- United States

- /

- Consumer Durables

- /

- NasdaqGS:CVCO

Cavco Industries (CVCO): Evaluating Valuation as Shares Climb 27% Year-to-Date

Reviewed by Simply Wall St

See our latest analysis for Cavco Industries.

With Cavco Industries’ share price advancing 27% year-to-date and total shareholder return reaching nearly 20% over the last twelve months, momentum remains strong. Recent gains reflect growing optimism around the company’s continued growth trajectory and improved industry sentiment.

If you’re interested in finding more stocks with a similar upward drive, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With shares climbing rapidly and optimism running high, are investors still catching Cavco Industries with room to run, or is the market already reflecting every bit of the company’s promising growth in its price?

Most Popular Narrative: 4.9% Undervalued

With Cavco Industries closing at $557.97 and the narrative’s fair value set at $586.67, the latest outlook sees a modest gap between price and potential. This keeps attention focused on which business factors could push valuation further.

The ongoing housing affordability crisis continues to drive significantly higher demand for manufactured homes, with Cavco reporting strong volume growth and sequential increases in both shipments and pricing. This points to durable revenue expansion as affordability constraints persist for traditional housing.

Want to see what turns housing shortages into big profits? The narrative points to a future shaped by expansion, efficiency, and notable revenue projections. Find out which assumptions drive Cavco’s upside and why analysts have raised their targets. Read the details and decide if the numbers support the premium.

Result: Fair Value of $586.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent tariff pressures and regional market softness could still challenge Cavco’s growth story and could affect future earnings momentum.

Find out about the key risks to this Cavco Industries narrative.

Another View: Looking at Market Multiples

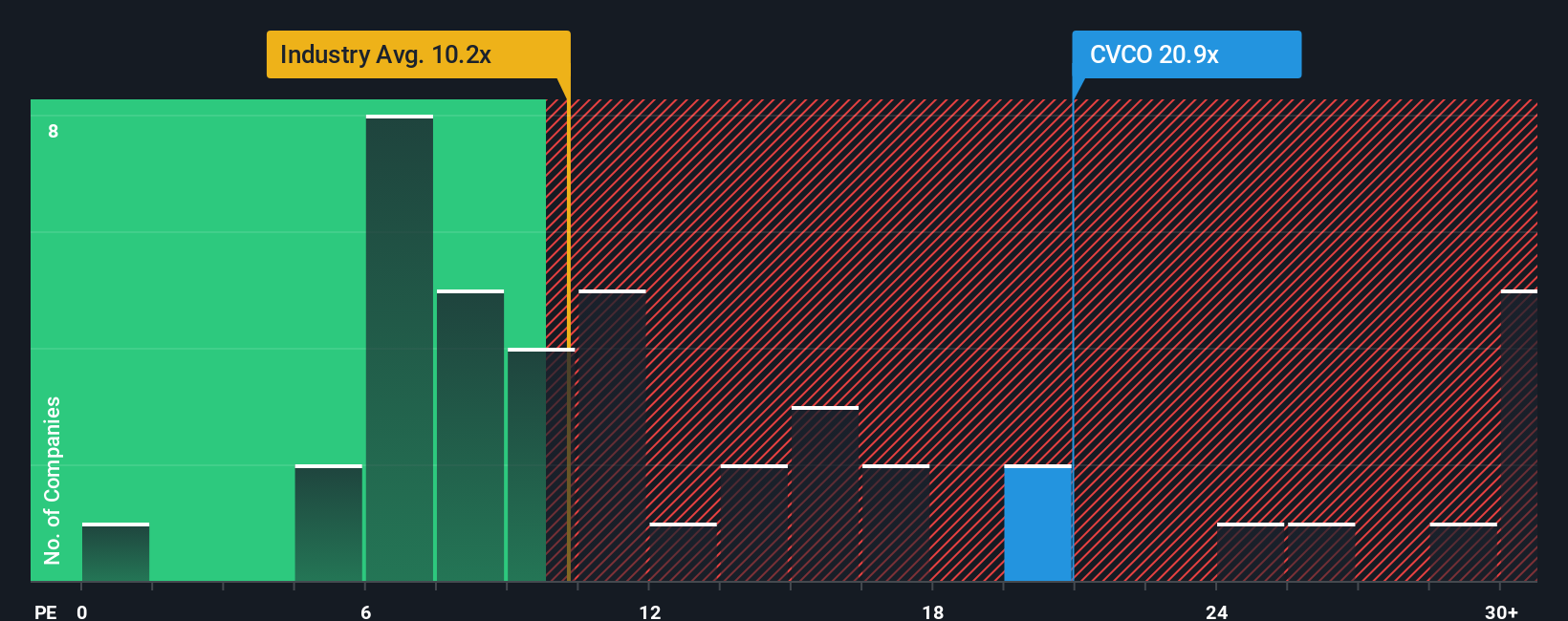

While the fair value estimate points to a 4.9% discount, market pricing tells a different story. Cavco Industries currently trades at a price-to-earnings ratio of 22.1x, which is well above the industry average of 10.5x and the calculated fair ratio of 14.9x. This premium signals that investors may be paying up for future growth, which could mean there is less room for error if expectations falter. Could this rich valuation pose a risk, or does it reflect lasting momentum?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cavco Industries Narrative

If you see a different story in the numbers or want to dig in for your own conclusions, try building your perspective from scratch in just a few minutes. Do it your way

A great starting point for your Cavco Industries research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors know that great opportunities rarely last forever. Open up your possibilities today by checking out the hottest trends and top-performing stocks using Simply Wall Street’s powerful screener tools.

- Capitalize on tech’s unstoppable momentum by researching these 25 AI penny stocks making waves in automation, data processing, and artificial intelligence innovation.

- Enhance your portfolio’s stability by reviewing these 16 dividend stocks with yields > 3% delivering consistent yields and proven shareholder rewards above 3%.

- Catch unique value opportunities with these 879 undervalued stocks based on cash flows currently flying under the radar and priced below their fair value based on robust cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CVCO

Cavco Industries

Designs, produces, and retails factory-built homes primarily in the United States.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives