It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

So if you're like me, you might be more interested in profitable, growing companies, like Escalade (NASDAQ:ESCA). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for Escalade

Escalade's Earnings Per Share Are Growing.

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. Impressively, Escalade has grown EPS by 29% per year, compound, in the last three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

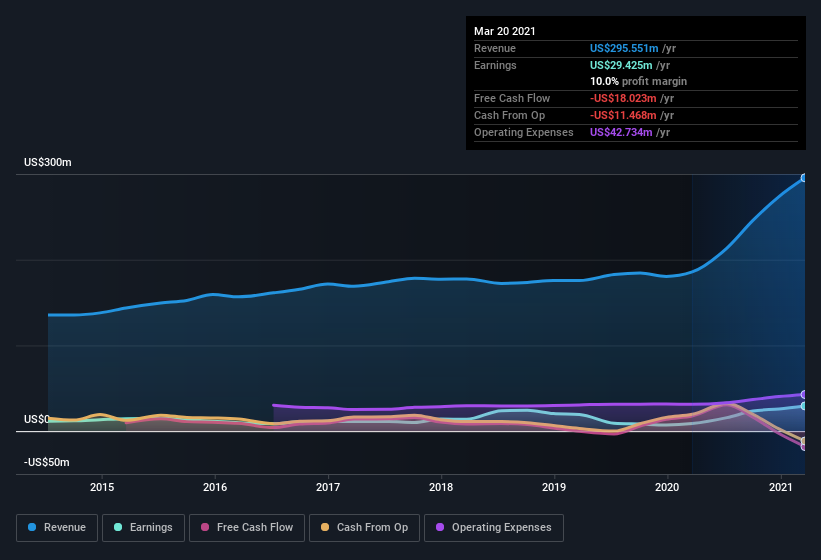

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The good news is that Escalade is growing revenues, and EBIT margins improved by 6.7 percentage points to 13%, over the last year. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Escalade Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The good news is that Escalade insiders spent a whopping US$1.2m on stock in just one year, and I didn't see any selling. As if for a flower bud approaching bloom, I become an expectant observer, anticipating with hope, that something splendid is coming. It is also worth noting that it was Chairman of the Board Walter Glazer who made the biggest single purchase, worth US$613k, paying US$11.78 per share.

Along with the insider buying, another encouraging sign for Escalade is that insiders, as a group, have a considerable shareholding. Given insiders own a small fortune of shares, currently valued at US$79m, they have plenty of motivation to push the business to succeed. That holding amounts to 25% of the stock on issue, thus making insiders influential, and aligned, owners of the business.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. The cherry on top is that the CEO, Walt Glazer is paid comparatively modestly to CEOs at similar sized companies. For companies with market capitalizations between US$200m and US$800m, like Escalade, the median CEO pay is around US$1.7m.

The CEO of Escalade only received US$130k in total compensation for the year ending . That's clearly well below average, so at a glance, that arrangement seems generous to shareholders, and points to a modest remuneration culture. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. I'd also argue reasonable pay levels attest to good decision making more generally.

Is Escalade Worth Keeping An Eye On?

You can't deny that Escalade has grown its earnings per share at a very impressive rate. That's attractive. On top of that, insiders own a significant stake in the company and have been buying more shares. So I do think this is one stock worth watching. Before you take the next step you should know about the 1 warning sign for Escalade that we have uncovered.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Escalade, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade Escalade, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Escalade might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGM:ESCA

Escalade

Manufactures, distributes, imports, and sells sporting goods in North America, Europe, and internationally.

Excellent balance sheet established dividend payer.