- United States

- /

- Consumer Durables

- /

- NasdaqGS:LCUT

Little Excitement Around Lifetime Brands, Inc.'s (NASDAQ:LCUT) Revenues As Shares Take 27% Pounding

Lifetime Brands, Inc. (NASDAQ:LCUT) shareholders that were waiting for something to happen have been dealt a blow with a 27% share price drop in the last month. Looking at the bigger picture, even after this poor month the stock is up 27% in the last year.

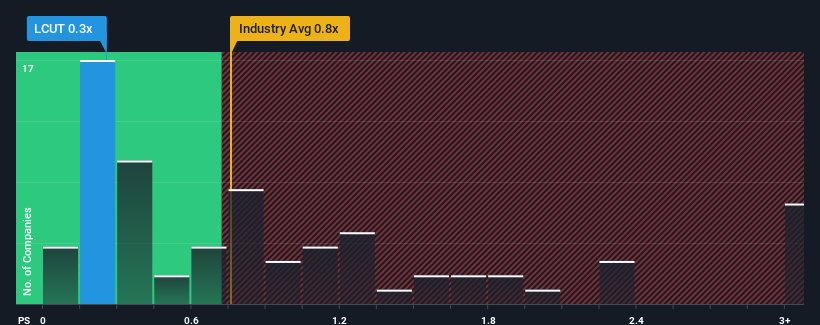

Since its price has dipped substantially, when close to half the companies operating in the United States' Consumer Durables industry have price-to-sales ratios (or "P/S") above 0.8x, you may consider Lifetime Brands as an enticing stock to check out with its 0.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Lifetime Brands

How Has Lifetime Brands Performed Recently?

While the industry has experienced revenue growth lately, Lifetime Brands' revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Lifetime Brands' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Lifetime Brands would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Whilst it's an improvement, it wasn't enough to get the company out of the hole it was in, with revenue down 17% overall from three years ago. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 3.5% each year as estimated by the three analysts watching the company. That's shaping up to be materially lower than the 6.0% per year growth forecast for the broader industry.

With this in consideration, its clear as to why Lifetime Brands' P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Lifetime Brands' P/S

Lifetime Brands' P/S has taken a dip along with its share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Lifetime Brands' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

Before you take the next step, you should know about the 1 warning sign for Lifetime Brands that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LCUT

Lifetime Brands

Designs, sources, and sells branded kitchenware, tableware, and other products for use in the home in the United States and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives