- United States

- /

- Luxury

- /

- NasdaqGS:FOSL

Undervalued Penny Stocks To Watch In March 2025

Reviewed by Simply Wall St

As of March 2025, the U.S. stock market is experiencing a downturn, with major indices like the S&P 500 sliding into correction territory amid political and economic uncertainty. In such volatile times, investors often look for opportunities that might offer growth potential at a lower cost. Penny stocks, despite their somewhat outdated name, continue to attract attention as they represent smaller or newer companies that could offer surprising value when backed by strong financial health.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.81 | $5.99M | ★★★★★★ |

| Sensus Healthcare (NasdaqCM:SRTS) | $4.43 | $75.55M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $145.67M | ★★★★★★ |

| Safe Bulkers (NYSE:SB) | $3.75 | $397.36M | ★★★★☆☆ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.40 | $74.92M | ★★★★★★ |

| Cango (NYSE:CANG) | $3.30 | $346.49M | ★★★★★★ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8515 | $78.16M | ★★★★★☆ |

| TETRA Technologies (NYSE:TTI) | $3.25 | $442.2M | ★★★★☆☆ |

| Smith Micro Software (NasdaqCM:SMSI) | $0.73 | $12.53M | ★★★★☆☆ |

Click here to see the full list of 766 stocks from our US Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

CuriosityStream (NasdaqCM:CURI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: CuriosityStream Inc. operates as a factual content streaming service and media company, with a market cap of $143.19 million.

Operations: The company generates revenue primarily from its streaming service, amounting to $51.13 million.

