- United States

- /

- Consumer Durables

- /

- NasdaqGS:HELE

If You Had Bought Helen of Troy Stock Five Years Ago, You Could Pocket A 64% Gain Today

It hasn't been the best quarter for Helen of Troy Limited (NASDAQ:HELE) shareholders, since the share price has fallen 21% in that time. While that's not great, the returns over five years have been decent. After all, the stock has performed better than the market (57%) in that time, and is up 64%.

Check out our latest analysis for Helen of Troy

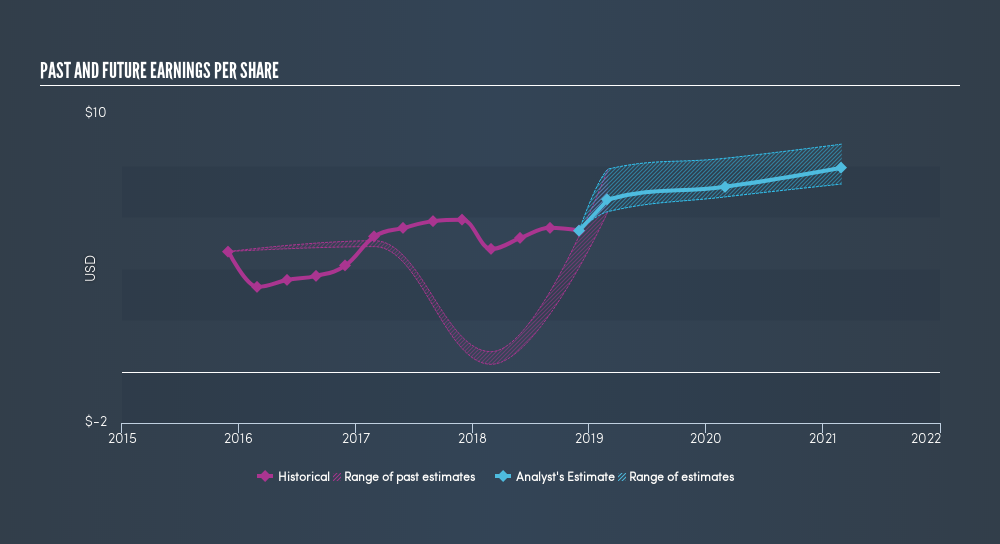

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During five years of share price growth, Helen of Troy achieved compound earnings per share (EPS) growth of 10% per year. This EPS growth is remarkably close to the 10% average annual increase in the share price. This indicates that investor sentiment towards the company has not changed a great deal. Rather, the share price has approximately tracked EPS growth.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It might be well worthwhile taking a look at our freereport on Helen of Troy's earnings, revenue and cash flow.

A Different Perspective

It's nice to see that Helen of Troy shareholders have received a total shareholder return of 26% over the last year. That gain is better than the annual TSR over five years, which is 10%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

We will like Helen of Troy better if we see some big insider buys. While we wait, check out this freelist of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:HELE

Helen of Troy

Provides various consumer products in the United States, Canada, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Fair value with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives