Crown Crafts, Inc.'s (NASDAQ:CRWS) investors are due to receive a payment of $0.08 per share on 5th of January. This makes the dividend yield 6.8%, which will augment investor returns quite nicely.

See our latest analysis for Crown Crafts

Crown Crafts' Dividend Is Well Covered By Earnings

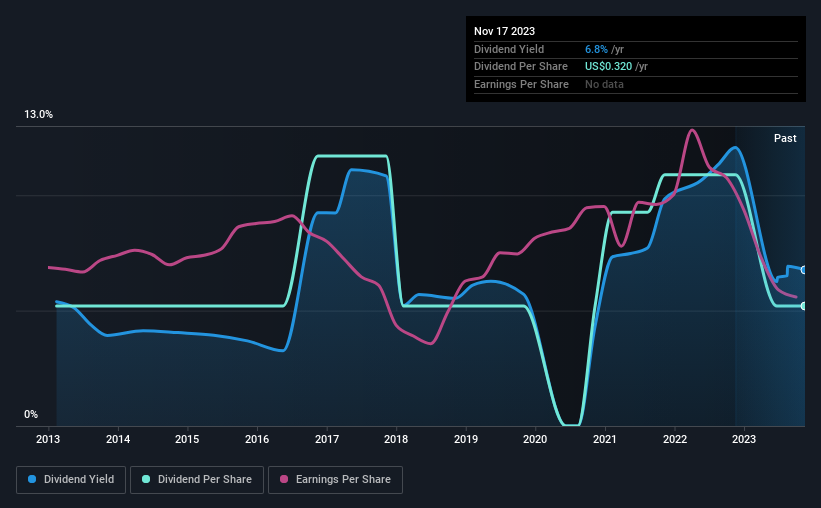

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Before this announcement, Crown Crafts was paying out 74% of earnings, but a comparatively small 38% of free cash flows. This leaves plenty of cash for reinvestment into the business.

Over the next year, EPS could expand by 2.2% if the company continues along the path it has been on recently. If recent patterns in the dividend continue, the payout ratio in 12 months could be 76% which is a bit high but can definitely be sustainable.

Dividend Volatility

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. There hasn't been much of a change in the dividend over the last 10 years. We're glad to see the dividend has risen, but with a limited rate of growth and fluctuations in the payments the total shareholder return may be limited.

Crown Crafts May Find It Hard To Grow The Dividend

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. Earnings have grown at around 2.2% a year for the past five years, which isn't massive but still better than seeing them shrink. There are exceptions, but limited earnings growth and a high payout ratio can signal that a company has reached maturity. When the rate of return on reinvestment opportunities falls below a certain minimum level, companies often elect to pay a larger dividend instead. This is why many mature companies often have larger dividend yields.

Our Thoughts On Crown Crafts' Dividend

Overall, we think Crown Crafts is a solid choice as a dividend stock, even though the dividend wasn't raised this year. The dividend has been at reasonable levels historically, but that hasn't translated into a consistent payment. Taking all of this into consideration, the dividend looks viable moving forward, but investors should be mindful that the company has pushed the boundaries of sustainability in the past and may do so again.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Taking the debate a bit further, we've identified 3 warning signs for Crown Crafts that investors need to be conscious of moving forward. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:CRWS

Crown Crafts

Through its subsidiaries, operates in the consumer products industry in the United States and internationally.

Adequate balance sheet slight.

Market Insights

Community Narratives