- United States

- /

- Leisure

- /

- NasdaqGS:HAS

Hasbro (HAS) Valuation Check as Headquarters Relocation to Boston Signals a Strategic Shift

Reviewed by Simply Wall St

Hasbro (HAS) is shaking up its future by shifting its longtime Rhode Island headquarters to Boston, rolling out a phased move, new Seaport office space, and an aggressive hiring push through 2026.

See our latest analysis for Hasbro.

Against that backdrop, Hasbro’s 1 month share price return of 5.5 percent and 43.7 percent year to date share price gain suggest momentum is rebuilding. At the same time, a 3 year total shareholder return above 56 percent points to a still compelling long term story.

If this strategic shift has you thinking more broadly about where the next big brand story could emerge, it is worth exploring fast growing stocks with high insider ownership as a fresh hunting ground for ideas.

Yet with the stock trading below analyst targets but up sharply this year, investors now face a key question: Is Hasbro still undervalued after its strategic reset, or has the market already priced in the next leg of growth?

Most Popular Narrative: 11.4% Undervalued

With Hasbro last closing at $81.10 versus a narrative fair value of $91.54, the most followed view sees further upside still on the table.

Rapidly growing cross platform digital gaming and licensing revenue, exemplified by Wizards of the Coast (notably Magic: The Gathering's 23%+ YoY growth and MONOPOLY GO!), is expanding Hasbro's addressable market and recurring high margin earnings streams and positioning the company to capitalize on the global rise of digital entertainment, which should drive outsized revenue and operating profit growth.

Want to see what kind of revenue runway and margin reset would justify that higher value, and how far profit expectations really stretch? The answer sits inside this narrative's detailed growth, margin, and earnings roadmap, built around a future valuation multiple that might surprise you.

Result: Fair Value of $91.54 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering reliance on blockbuster franchises and execution risks in digital expansion mean that any stumble could quickly erode today’s upbeat expectations.

Find out about the key risks to this Hasbro narrative.

Another View: Multiples Paint a Richer Picture

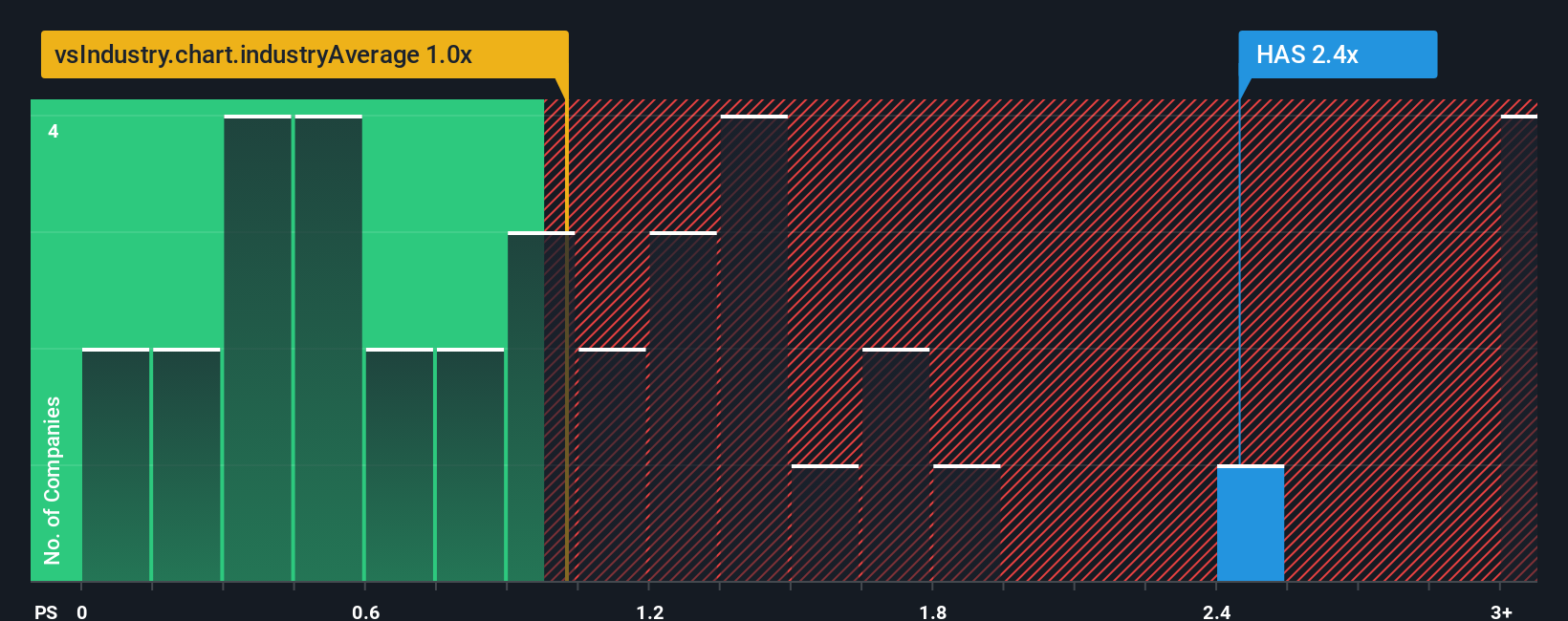

While narratives and analyst targets lean toward upside, Hasbro’s 2.6x price to sales ratio looks demanding versus a 2.2x fair ratio, a 1.2x peer average, and a 0.9x industry level. That premium narrows the margin of safety, so how much optimism are you really comfortable paying for?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hasbro Narrative

If you see the story differently or want to stress test the numbers yourself, you can spin up a custom narrative in minutes: Do it your way.

A great starting point for your Hasbro research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Hasbro might be front of mind today, but you will kick yourself later if you overlook other opportunities the Simply Wall St Screener is surfacing right now.

- Target steady income by zeroing in on these 15 dividend stocks with yields > 3% that can potentially strengthen your portfolio with reliable cash returns.

- Ride structural tech trends by focusing on these 26 AI penny stocks harnessing artificial intelligence to reshape entire industries and long term earnings power.

- Pursue mispriced opportunities through these 906 undervalued stocks based on cash flows where cash flow strength and market pessimism may be completely out of sync.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hasbro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HAS

Hasbro

Operates as a toy and game company in the United States, Europe, Canada, Mexico, Latin America, Australia, China, and Hong Kong.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026