- United States

- /

- Luxury

- /

- NasdaqCM:CRWS

We Think The Compensation For Crown Crafts, Inc.'s (NASDAQ:CRWS) CEO Looks About Right

Key Insights

- Crown Crafts will host its Annual General Meeting on 13th of August

- Salary of US$400.0k is part of CEO Olivia Elliott's total remuneration

- Total compensation is 58% below industry average

- Crown Crafts' EPS declined by 7.5% over the past three years while total shareholder loss over the past three years was 17%

Shareholders may be wondering what CEO Olivia Elliott plans to do to improve the less than great performance at Crown Crafts, Inc. (NASDAQ:CRWS) recently. At the next AGM coming up on 13th of August, they can influence managerial decision making through voting on resolutions, including executive remuneration. Setting appropriate executive remuneration to align with the interests of shareholders may also be a way to influence the company performance in the long run. In our opinion, CEO compensation does not look excessive and we discuss why.

View our latest analysis for Crown Crafts

Comparing Crown Crafts, Inc.'s CEO Compensation With The Industry

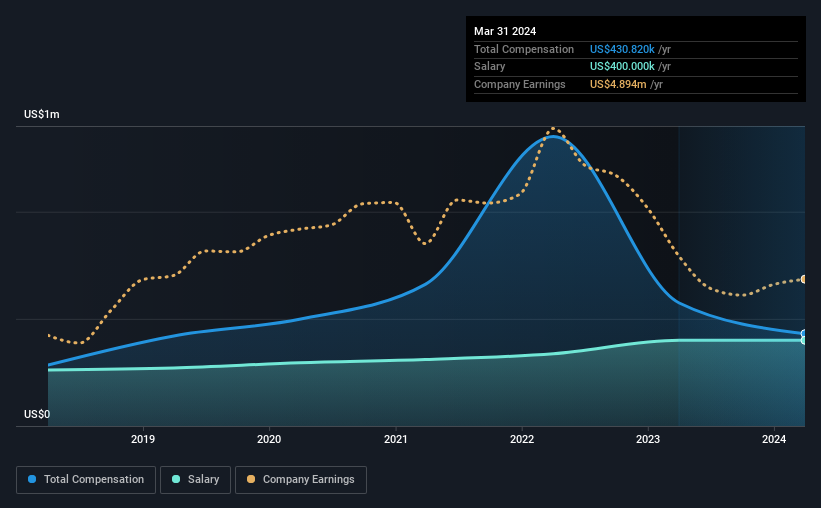

At the time of writing, our data shows that Crown Crafts, Inc. has a market capitalization of US$49m, and reported total annual CEO compensation of US$431k for the year to March 2024. That's a notable decrease of 25% on last year. Notably, the salary which is US$400.0k, represents most of the total compensation being paid.

For comparison, other companies in the American Luxury industry with market capitalizations below US$200m, reported a median total CEO compensation of US$1.0m. Accordingly, Crown Crafts pays its CEO under the industry median. Moreover, Olivia Elliott also holds US$858k worth of Crown Crafts stock directly under their own name.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | US$400k | US$400k | 93% |

| Other | US$31k | US$174k | 7% |

| Total Compensation | US$431k | US$574k | 100% |

Speaking on an industry level, nearly 21% of total compensation represents salary, while the remainder of 79% is other remuneration. According to our research, Crown Crafts has allocated a higher percentage of pay to salary in comparison to the wider industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Crown Crafts, Inc.'s Growth

Over the last three years, Crown Crafts, Inc. has shrunk its earnings per share by 7.5% per year. In the last year, its revenue is up 17%.

Investors would be a bit wary of companies that have lower EPS But in contrast the revenue growth is strong, suggesting future potential for EPS growth. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Crown Crafts, Inc. Been A Good Investment?

With a three year total loss of 17% for the shareholders, Crown Crafts, Inc. would certainly have some dissatisfied shareholders. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

The loss to shareholders over the past three years is certainly concerning. The downward trend in share price performance may be attributable to the the fact that earnings growth has gone backwards. The upcoming AGM will provide shareholders the opportunity to raise their concerns and evaluate if the board’s judgement and decision-making is aligned with their expectations.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. In our study, we found 3 warning signs for Crown Crafts you should be aware of, and 1 of them doesn't sit too well with us.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CRWS

Crown Crafts

Through its subsidiaries, operates in the consumer products industry in the United States and internationally.

Excellent balance sheet moderate.

Market Insights

Community Narratives