- United States

- /

- Luxury

- /

- NasdaqGS:CROX

The Bull Case For Crocs (CROX) Could Change Following Easing Tariff Pressures and Buyback Boost

Reviewed by Simply Wall St

- Following the announcement of new trade agreements and tariff adjustments earlier this week, Crocs expects estimated tariff costs for 2025 to drop, easing previous margin pressures for the company.

- Insider buying and the approval of a US$280 million stock repurchase program highlight management’s confidence and commitment to enhancing shareholder value amid these developments.

- Let’s explore how reduced tariff headwinds may reshape Crocs' investment narrative and capital allocation priorities.

We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Crocs Investment Narrative Recap

To own Crocs stock, you need to believe in the company's ability to drive both international expansion and creative brand engagement through new product launches, even as it contends with evolving consumer preferences and challenges at its HEYDUDE unit. While this week’s tariff relief meaningfully reduces a major margin headwind, short-term performance will still likely be shaped by the pace of HEYDUDE stabilization and overall revenue trends. The most pressing risk remains the ongoing pressure on wholesale and potential softness in consumer demand, which hasn’t been fully addressed by the tariff news.

The recently announced US$280 million share repurchase program stands out as highly relevant: it sends a strong signal about Crocs’ capital allocation priorities at a time when management is seeing improved margin visibility thanks to lower tariffs. While this move may bolster shareholder confidence after recent share price volatility, it does not offset the need for progress on stabilizing HEYDUDE's revenue trajectory and adapting to shifts in consumer sentiment.

However, investors should be aware that even with margin relief, Crocs continues to face pressure from HEYDUDE’s expected revenue decline and persistent uncertainty in...

Read the full narrative on Crocs (it's free!)

Crocs' narrative projects $4.4 billion in revenue and $722.0 million in earnings by 2028. This requires 2.1% yearly revenue growth and a $228.1 million decrease in earnings from $950.1 million today.

Uncover how Crocs' forecasts yield a $121.23 fair value, a 15% upside to its current price.

Exploring Other Perspectives

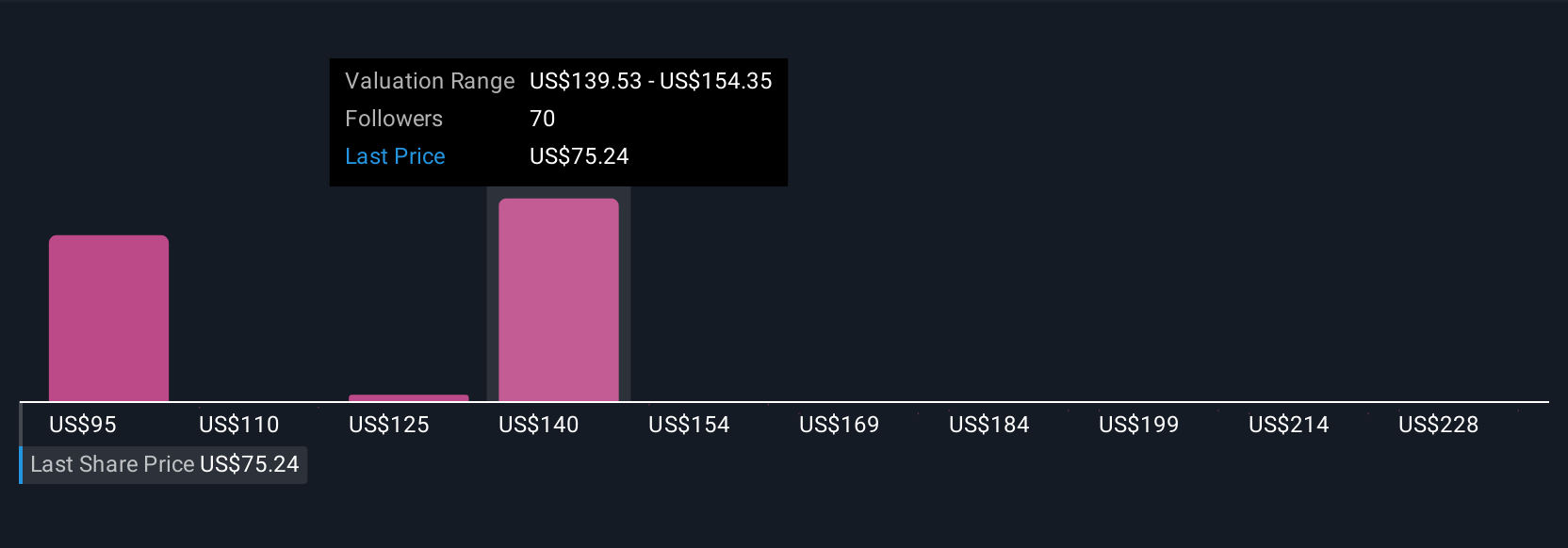

Eighteen fair value estimates from the Simply Wall St Community span a wide range, from US$110 up to US$243.25 per share. While community opinions vary, ongoing concerns about HEYDUDE’s revenue performance remain central to the outlook for Crocs’ future earnings and market perception.

Explore 18 other fair value estimates on Crocs - why the stock might be worth over 2x more than the current price!

Build Your Own Crocs Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Crocs research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Crocs research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Crocs' overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CROX

Crocs

Designs, develops, manufactures, markets, distributes, and sells casual lifestyle footwear and accessories for men, women, and children under the Crocs and HEYDUDE Brands in the United States and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives