- United States

- /

- Consumer Durables

- /

- NasdaqGS:IRBT

iRobot (IRBT) Is Up 105.5% After White House Weighs Federal Boost For U.S. Robotics Sector

Reviewed by Sasha Jovanovic

- In early December 2025, iRobot drew heightened attention after reports that the White House is weighing an executive order to accelerate growth in the U.S. robotics sector, potentially involving subsidies, tax incentives, and R&D support.

- This policy discussion has sparked debate over how much a government push for robotics, likely centered on industrial applications, might practically benefit a consumer-focused company facing liquidity pressure and bankruptcy risk.

- With this backdrop of policy speculation and financial strain, we’ll explore how potential federal robotics support reshapes iRobot’s investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is iRobot's Investment Narrative?

For anyone considering iRobot today, the core belief has to be that a consumer robotics brand with shrinking sales, rising losses, and a stretched balance sheet can still find a path to survive and eventually rebuild. The White House’s potential robotics push has clearly jolted sentiment, as seen in the very large short‑term share price move, but the policy conversation looks centered on industrial robotics, so it does not obviously fix iRobot’s liquidity crunch, credit waivers, or bankruptcy risk. In the near term, the real catalysts still sit with debt renegotiations, any strategic transaction from the ongoing review, and whether new Roomba products can stabilize demand. The policy news may improve optionality at the margin, yet it does not remove the need for urgent financial repair.

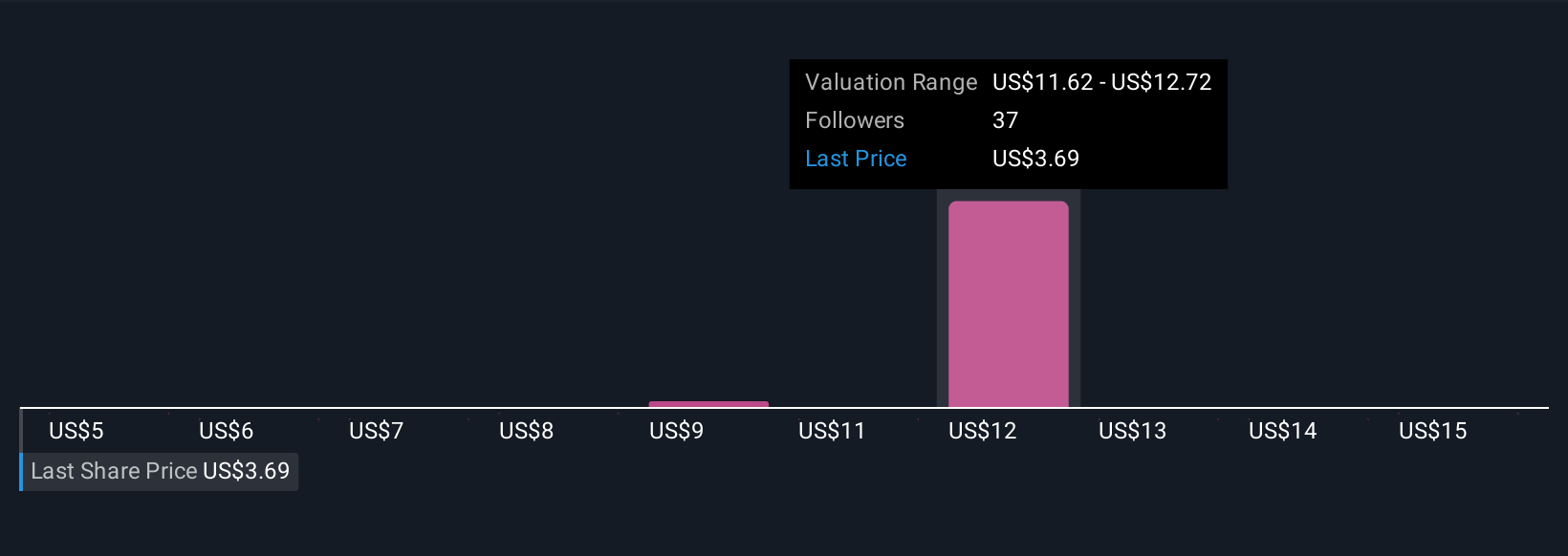

However, investors should not overlook how short the company’s cash runway now appears. Our comprehensive valuation report raises the possibility that iRobot is priced higher than what may be justified by its financials.Exploring Other Perspectives

Explore 7 other fair value estimates on iRobot - why the stock might be worth just $5.05!

Build Your Own iRobot Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your iRobot research is our analysis highlighting 4 important warning signs that could impact your investment decision.

- Our free iRobot research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate iRobot's overall financial health at a glance.

No Opportunity In iRobot?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if iRobot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IRBT

iRobot

Designs, builds, and sells robots and home innovation products in the United States, Europe, the Middle East, Africa, Japan, and internationally.

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026