- United States

- /

- Luxury

- /

- NasdaqGS:GIII

US Market's Undiscovered Gems for April 2025

Reviewed by Simply Wall St

The United States market has recently experienced a robust climb, rising by 8.4% over the past week with gains across all sectors, and showing a 5.9% increase over the last year. In such an environment where earnings are projected to grow significantly, identifying stocks that are undervalued yet poised for growth can be key to uncovering potential opportunities in the market.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 9.72% | 4.94% | 6.51% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Oakworth Capital | 32.14% | 14.78% | 4.37% | ★★★★★★ |

| Omega Flex | NA | -0.52% | 0.74% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Teekay | NA | -0.89% | 62.53% | ★★★★★★ |

| Anbio Biotechnology | NA | 8.43% | 184.88% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| Pure Cycle | 5.11% | 1.07% | -4.05% | ★★★★★☆ |

| First IC | 38.58% | 9.04% | 14.76% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

G-III Apparel Group (NasdaqGS:GIII)

Simply Wall St Value Rating: ★★★★★★

Overview: G-III Apparel Group, Ltd. is engaged in designing, sourcing, distributing, and marketing women's and men's apparel both in the United States and internationally, with a market capitalization of approximately $1.06 billion.

Operations: G-III Apparel Group generates revenue primarily through its wholesale segment, which accounts for $3.08 billion, while the retail segment contributes $166.46 million.

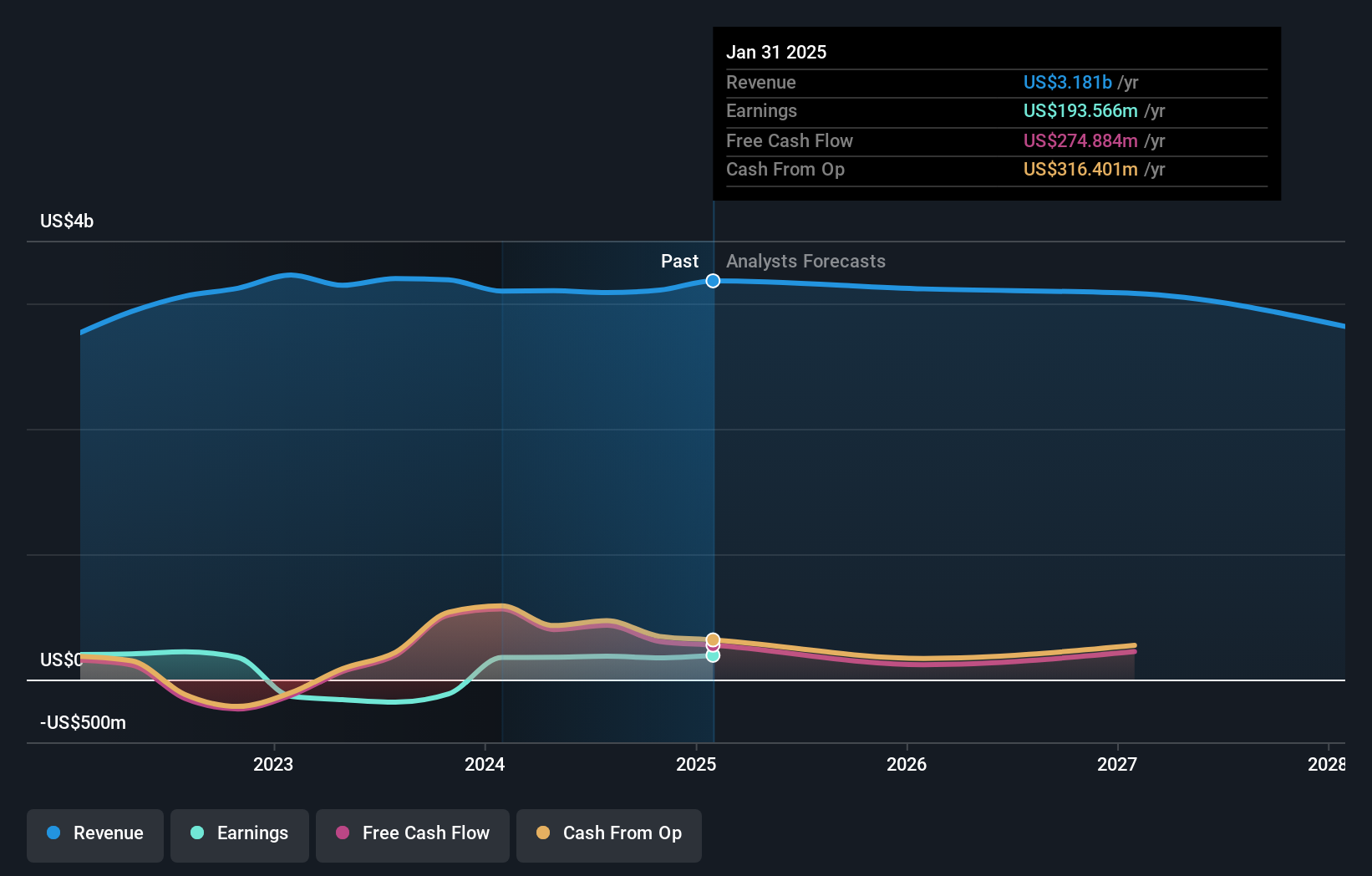

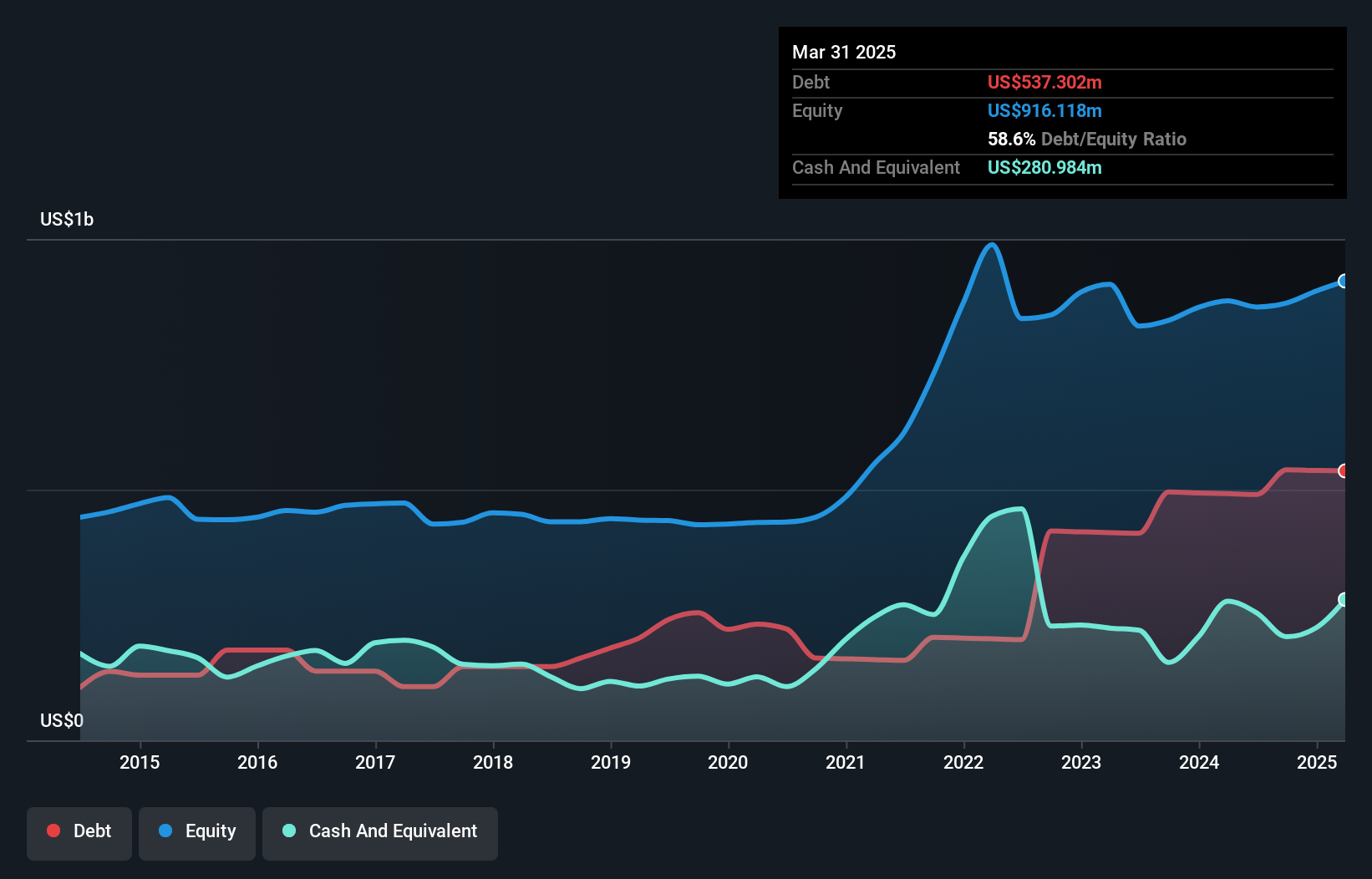

G-III Apparel Group has shown robust financial health with earnings growth of 9.9% over the past year, outpacing the luxury industry average of 7.9%. The company is trading at a significant discount, approximately 39% below its estimated fair value. Its debt-to-equity ratio impressively dropped from 30.8% to just 0.4% over five years, highlighting effective debt management. Recent earnings reports revealed a full-year net income increase to US$193.57 million from US$176.17 million previously, alongside basic earnings per share rising to US$4.35 from US$3.84, underscoring strong profitability and operational efficiency improvements in this small-cap stock space.

Himax Technologies (NasdaqGS:HIMX)

Simply Wall St Value Rating: ★★★★★☆

Overview: Himax Technologies, Inc. is a fabless semiconductor company that offers display imaging processing technologies across various international markets and has a market cap of approximately $1.14 billion.

Operations: The company generates revenue primarily from its Driver IC segment, contributing approximately $751.33 million, followed by Non-Driver Products at around $155.48 million.

Himax Technologies, a fabless semiconductor company, is making waves with its strong earnings growth of 57.6% over the past year, outperforming the broader semiconductor industry. The firm's price-to-earnings ratio stands at 14.7x, indicating good value compared to the US market's 16.3x average. Despite a net debt to equity ratio of 35%, considered satisfactory, Himax faces challenges from market volatility and competitive pressures in China. Recent strategic alliances and advancements in display technologies position it well for future growth, with analysts projecting revenue to increase by an annual rate of 13.7% over three years.

Bowhead Specialty Holdings (NYSE:BOW)

Simply Wall St Value Rating: ★★★★★☆

Overview: Bowhead Specialty Holdings Inc. offers commercial specialty property and casualty insurance products in the United States, with a market capitalization of approximately $1.30 billion.

Operations: The company generates revenue primarily from its commercial specialty property and casualty insurance segment, amounting to $425.66 million. With a market capitalization of approximately $1.30 billion, it is positioned within the insurance sector in the United States.

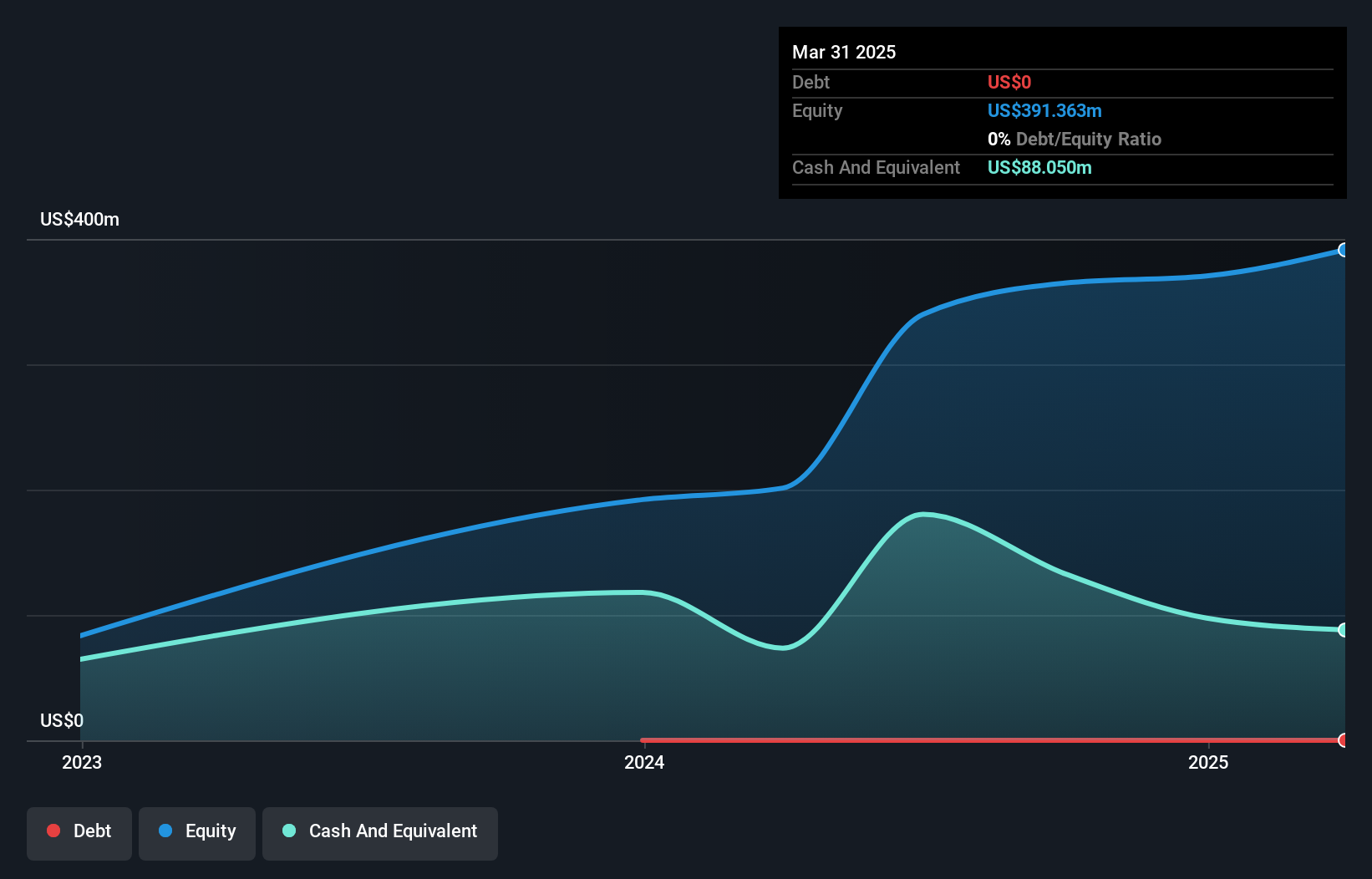

Bowhead Specialty Holdings, a nimble player in the insurance sector, showcases robust growth with earnings rising 52.7% over the past year, outpacing the industry's 22%. The company reported impressive financials for 2024, with revenue at US$425.66 million and net income reaching US$38.24 million, up from US$25.05 million previously. Demonstrating fiscal discipline, Bowhead remains debt-free and boasts high-quality earnings alongside positive free cash flow of approximately US$291 million as of April 2025. With a forecasted annual earnings growth rate of 28.67%, Bowhead seems poised to continue its upward trajectory in the competitive market landscape.

Key Takeaways

- Embark on your investment journey to our 284 US Undiscovered Gems With Strong Fundamentals selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GIII

G-III Apparel Group

Designs, sources, distributes, and markets women’s and men’s apparel in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives