- United States

- /

- Luxury

- /

- NasdaqGS:COLM

Analyst Upgrades and Insider Buying Could Be a Game Changer for Columbia Sportswear (COLM)

Reviewed by Sasha Jovanovic

- In recent days, Columbia Sportswear received renewed Buy ratings from both Stifel Nicolaus and BTIG, while corporate insider sentiment turned positive with increased insider buying activity last quarter.

- This simultaneous show of optimism from analysts and company insiders signals growing confidence in Columbia Sportswear's outlook despite industry and market uncertainties.

- We'll now assess how this convergence of analyst and insider optimism could influence Columbia Sportswear's investment narrative and future expectations.

Find companies with promising cash flow potential yet trading below their fair value.

Columbia Sportswear Investment Narrative Recap

To be a Columbia Sportswear shareholder, you need to have confidence in the company’s ability to reignite sustainable growth and defend its market share in a fast-evolving, competitive sector. The recent analyst Buy ratings and uptick in insider buying suggest renewed confidence but do not materially change the primary near-term catalyst: upcoming quarterly earnings, or the ongoing risk from weak US sales and margin pressure due to cost inflation and digital competition.

Of the recent company updates, the announcement of share buybacks conducted in Q2 2025 most closely aligns with the positive insider sentiment. While these buybacks support shareholder value and can reflect confidence in the company’s future, the most important earnings and sales trends will still be determined by core operational execution, especially as management continues to strengthen omnichannel capabilities.

However, despite this insider and analyst optimism, investors should be aware that persistent underperformance in US direct-to-consumer sales could...

Read the full narrative on Columbia Sportswear (it's free!)

Columbia Sportswear is projected to reach $3.7 billion in revenue and $184.1 million in earnings by 2028. This outlook assumes a 2.3% annual revenue growth rate and a decrease in earnings of $40.7 million from current earnings of $224.8 million.

Uncover how Columbia Sportswear's forecasts yield a $58.22 fair value, a 9% upside to its current price.

Exploring Other Perspectives

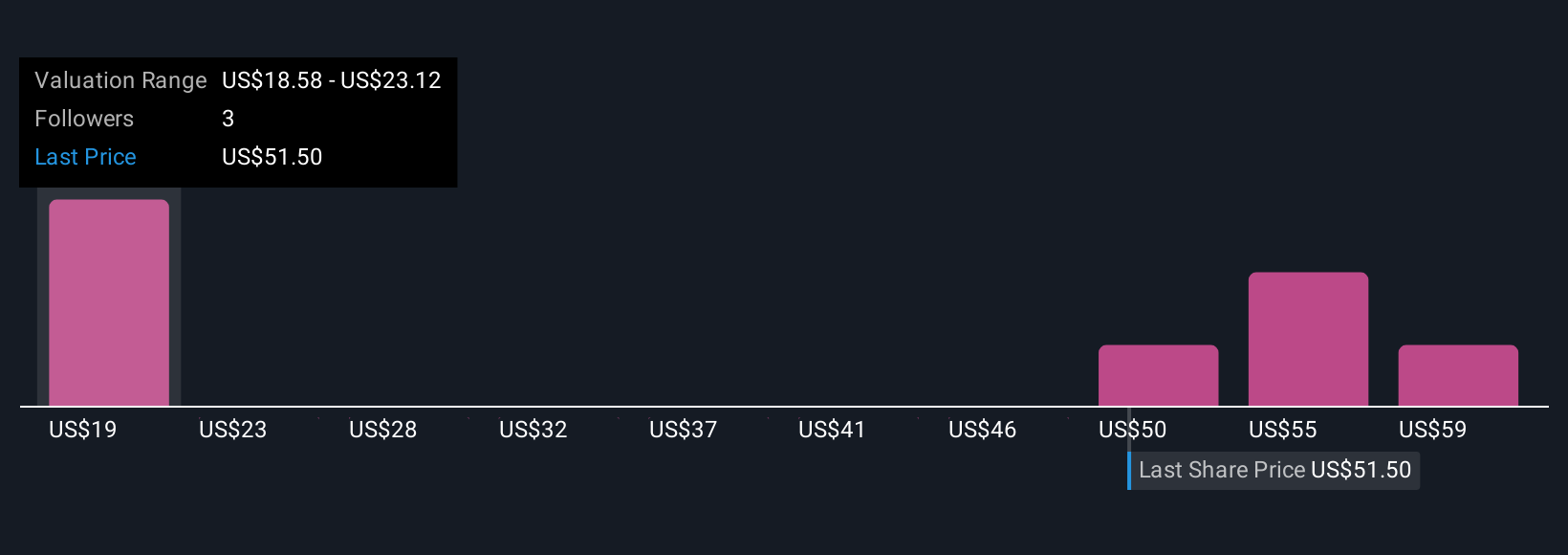

Four members of the Simply Wall St Community see fair value for Columbia Sportswear shares ranging from US$18.57 to US$64. Disagreement is not surprising given concerns about soft US sales growth and ongoing margin pressures, readers can explore these perspectives to see where their own view fits.

Explore 4 other fair value estimates on Columbia Sportswear - why the stock might be worth less than half the current price!

Build Your Own Columbia Sportswear Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Columbia Sportswear research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Columbia Sportswear research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Columbia Sportswear's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COLM

Columbia Sportswear

Designs, develops, markets, and distributes outdoor, active, and lifestyle products in the United States, Latin America, the Asia Pacific, Europe, the Middle East, Africa, and Canada.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives