why the stock might be worth as much as 45% more than the current price!

Build Your Own LGI Homes Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your LGI Homes research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free LGI Homes research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate LGI Homes' overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LGIH

LGI Homes

Engages in the design, construction, and sale of homes in the United States.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026