- United States

- /

- Consumer Durables

- /

- NasdaqGS:CVCO

Some Confidence Is Lacking In Cavco Industries, Inc.'s (NASDAQ:CVCO) P/E

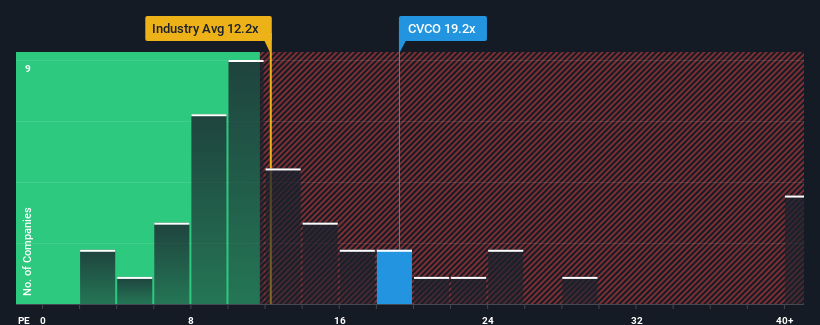

Cavco Industries, Inc.'s (NASDAQ:CVCO) price-to-earnings (or "P/E") ratio of 19.2x might make it look like a sell right now compared to the market in the United States, where around half of the companies have P/E ratios below 16x and even P/E's below 9x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

Recent times haven't been advantageous for Cavco Industries as its earnings have been falling quicker than most other companies. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Cavco Industries

Does Growth Match The High P/E?

Cavco Industries' P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 28%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 197% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 8.2% as estimated by the three analysts watching the company. With the market predicted to deliver 11% growth , the company is positioned for a weaker earnings result.

In light of this, it's alarming that Cavco Industries' P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Bottom Line On Cavco Industries' P/E

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Cavco Industries currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Cavco Industries with six simple checks will allow you to discover any risks that could be an issue.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CVCO

Cavco Industries

Designs, produces, and retails factory-built homes primarily in the United States.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026