- United States

- /

- Metals and Mining

- /

- NYSEAM:VGZ

Discovering Aclaris Therapeutics And Two Other Noteworthy Penny Stocks

Reviewed by Simply Wall St

With major U.S. stock indexes recently snapping a four-session skid, investors are keeping a close eye on market movements and upcoming economic reports. In this context, penny stocks—though an older term—continue to capture interest as they often represent smaller or emerging companies with potential for growth. By focusing on those with strong financial health, investors can uncover opportunities in these lesser-known stocks that might offer both stability and potential upside.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Here Group (HERE) | $3.08 | $289.87M | ✅ 3 ⚠️ 1 View Analysis > |

| Dingdong (Cayman) (DDL) | $1.73 | $360.03M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.63 | $600.36M | ✅ 4 ⚠️ 0 View Analysis > |

| LexinFintech Holdings (LX) | $3.61 | $666.32M | ✅ 4 ⚠️ 2 View Analysis > |

| Puma Biotechnology (PBYI) | $4.885 | $254.98M | ✅ 3 ⚠️ 3 View Analysis > |

| Performance Shipping (PSHG) | $2.16 | $27.23M | ✅ 4 ⚠️ 2 View Analysis > |

| CI&T (CINT) | $4.32 | $554.32M | ✅ 5 ⚠️ 0 View Analysis > |

| VAALCO Energy (EGY) | $3.62 | $388.88M | ✅ 2 ⚠️ 3 View Analysis > |

| BAB (BABB) | $0.89307 | $6.51M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.72 | $75.9M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 359 stocks from our US Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Aclaris Therapeutics (ACRS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Aclaris Therapeutics, Inc. is a clinical-stage biopharmaceutical company focused on developing novel drug candidates for immune-inflammatory diseases in the United States, with a market cap of $269.78 million.

Operations: Aclaris Therapeutics generates revenue through its Therapeutics segment, which accounts for $13.76 million, and its Contract Research segment, contributing $16.37 million.

Market Cap: $269.78M

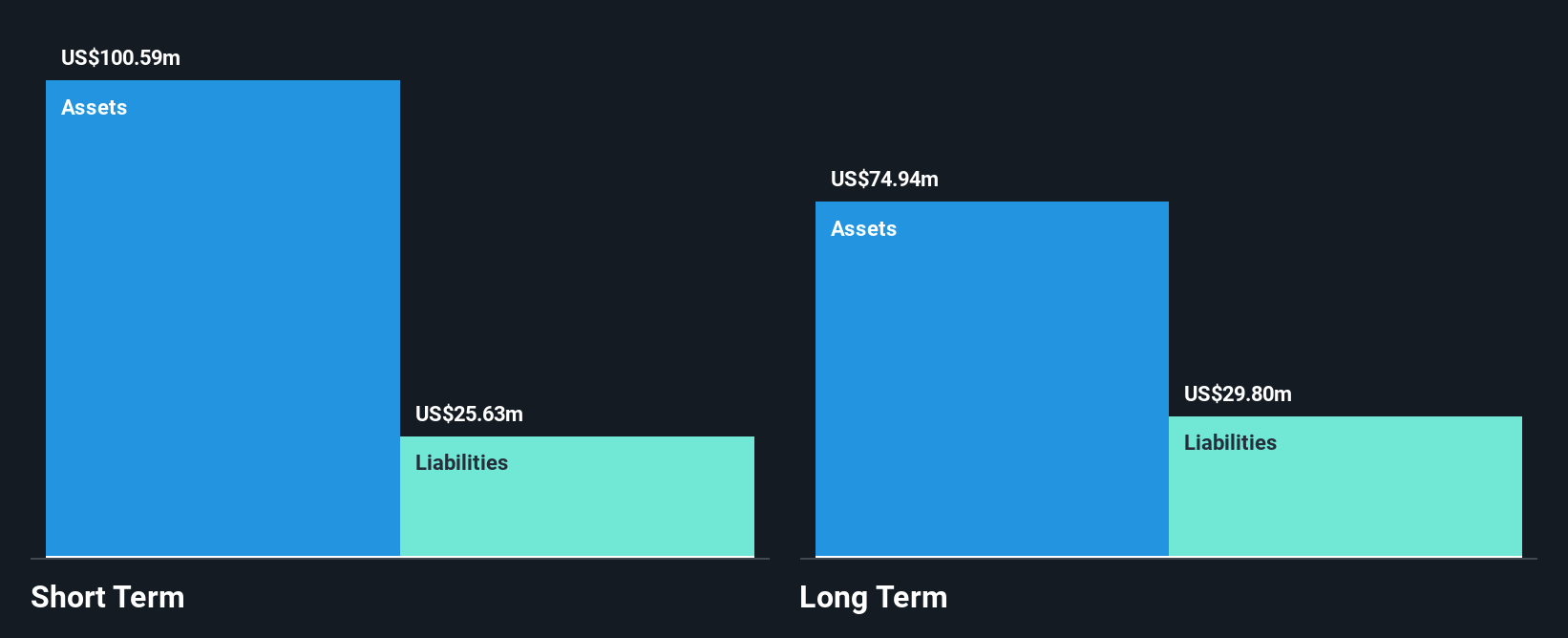

Aclaris Therapeutics, with a market cap of US$269.78 million, is navigating challenges typical for penny stocks in the biotech sector. Despite being debt-free and having short-term assets of US$100.6 million exceeding liabilities, the company remains unprofitable with increasing losses over five years and recent quarterly revenue declining to US$3.3 million from US$4.35 million year-on-year. Revenue forecasts suggest growth at 19.71% annually; however, earnings are expected to decline by 3.3% per year over the next three years, highlighting ongoing financial hurdles despite a seasoned board and active participation in industry conferences.

- Unlock comprehensive insights into our analysis of Aclaris Therapeutics stock in this financial health report.

- Assess Aclaris Therapeutics' future earnings estimates with our detailed growth reports.

Lifetime Brands (LCUT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Lifetime Brands, Inc. designs, sources, and sells branded kitchenware and tableware for home use both in the United States and internationally, with a market cap of $75.90 million.

Operations: The company's revenue is primarily generated from the U.S. market, including retail direct sales, totaling $601.94 million, while international sales contribute $57.12 million.

Market Cap: $75.9M

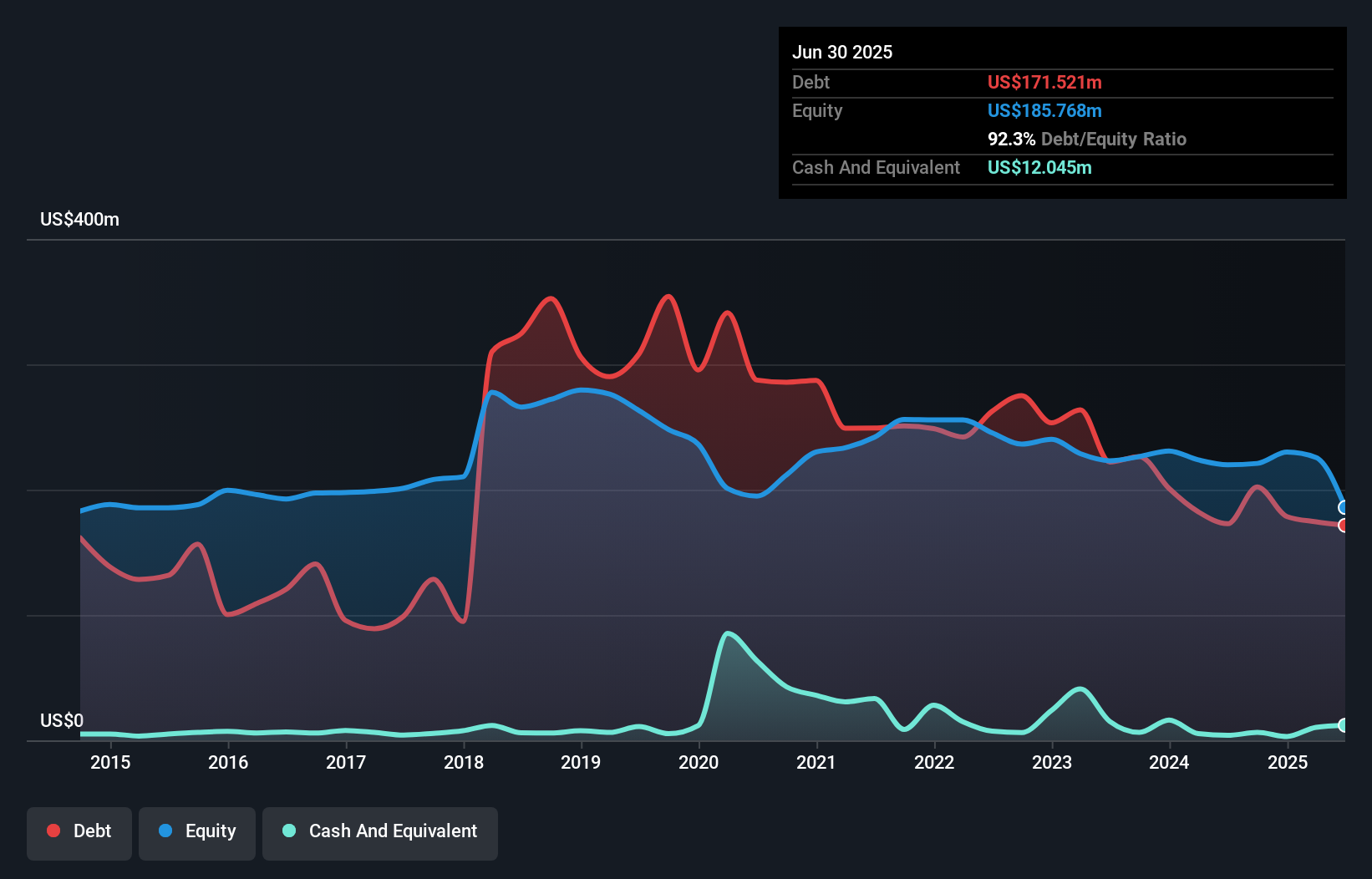

Lifetime Brands, Inc. faces typical challenges of penny stocks with a market cap of US$75.90 million and declining sales, reporting US$171.91 million for Q3 2025 compared to US$183.84 million the previous year. The company is unprofitable, with net losses widening to US$45.09 million for the first nine months of 2025 from US$24.08 million a year ago, yet maintains a positive cash flow runway exceeding three years despite shrinking free cash flow by 5.2% annually. While trading at significant undervaluation relative to its fair value estimate, high debt levels remain a concern amidst stable volatility and seasoned management guidance.

- Navigate through the intricacies of Lifetime Brands with our comprehensive balance sheet health report here.

- Evaluate Lifetime Brands' prospects by accessing our earnings growth report.

Vista Gold (VGZ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Vista Gold Corp., along with its subsidiaries, operates as a development-stage company in the gold mining industry in Australia, with a market cap of approximately $219.60 million.

Operations: Vista Gold Corp. does not report any revenue segments.

Market Cap: $219.6M

Vista Gold Corp., with a market cap of US$219.60 million, operates as a pre-revenue entity in the gold mining sector, highlighting typical penny stock traits such as high volatility and unprofitability. Despite reporting a net loss of US$0.723 million for Q3 2025, it has reduced its losses compared to the previous year. The company benefits from strong liquidity with short-term assets exceeding both short and long-term liabilities significantly, alongside being debt-free for five years. Vista's experienced board and management team provide stability amidst its volatile share price and negative return on equity of -50.9%.

- Jump into the full analysis health report here for a deeper understanding of Vista Gold.

- Learn about Vista Gold's historical performance here.

Summing It All Up

- Unlock more gems! Our US Penny Stocks screener has unearthed 356 more companies for you to explore.Click here to unveil our expertly curated list of 359 US Penny Stocks.

- Looking For Alternative Opportunities? AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:VGZ

Vista Gold

Vista Gold Corp., together with its subsidiaries, operate as a development-stage company in the gold mining industry in Australia.

Flawless balance sheet with very low risk.

Market Insights

Community Narratives