- United States

- /

- Commercial Services

- /

- NYSEAM:DSS

Document Security Systems (NYSEMKT:DSS) Has Debt But No Earnings; Should You Worry?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Document Security Systems, Inc. (NYSEMKT:DSS) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Document Security Systems

What Is Document Security Systems's Debt?

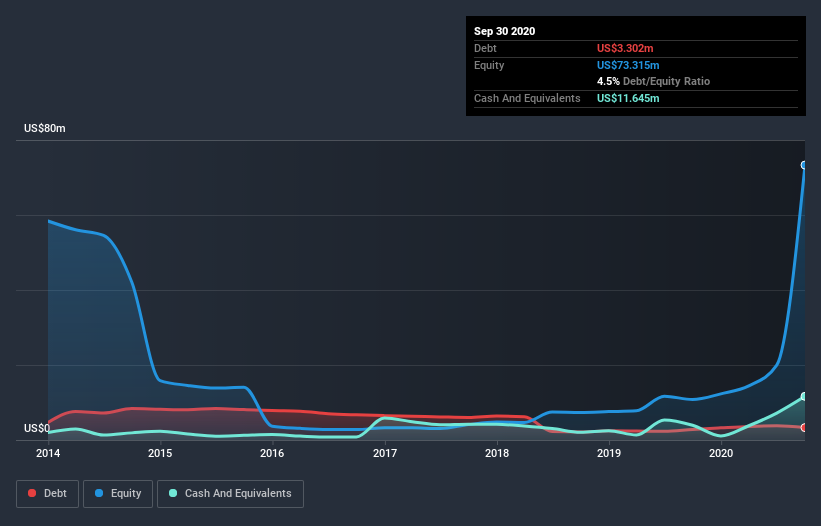

You can click the graphic below for the historical numbers, but it shows that as of September 2020 Document Security Systems had US$3.30m of debt, an increase on US$2.83m, over one year. However, it does have US$11.6m in cash offsetting this, leading to net cash of US$8.34m.

A Look At Document Security Systems's Liabilities

We can see from the most recent balance sheet that Document Security Systems had liabilities of US$4.47m falling due within a year, and liabilities of US$4.21m due beyond that. On the other hand, it had cash of US$11.6m and US$2.59m worth of receivables due within a year. So it can boast US$5.56m more liquid assets than total liabilities.

This excess liquidity suggests that Document Security Systems is taking a careful approach to debt. Because it has plenty of assets, it is unlikely to have trouble with its lenders. Simply put, the fact that Document Security Systems has more cash than debt is arguably a good indication that it can manage its debt safely. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Document Security Systems's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, Document Security Systems reported revenue of US$21m, which is a gain of 33%, although it did not report any earnings before interest and tax. With any luck the company will be able to grow its way to profitability.

So How Risky Is Document Security Systems?

While Document Security Systems lost money on an earnings before interest and tax (EBIT) level, it actually booked a paper profit of US$3.6m. So when you consider it has net cash, along with the statutory profit, the stock probably isn't as risky as it might seem, at least in the short term. We think its revenue growth of 33% is a good sign. We'd see further strong growth as an optimistic indication. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 5 warning signs for Document Security Systems (3 can't be ignored!) that you should be aware of before investing here.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you decide to trade Document Security Systems, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NYSEAM:DSS

DSS

Operates in the product packaging, biotechnology, commercial lending, securities and investment management, and direct marketing businesses in the United States.

Mediocre balance sheet low.

Similar Companies

Market Insights

Community Narratives