- United States

- /

- Professional Services

- /

- NYSE:WNS

Is WNS (Holdings)’s New Mumbai Hub Shaping Its Operational Edge and Investment Narrative (WNS)?

Reviewed by Simply Wall St

- WNS (Holdings) Limited recently inaugurated a new, advanced 5,000-seat global operations hub in Thane, Mumbai, consolidating its local operations into a single, energy-efficient facility.

- This expansion reflects WNS's focus on fostering innovation, employee experience, and sustainability, supporting its aim for long-term value creation for clients worldwide.

- We'll examine how this major Mumbai facility consolidation could strengthen WNS’s operational efficiency and influence its forward-looking investment narrative.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

WNS (Holdings) Investment Narrative Recap

To be a shareholder in WNS (Holdings), you need to trust in its blend of operational resilience and client-focused growth, even as earnings and revenue growth have faced recent headwinds. The inauguration of the new Mumbai hub is a significant operational milestone, but with the Capgemini acquisition pending, short-term catalysts now hinge primarily on deal completion rather than facility upgrades; the biggest immediate risk remains related to client losses and the resulting impact on operating margins, which the new hub may only partially address.

Among WNS's recent developments, shareholder approval of the Capgemini acquisition stands out as most relevant to the current situation. With 99.9% of votes in favor, this outcome sets the stage for integration, likely overshadowing impacts from core operational changes and fundamentally altering the near-term investment outlook, regardless of the enhanced efficiency the new facility promises.

However, investors should be aware that amid these developments, elevated client concentration risk remains...

Read the full narrative on WNS (Holdings) (it's free!)

WNS (Holdings) is projected to generate $1.7 billion in revenue and $180.9 million in earnings by 2028. This outlook is based on a 7.8% annual revenue growth rate and reflects an earnings increase of $18 million from current earnings of $162.9 million.

Uncover how WNS (Holdings)'s forecasts yield a $76.20 fair value, in line with its current price.

Exploring Other Perspectives

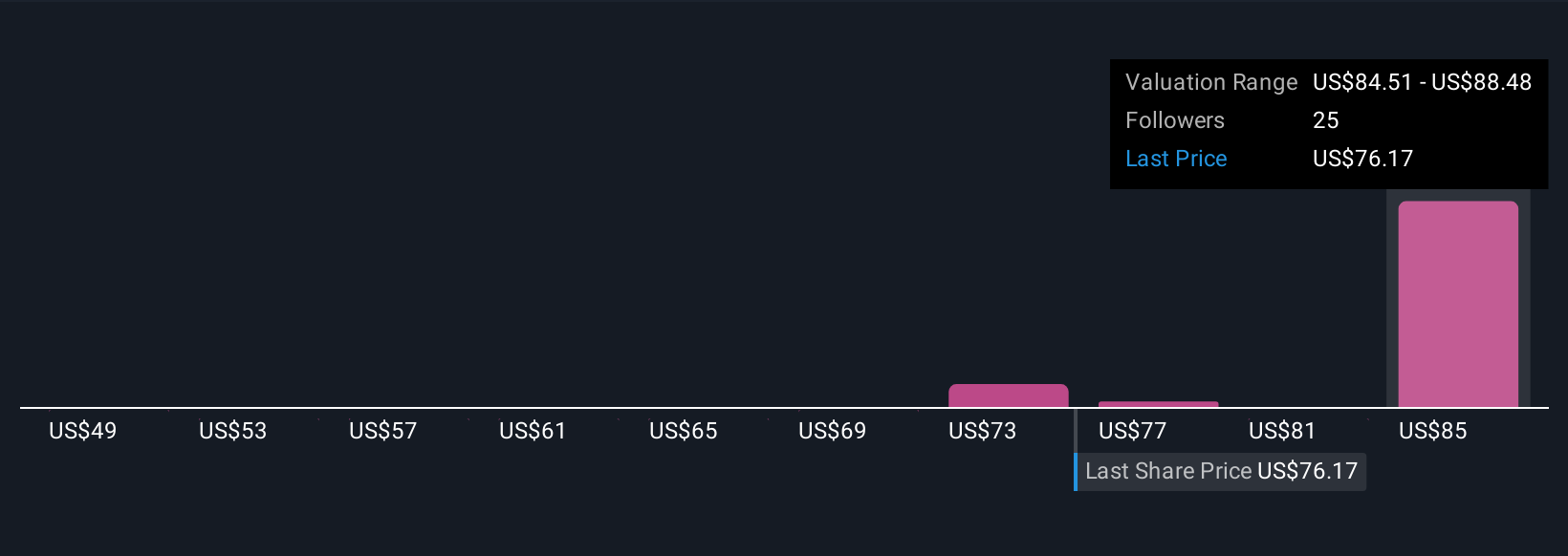

Five recent fair value estimates from the Simply Wall St Community range from US$48.78 to US$88.48 per share, underscoring a broad spectrum of individual investor outlooks. While shareholder optimism surrounds the Capgemini deal, client retention concerns continue to shape expectations for WNS’s earnings stability and long-term prospects.

Explore 5 other fair value estimates on WNS (Holdings) - why the stock might be worth as much as 16% more than the current price!

Build Your Own WNS (Holdings) Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WNS (Holdings) research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free WNS (Holdings) research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WNS (Holdings)'s overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 30 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WNS (Holdings) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WNS

WNS (Holdings)

A business process management (BPM) company, provides data, voice, analytical, and business transformation services worldwide.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives