- United States

- /

- Luxury

- /

- NasdaqGS:GIII

G-III Apparel Group (GIII): Valuation Insights After Q2 Beat, Weaker Guidance, and Insider Buying

Reviewed by Kshitija Bhandaru

G-III Apparel Group (GIII) just delivered earnings for Q2 that topped expectations, thanks to continued momentum in its leading brands and positive performance across the wider apparel sector. However, investors are weighing this against management’s cautious forward guidance, which landed below what many had anticipated.

See our latest analysis for G-III Apparel Group.

G-III’s stronger-than-expected Q2 earnings helped lift sentiment, but the stock’s momentum has been mixed lately as weaker revenue guidance for the next quarter took center stage. Despite recent headwinds, G-III’s three-year total shareholder return of nearly 65% hints at the longer-term resilience investors have seen in the stock. Insider buying is also providing another vote of confidence.

If management’s optimism has you curious about other companies with a similar edge, now could be a great opportunity to discover fast growing stocks with high insider ownership

So with mixed signals from management and insiders alike, is G-III still flying under the radar at current prices, or have investors already accounted for all of its future growth potential?

Price-to-Earnings of 6.2x: Is it justified?

G-III’s current price-to-earnings (P/E) ratio stands at just 6.2x, a significant discount compared to both its peers and the broader US market. At the last close of $26.92, the stock appears undervalued by this measure, especially as it trades well below both peer and industry averages.

The P/E ratio shows how much investors are willing to pay per dollar of earnings. A lower ratio often suggests the market is less optimistic about future growth, or that a bargain might exist if the company’s outlook is better than implied. For a company like G-III, operating in a cyclical and competitive sector, this metric is especially relevant given the volatility in earnings and fluctuating demand trends that come with fashion and consumer durables.

Currently, G-III’s 6.2x P/E is dramatically lower relative to its peer group average of 51.8x and the US Luxury industry average of 21.2x. This steep discount can point to a potential market mispricing, especially if the company’s fundamentals or future earnings prospects are stronger than expected. While no fair ratio is available for further context, the substantial gap underscores G-III’s attractively low valuation based on earnings.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 6.2x (UNDERVALUED)

However, recent annual revenue declines and underwhelming one-year total returns highlight the risk that weaker growth could persist even though the stock is trading at a low valuation.

Find out about the key risks to this G-III Apparel Group narrative.

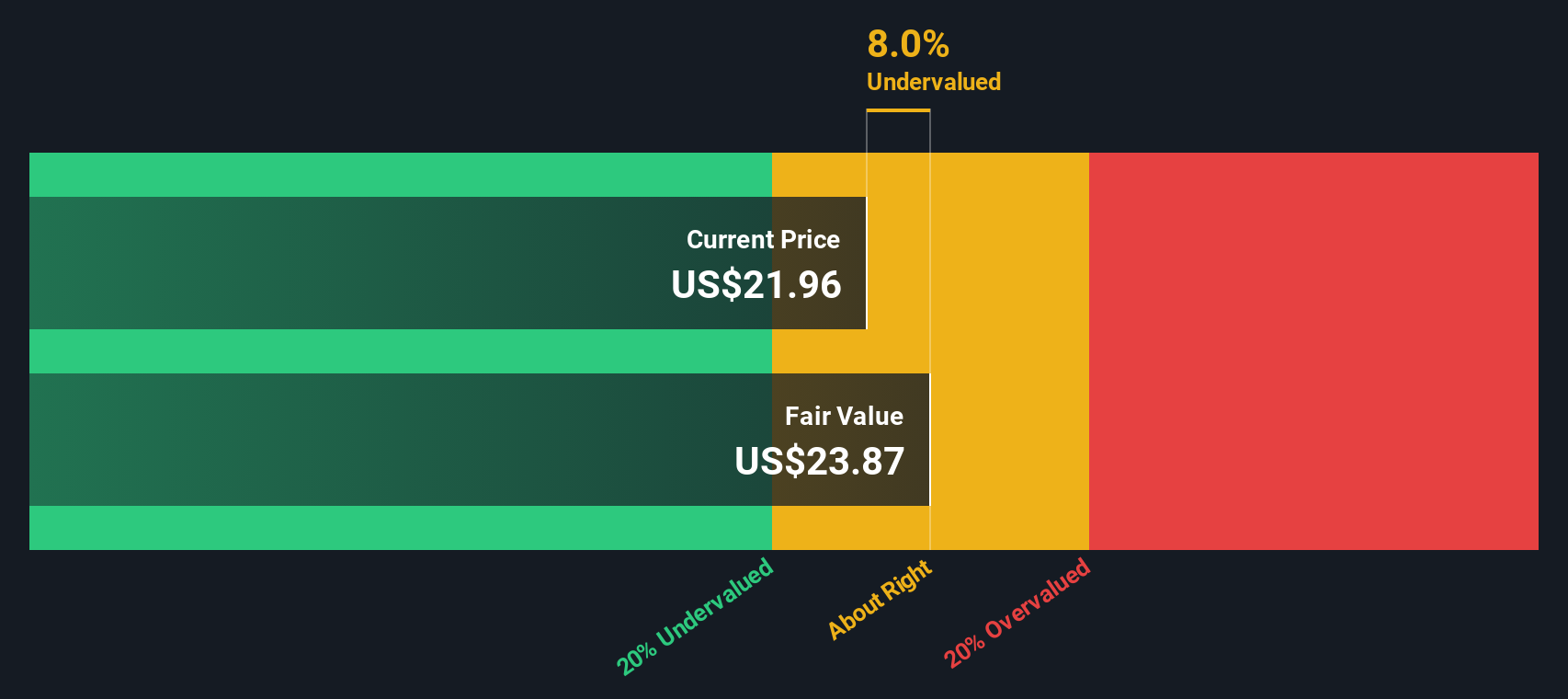

Another View: Discounted Cash Flow Tells a Different Story

Looking at G-III through the lens of our DCF model provides a more cautious view. According to this approach, the stock trades above its estimated fair value of $13.04. While multiples suggest a bargain, DCF analysis shows G-III as potentially overvalued at current prices.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out G-III Apparel Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own G-III Apparel Group Narrative

If you have a different perspective or want to look deeper into the numbers yourself, you can quickly put together your own take in just a few minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding G-III Apparel Group.

Looking for more investment ideas?

Don’t let a single stock limit your potential. Explore opportunities across distinct market trends and put your investment strategy a step ahead.

- Collect attractive yields by tapping into these 19 dividend stocks with yields > 3% for reliable income and potentially stronger returns than savings accounts.

- Benefit from innovation in digital assets while others hesitate with these 78 cryptocurrency and blockchain stocks to participate in the momentum of blockchain technology and crypto adoption.

- Keep your portfolio ahead of the curve as breakthroughs in medicine accelerate with these 31 healthcare AI stocks driving healthcare transformation through next-generation AI-driven solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GIII

G-III Apparel Group

Designs, sources, distributes, and markets women’s and men’s apparel in the United States and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives