- United States

- /

- Luxury

- /

- NasdaqGS:CROX

Crocs (CROX): Evaluating Valuation Following Key Leadership Shift at HEYDUDE Brand

Reviewed by Simply Wall St

Crocs (CROX) announced a key leadership shift, with Rupert Campbell taking on the role of Executive Vice President and President of the HEYDUDE brand. Investors are watching to see how his background shapes strategy and growth.

See our latest analysis for Crocs.

While the leadership change at HEYDUDE has caught fresh attention, Crocs’ recent share price action presents a mixed picture. After a quick 5.79% jump over the past week, the stock is still down 22.77% year-to-date and has delivered a one-year total shareholder return of -22.52%. Still, Crocs has remained a long-term outlier with a 33% five-year total return, which highlights cyclical momentum shifts amid changing leadership and brand ambitions.

If you're eyeing new names making bold moves or catching a rebound, this could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares still trading at a notable discount to their intrinsic value while growth is tempering, the question for investors is whether Crocs is undervalued and primed for a bounce, or if the market has already factored in future gains.

Most Popular Narrative: 3.2% Undervalued

With Crocs closing at $84.98 and the most widely followed narrative setting fair value just above at $87.83, there is a modest valuation gap worth exploring. Some investors are beginning to notice how forward-looking assumptions could set the stage for a bigger shift.

The company's accelerating direct-to-consumer (DTC) strategy, expanding owned retail and digital channels, experimenting with new retail concepts, and scaling global social commerce, is enabling Crocs to maintain higher pricing, reduce reliance on promotional activity, and capture higher-margin sales. Over time, this is expected to structurally increase net margins and improve the overall quality and predictability of earnings.

Curious how Crocs aims to boost earnings power while the rest of the market hesitates? The secret: ambitious margin expansion and direct sales, plus a sharp pivot in key performance focuses. Want to discover the potential upside and what controversial financial forecast is behind this price? Find out by diving deeper into the full narrative.

Result: Fair Value of $87.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in U.S. consumer demand and intensifying competition from athletic and lifestyle brands could limit Crocs’ margin upside in the near term.

Find out about the key risks to this Crocs narrative.

Another View: Market Price Gaps Widen

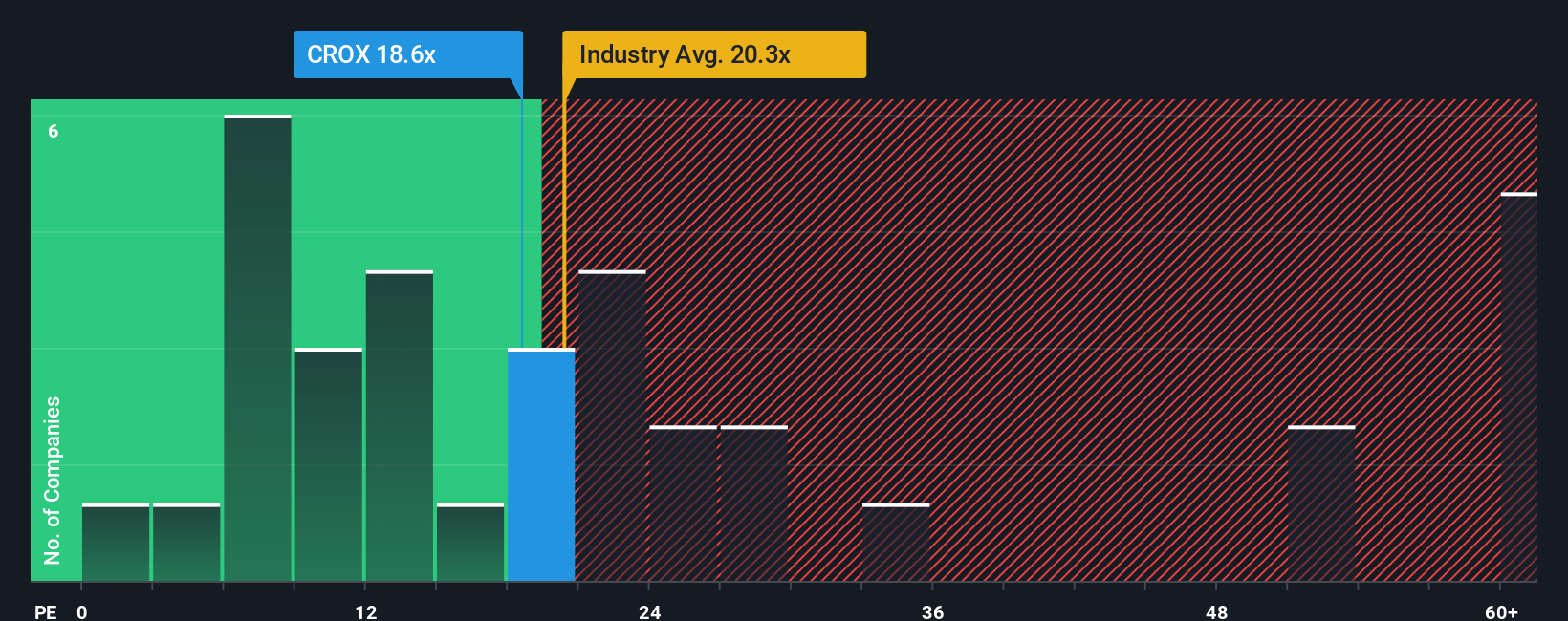

Looking at Crocs through the lens of its price-to-earnings ratio, the story changes. The shares are currently trading at 24.2 times earnings, which is higher than both the US Luxury industry average of 20 and the peer group average of 23. However, our fair ratio stands much higher at 59.3, meaning the market might not be pricing Crocs as richly as some models suggest. Does this premium reflect opportunity or risk as the company faces ongoing market headwinds?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Crocs Narrative

If you think there’s more to the story or want to reach your own conclusions, you can easily craft a fresh narrative in just a few minutes. Do it your way

A great starting point for your Crocs research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let market momentum pass you by. Unlock prime opportunities by targeting high-yield stocks, innovative trends, and next-generation technologies right now.

- Capture reliable income streams as you check out these 15 dividend stocks with yields > 3% delivering yields above 3% from companies built for durability.

- Spot emerging breakthroughs when you tap into these 25 AI penny stocks fueling rapid growth across artificial intelligence and automation sectors.

- Benefit from potential bargains by reviewing these 913 undervalued stocks based on cash flows that fundamental analysis flags as attractive based on their underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CROX

Crocs

Designs, develops, manufactures, markets, distributes, and sells casual lifestyle footwear and accessories for men, women, and children under the Crocs and HEYDUDE Brands in the United States and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026