Market Cap: $143.19M

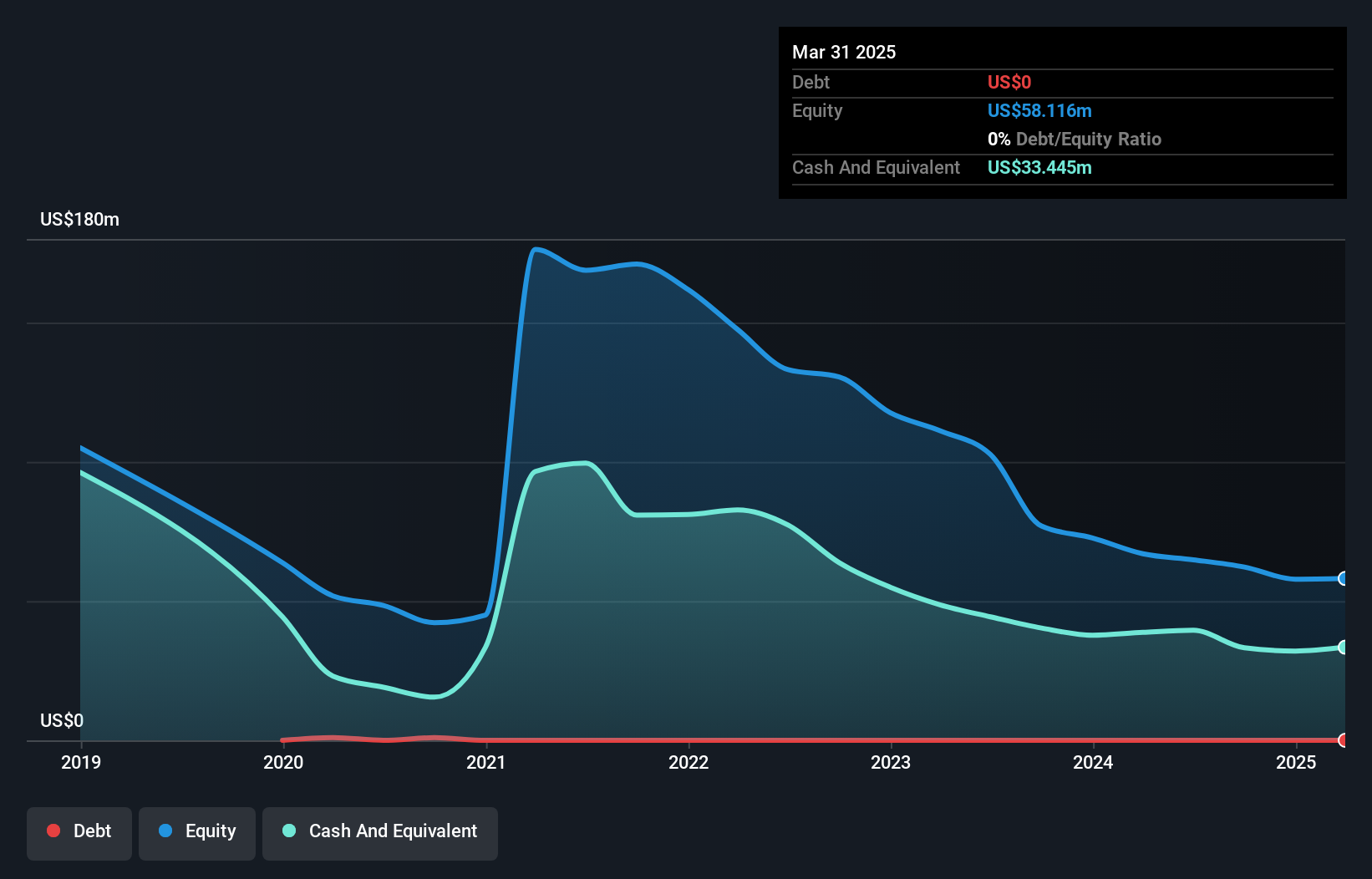

CuriosityStream Inc., with a market cap of US$143.19 million, stands out among penny stocks due to its factual content streaming service generating US$51.13 million in revenue. Despite being unprofitable, the company has reduced its net loss significantly from US$48.9 million to US$12.94 million over the past year and maintains a positive free cash flow with sufficient cash runway for over three years. While trading at a significant discount to estimated fair value, CuriosityStream's experienced board and debt-free status provide stability amidst high share price volatility and ongoing earnings challenges.

- Click to explore a detailed breakdown of our findings in CuriosityStream's financial health report.

- Learn about CuriosityStream's future growth trajectory here.

Beauty Health (NasdaqCM:SKIN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: The Beauty Health Company designs, develops, manufactures, markets, and sells aesthetic technologies and products globally with a market cap of approximately $177.85 million.

Operations: The company's revenue is primarily generated from its Personal Products segment, totaling $334.29 million.

Market Cap: $177.85M

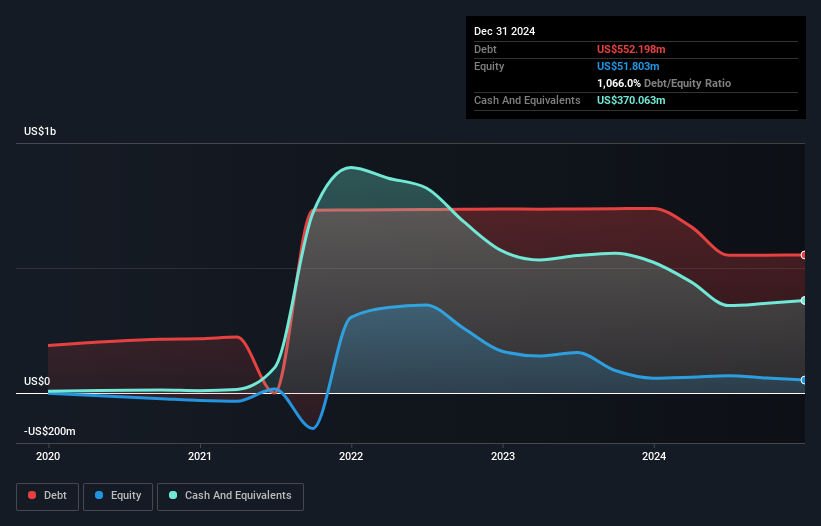

Beauty Health, with a market cap of US$177.85 million, is navigating the challenges typical of penny stocks. Despite reporting US$334.29 million in revenue last year, the company remains unprofitable but has reduced its net loss from US$100.12 million to US$29.1 million year-over-year. It maintains a positive free cash flow and sufficient cash runway for over three years, though its high net debt to equity ratio remains a concern. Recent management changes and board appointments aim to leverage industry expertise, while sales guidance for 2025 indicates potential revenue contraction amidst volatile share prices and forecasted earnings decline.

- Click here and access our complete financial health analysis report to understand the dynamics of Beauty Health.

- Understand Beauty Health's earnings outlook by examining our growth report.

Fossil Group (NasdaqGS:FOSL)

Simply Wall St Financial Health Rating: ★★★★★☆

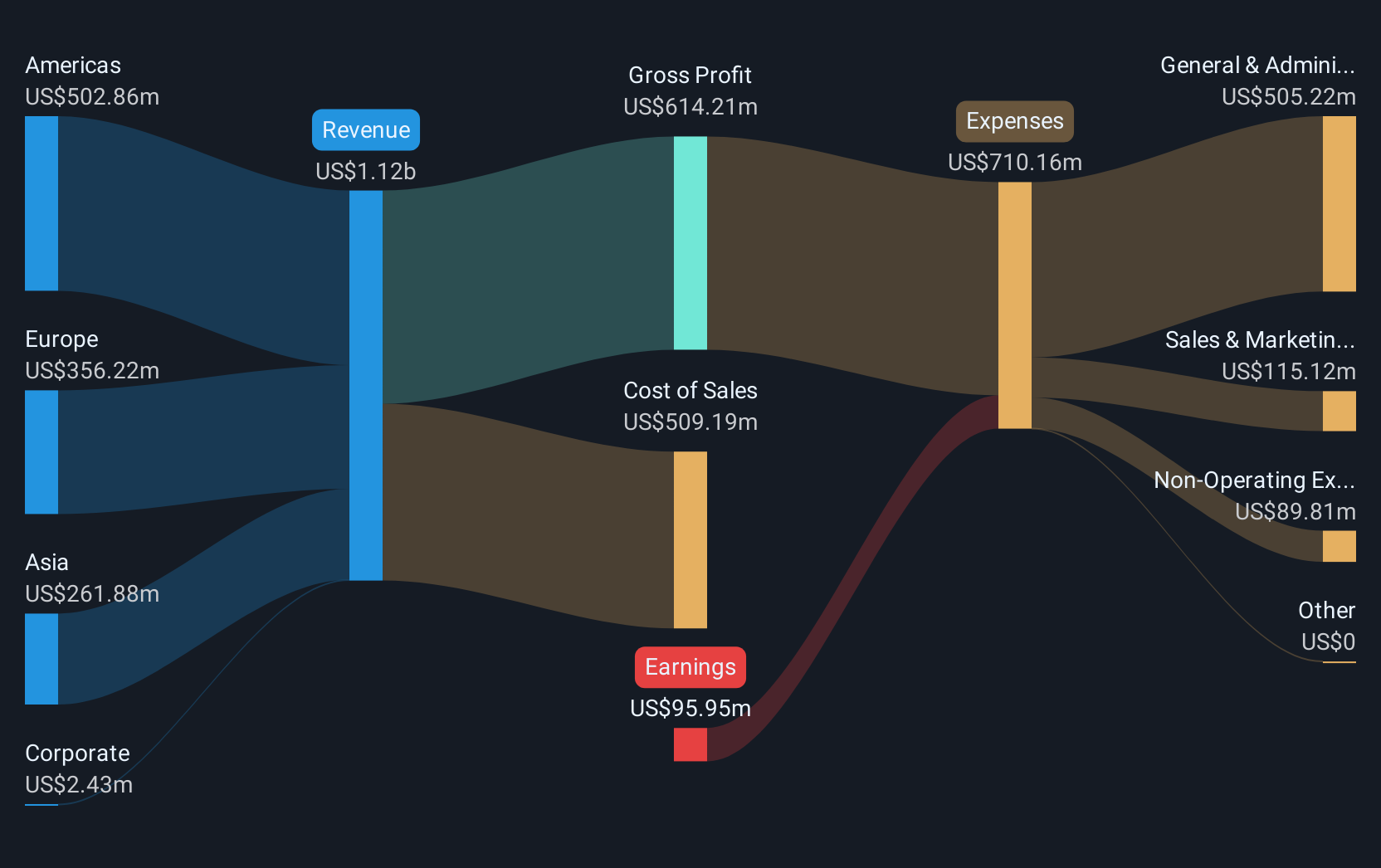

Overview: Fossil Group, Inc. designs, develops, markets, and distributes consumer fashion accessories globally with a market cap of $67.56 million.

Operations: Fossil Group, Inc. does not report specific revenue segments for its global consumer fashion accessories business.

Market Cap: $67.56M

Fossil Group, with a market cap of US$67.56 million, is navigating the complexities of penny stocks amid unprofitability and declining sales. Despite reporting US$342.3 million in fourth-quarter sales, down from US$421.3 million the previous year, the company maintains a sufficient cash runway exceeding three years due to positive free cash flow. Recent executive appointments aim to drive financial turnaround and business transformation efforts. The company's short-term assets surpass its liabilities, although increased debt levels pose challenges. Fossil anticipates a mid to high teens decline in 2025 net sales while addressing volatility concerns with strategic leadership changes and extended brand partnerships.

- Unlock comprehensive insights into our analysis of Fossil Group stock in this financial health report.

- Gain insights into Fossil Group's past trends and performance with our report on the company's historical track record.

Where To Now?

- Embark on your investment journey to our 766 US Penny Stocks selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FOSL

Fossil Group

Designs, develops, markets, and distributes consumer fashion accessories in the United States, Europe, Asia, and internationally.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives