- United States

- /

- Consumer Durables

- /

- NasdaqGS:HELE

Helen of Troy (NASDAQ:HELE) earnings and shareholder returns have been trending downwards for the last three years, but the stock rallies 5.4% this past week

It is a pleasure to report that the Helen of Troy Limited (NASDAQ:HELE) is up 34% in the last quarter. But that doesn't change the fact that the returns over the last three years have been stomach churning. In that time the share price has melted like a snowball in the desert, down 71%. So we're relieved for long term holders to see a bit of uplift. The thing to think about is whether the business has really turned around.

On a more encouraging note the company has added US$83m to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

View our latest analysis for Helen of Troy

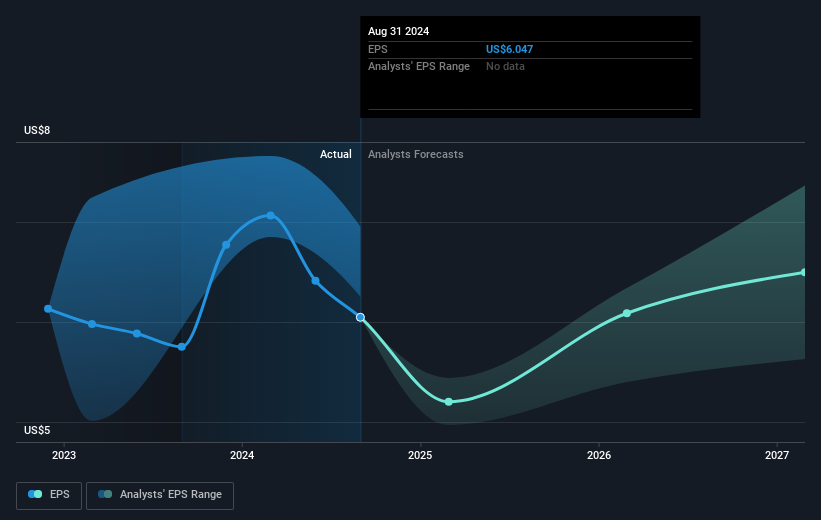

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Helen of Troy saw its EPS decline at a compound rate of 11% per year, over the last three years. This reduction in EPS is slower than the 34% annual reduction in the share price. So it seems the market was too confident about the business, in the past. The less favorable sentiment is reflected in its current P/E ratio of 11.39.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of Helen of Troy's earnings, revenue and cash flow.

A Different Perspective

Investors in Helen of Troy had a tough year, with a total loss of 32%, against a market gain of about 35%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 9% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Helen of Troy better, we need to consider many other factors. To that end, you should be aware of the 1 warning sign we've spotted with Helen of Troy .

But note: Helen of Troy may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Helen of Troy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:HELE

Helen of Troy

Provides various consumer products in the United States, Canada, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Slight and slightly overvalued.

Similar Companies

Market Insights

Community Narratives