- United States

- /

- Leisure

- /

- NasdaqGS:JOUT

Top Growth Stocks With Strong Insider Ownership In June 2025

Reviewed by Simply Wall St

As the U.S. stock market continues to navigate a complex landscape of trade negotiations and economic indicators, with the S&P 500 nearing its all-time high, investors are keenly observing growth opportunities. In this environment, companies with strong insider ownership often signal confidence from those closest to the business, making them attractive options for those seeking robust growth potential.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 16.2% | 39.1% |

| QT Imaging Holdings (QTIH) | 26.7% | 84.5% |

| Prairie Operating (PROP) | 34.5% | 71.1% |

| Hesai Group (HSAI) | 21.3% | 45.2% |

| FTC Solar (FTCI) | 27.9% | 62.5% |

| Enovix (ENVX) | 12.1% | 58.4% |

| Duolingo (DUOL) | 14.3% | 40% |

| Credo Technology Group Holding (CRDO) | 12.1% | 45% |

| Atour Lifestyle Holdings (ATAT) | 22.6% | 24.1% |

| Astera Labs (ALAB) | 14.7% | 44.4% |

We're going to check out a few of the best picks from our screener tool.

ARS Pharmaceuticals (SPRY)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ARS Pharmaceuticals, Inc. is a biopharmaceutical company focused on developing and commercializing treatments for severe allergic reactions, with a market cap of $1.44 billion.

Operations: ARS Pharmaceuticals, Inc. does not currently have any reported revenue segments.

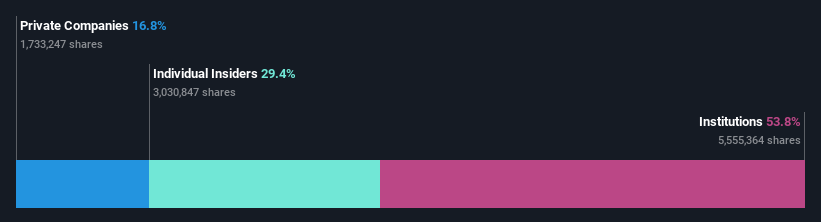

Insider Ownership: 14.3%

ARS Pharmaceuticals is trading significantly below its estimated fair value and is expected to achieve profitability within three years, with earnings projected to grow at 60.57% annually. Despite no substantial insider buying recently, the company has seen more insider purchases than sales over the past three months. Revenue growth forecasts of 40.4% annually exceed market averages, supported by recent FDA approval and strategic agreements for their needle-free epinephrine spray, neffy, targeting pediatricians across the U.S.

- Take a closer look at ARS Pharmaceuticals' potential here in our earnings growth report.

- Upon reviewing our latest valuation report, ARS Pharmaceuticals' share price might be too pessimistic.

Johnson Outdoors (JOUT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Johnson Outdoors Inc. designs, manufactures, and markets seasonal and outdoor recreation products for fishing worldwide, with a market cap of $296.29 million.

Operations: The company's revenue is primarily derived from its fishing segment, which accounts for $420.60 million, followed by its diving segment at $70.73 million.

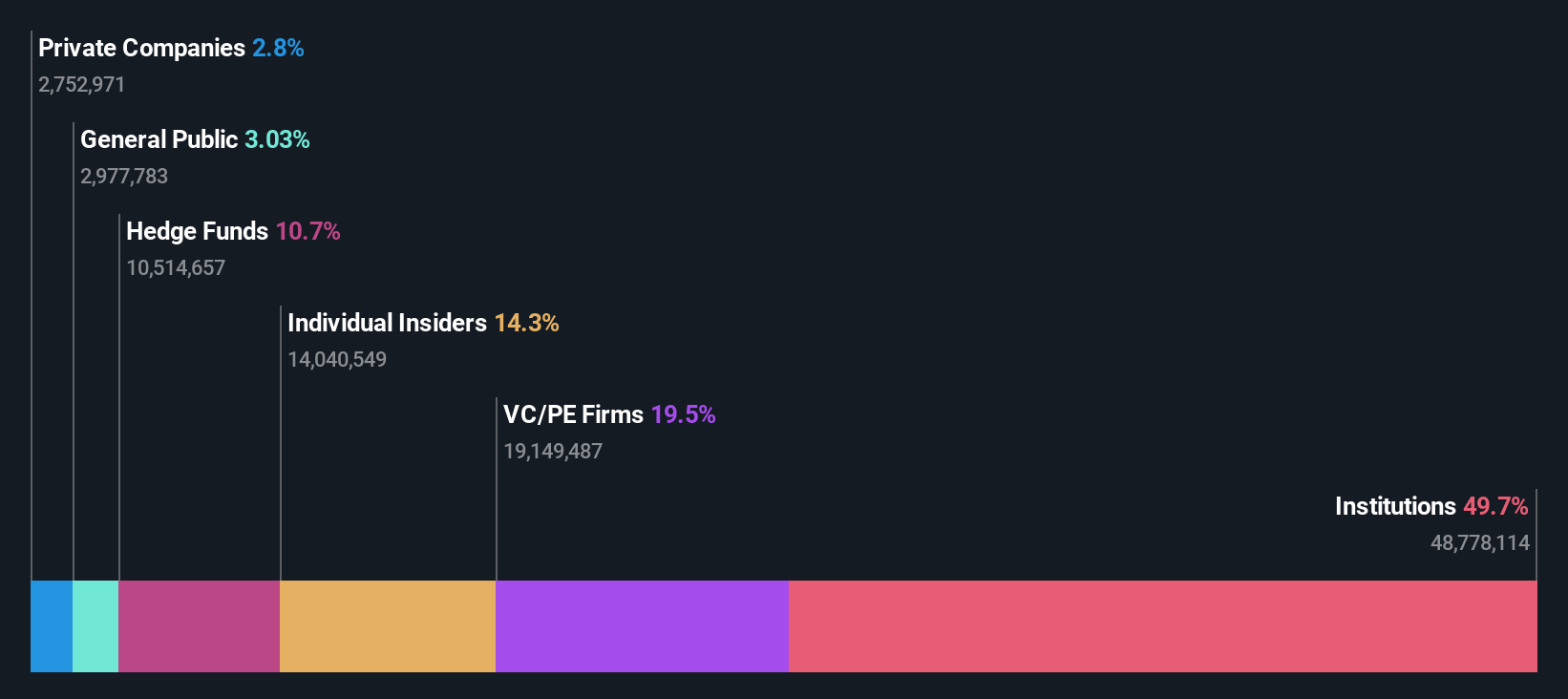

Insider Ownership: 29.7%

Johnson Outdoors is expected to see revenue growth of 10.1% annually, surpassing the US market average. While trading at a significant discount to its estimated fair value, it offers good relative value compared to peers. Earnings are projected to grow substantially by 157.77% per year, with profitability anticipated within three years, exceeding market averages. Recent earnings show mixed results with a net loss over six months despite slight improvements in quarterly net income and earnings per share.

- Get an in-depth perspective on Johnson Outdoors' performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that Johnson Outdoors is trading behind its estimated value.

MetroCity Bankshares (MCBS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MetroCity Bankshares, Inc. is the bank holding company for Metro City Bank, offering a range of banking products and services in the United States with a market cap of $728.26 million.

Operations: MetroCity Bankshares generates its revenue primarily from community banking, amounting to $143.78 million.

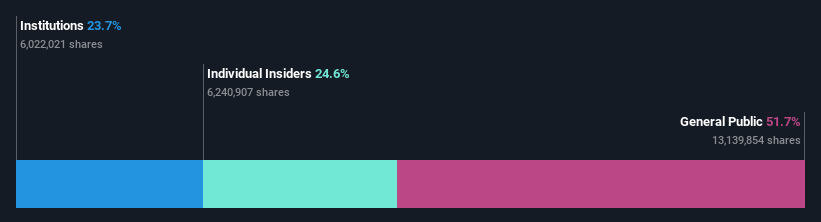

Insider Ownership: 25.8%

MetroCity Bankshares is forecast to achieve robust earnings growth of 22.6% annually, outpacing the US market average. The stock trades at a significant discount to its estimated fair value and offers good relative value compared to industry peers. Recent financial results show an increase in net interest income and net income for the first quarter of 2025, with basic earnings per share rising from US$0.58 to US$0.64 year-over-year, despite minor net charge-offs reported during the same period.

- Delve into the full analysis future growth report here for a deeper understanding of MetroCity Bankshares.

- Our valuation report unveils the possibility MetroCity Bankshares' shares may be trading at a discount.

Seize The Opportunity

- Embark on your investment journey to our 194 Fast Growing US Companies With High Insider Ownership selection here.

- Searching for a Fresh Perspective? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:JOUT

Johnson Outdoors

Designs, manufactures, and markets seasonal and outdoor recreation products for fishing worldwide.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives