- United States

- /

- Luxury

- /

- NasdaqGS:GIII

G-III Apparel Group (GIII): Evaluating Valuation After a Recent 4% Share Price Gain

Reviewed by Kshitija Bhandaru

G-III Apparel Group (GIII) shares gained 4% in recent trading, catching the eye of investors after a period of choppy performance over the past month. With the stock showing a year-to-date decline, some investors are revisiting its long-term prospects.

See our latest analysis for G-III Apparel Group.

After a stretch of volatility, G-III’s share price is showing fresh momentum, with a 3.6% one-day jump that is pulling attention back to its longer-term story. While 2024 has gotten off to a slow start for shareholders, with a year-to-date share price decline, the stock has still delivered a standout three-year total return of nearly 54% and a five-year total return just over 90%. Investors seem to be weighing short-term softness against an impressive longer track record.

If the bounce in G-III has you scanning for more opportunities, this could be the moment to broaden your radar and uncover fast growing stocks with high insider ownership

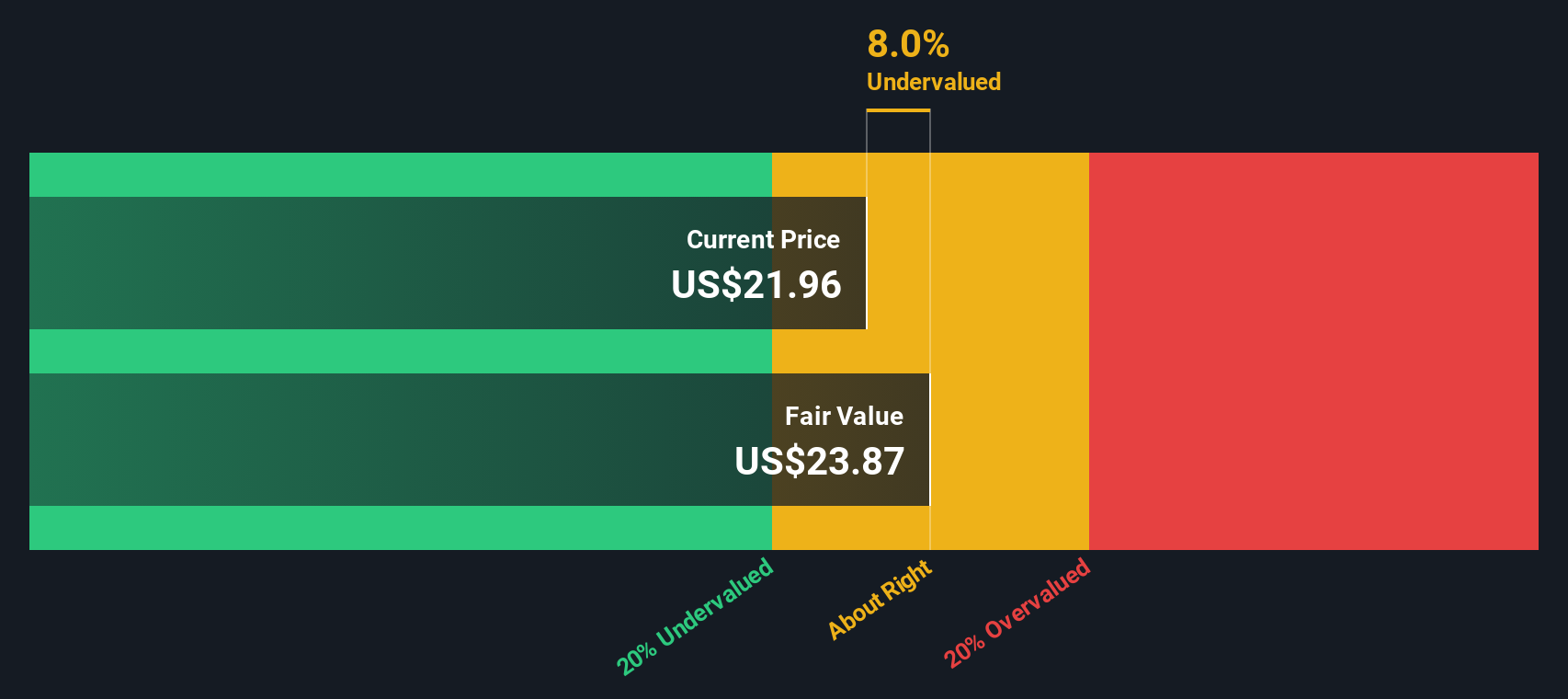

But with recent gains following a lackluster stretch, the key question is whether G-III Apparel Group is undervalued at current levels or if the market has already factored in its future growth potential. Could there still be room to run?

Price-to-Earnings of 6.1x: Is it justified?

G-III Apparel Group trades at a price-to-earnings (P/E) ratio of 6.1x, well below both its industry peers and the overall US equity market, based on the most recent share price of $26.53.

The P/E ratio is a widely used measure that compares a company’s stock price to its earnings per share, helping investors gauge if shares are cheap or expensive relative to profits. For apparel companies like G-III, where fashion cycles and consumer sentiment can lead to variable profits, the P/E acts as a reality check. Are the company’s current profits undervalued by the market?

At 6.1x, G-III’s P/E is strikingly lower than the US Luxury industry average of 19.4x as well as the broader US market’s 18.6x. The number signals investors are putting a hefty discount on G-III despite its positive long-term returns, possibly due to recent negative growth and uncertain near-term prospects. No fair ratio is available for an additional data point, so this low multiple may reflect skepticism about future earnings growth.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 6.1x (UNDERVALUED)

However, G-III’s recent revenue contraction and ongoing share price volatility remain risks. These factors could limit further upside in the near term.

Find out about the key risks to this G-III Apparel Group narrative.

Another View: Discounted Cash Flow Gives a Different Signal

While the low P/E ratio suggests G-III could be undervalued compared to its peers and the broader market, our SWS DCF model offers a starkly different outlook. According to this approach, G-III’s current share price of $26.53 is above our fair value estimate of $13.01, which points toward potential overvaluation.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out G-III Apparel Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own G-III Apparel Group Narrative

If you have a different viewpoint or want to dive into the numbers yourself, it only takes a few minutes to craft your own narrative and see where your analysis leads. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding G-III Apparel Group.

Looking for more investment ideas?

Don’t settle for just one opportunity. Set yourself up for smarter investing by checking out these handpicked stock ideas powered by the Simply Wall Street Screener:

- Boost your potential returns by getting ahead with these 881 undervalued stocks based on cash flows, which is built on compelling cash flow bargains many investors overlook.

- Secure steady income by tapping into these 18 dividend stocks with yields > 3%, which reveals stocks offering attractive yields above 3% for a stronger portfolio foundation.

- Capitalize on exciting industry shifts by targeting these 24 AI penny stocks, which are at the forefront of AI advancements and rapid innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GIII

G-III Apparel Group

Designs, sources, distributes, and markets women’s and men’s apparel in the United States and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026