- United States

- /

- Professional Services

- /

- NYSE:WNS

WNS (Holdings) (NYSE:WNS): Assessing Current Valuation in Light of Recent Developments

Reviewed by Kshitija Bhandaru

WNS (Holdings) (NYSE:WNS) stock has moved slightly in recent trading, so let us check how the numbers stack up. Investors are likely weighing the company’s track record against broader industry trends right now.

See our latest analysis for WNS (Holdings).

After a relatively mild move in recent sessions, WNS (Holdings)’s share price is still riding the momentum from a solid stretch, with its latest share price sitting at $76.3. Over the past year, total shareholder return edged up just over half a percent, highlighting a steady if unspectacular performance and suggesting investors are recalibrating their expectations as the company’s growth narrative evolves amid sector shifts.

If you’re curious about what else is trending, this might be a perfect moment to broaden your search and discover fast growing stocks with high insider ownership

Does the recent subdued movement in WNS (Holdings) mean the stock is now undervalued, or has the market already accounted for all its future growth potential, presenting less of a buying opportunity than some investors hope?

Most Popular Narrative: Fairly Valued

With WNS (Holdings) trading at $76.30 and the most-followed narrative indicating a fair value of $76.20, the market is viewed as pinning the stock's price to analyst forecasts. What’s behind this alignment between the narrative and the market? Let’s look at a core catalyst from the narrative itself.

The acquisition of Kipi.ai enhances WNS' positioning in the data management space with significant potential for value creation through combining data and AI expertise. This is likely to impact revenue and margins positively through higher-value services. Mentioned expansion in AI and hiring of significant leadership in AI and digital strategy suggest a focused investment in growth areas that can lead to improved productivity and higher-value service offerings, enhancing both revenue and net margins.

Want to peek behind the curtain? Dive in to see why revenue growth and transformative deals are at the heart of this price target. A future profit multiple more typical of market leaders is central to the valuation puzzle. What number crunching leads to this verdict? The answer may surprise you.

Result: Fair Value of $76.20 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent client losses and high employee attrition remain critical risks that could significantly impact WNS (Holdings)’s growth outlook and margins.

Find out about the key risks to this WNS (Holdings) narrative.

Another View: Multiples Suggest Relative Value

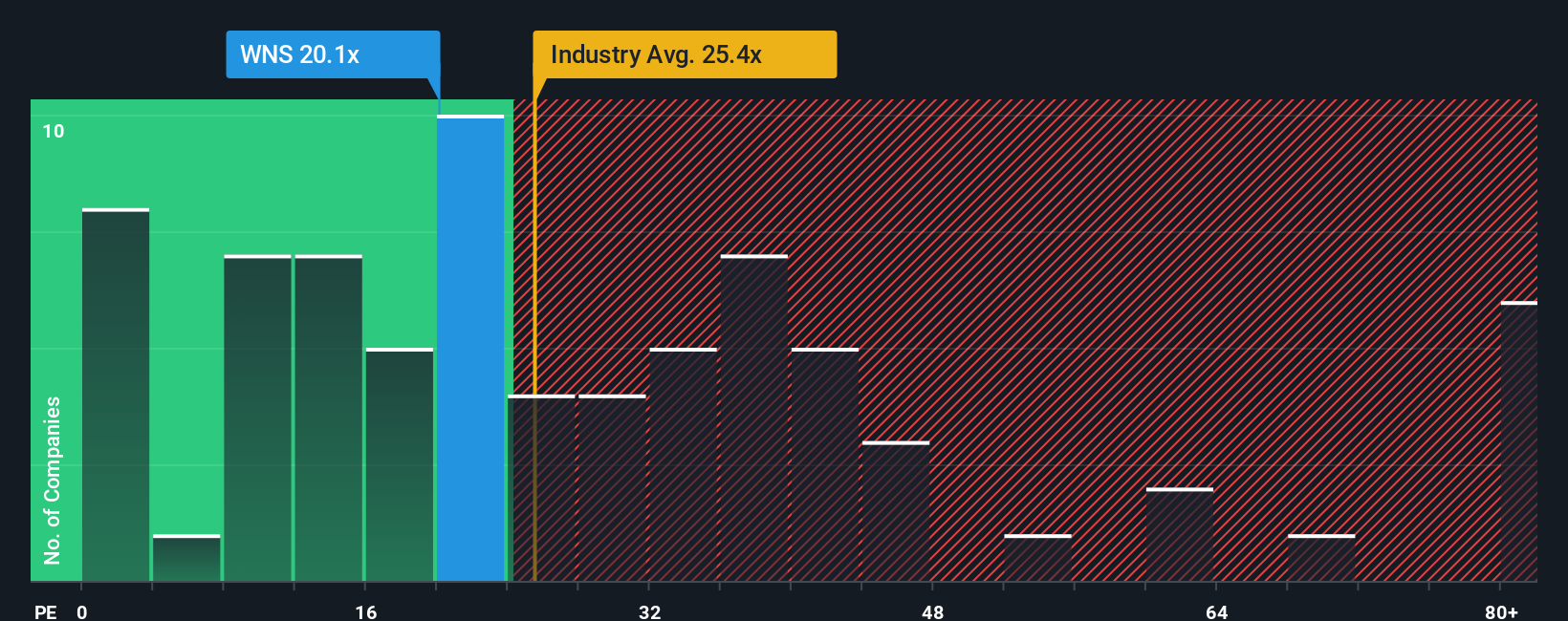

While the market and analyst expectations point to fair value, a look at the price-to-earnings ratio adds perspective. WNS trades at 20.1 times earnings, which is below both its industry average (26.7x) and the peer average (30x), and also under our estimated fair ratio of 21.7x. This gap hints at a potential value opportunity, but is the discount a genuine bargain or a sign the market sees more risk ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own WNS (Holdings) Narrative

If you want to dive deeper and see the data from your own angle, you can shape your own perspective and reach a verdict in under three minutes with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding WNS (Holdings).

Ready for More Smart Investment Opportunities?

The market is packed with stocks primed for unique growth. Don’t just stop at WNS (Holdings). Use the Simply Wall Street Screener to confidently target themes powering the next big wins. Even a small shift in your research can give you a major edge, so make every decision count while others wait and wonder.

- Target reliable passive income by evaluating steady yields through these 19 dividend stocks with yields > 3%, designed to spotlight standout payouts above 3%.

- Tap into rapid innovation and seize your edge in artificial intelligence with these 24 AI penny stocks, built to surface tomorrow's frontrunners.

- Position yourself ahead of the crowd by finding mispriced gems using these 901 undervalued stocks based on cash flows, based on cash flow analysis and objective value signals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WNS (Holdings) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WNS

WNS (Holdings)

A business process management (BPM) company, provides data, voice, analytical, and business transformation services worldwide.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives