- United States

- /

- Commercial Services

- /

- NYSE:WM

Waste Management (WM): Evaluating Valuation Following Recent Pullback in Share Price

Reviewed by Kshitija Bhandaru

See our latest analysis for Waste Management.

Looking beyond the latest pullback, Waste Management’s 1-year total shareholder return of 5% suggests steady, if unspectacular, gains. Momentum has faded a bit compared to the robust multi-year streak. Recent price action likely reflects shifting market sentiment around growth prospects and valuation rather than any single event.

If you’re interested in broadening your investing toolkit, this is an ideal moment to discover fast growing stocks with high insider ownership.

The question now is whether Waste Management’s recent weakness leaves the stock undervalued, presenting a buying opportunity, or if the market has already priced in most of its future growth potential.

Most Popular Narrative: 15.7% Undervalued

Waste Management’s last close of $216.91 stands noticeably below the most popular narrative fair value estimate of $257.3. This suggests a possible opportunity seen by consensus analysts. With a gap like this, understanding what drives these assumptions becomes essential for investors watching the stock’s next move.

The implementation of technology to supplement the workforce and optimize cost structures is expected to be a significant differentiator for Waste Management. This could potentially lead to improved net margins. The company's strategic investments in sustainability, particularly in the areas of recycling and renewable energy, are showing strong, high-return growth, which could drive future revenue increases.

Want to know what’s fueling this ambitious price target? The combination of margin expansion, aggressive tech investment, and a bold vision for future growth forms the basis. Curious about the financial leaps analysts expect Waste Management to make in the coming years? The full narrative reveals the key profit and revenue assumptions behind this valuation.

Result: Fair Value of $257.3 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing economic pressures and the expiration of tax credits could disrupt Waste Management’s growth story. This may challenge the current bullish outlook.

Find out about the key risks to this Waste Management narrative.

Another View: Valuation by Earnings Multiple

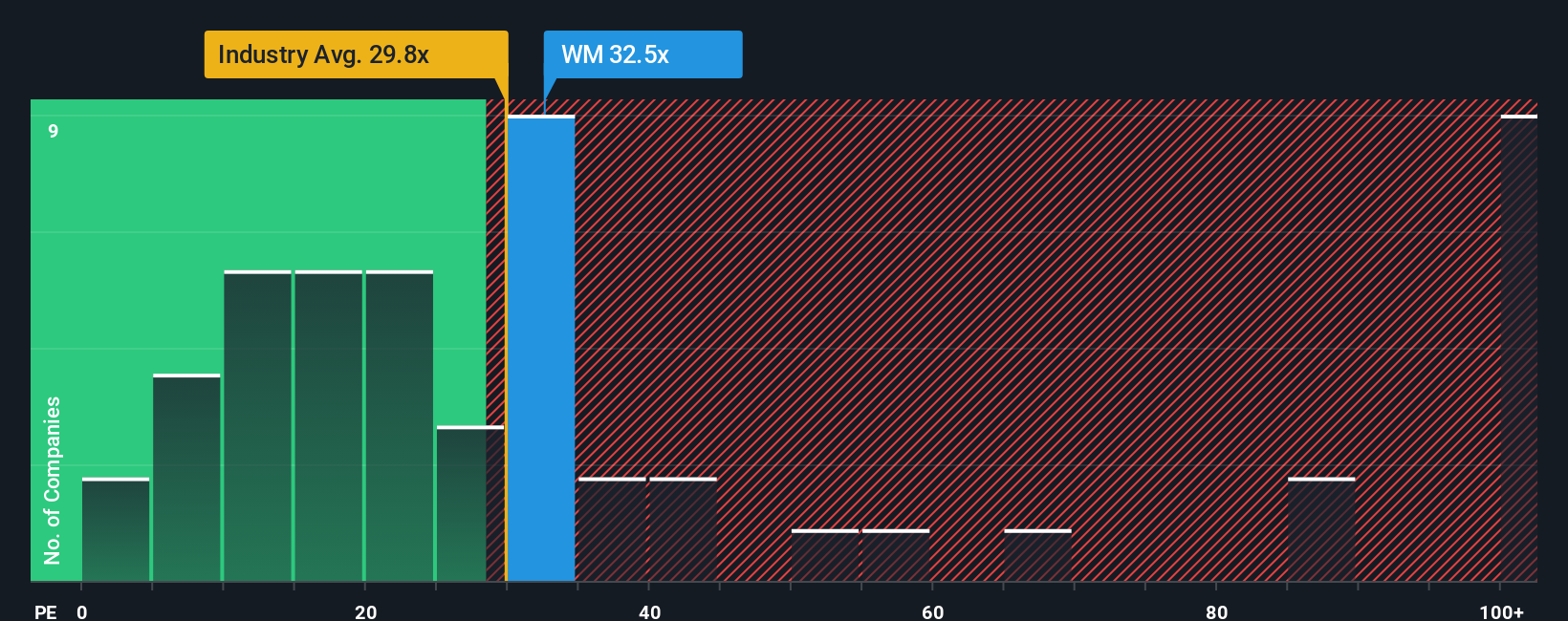

While analyst forecasts highlight upside, Waste Management’s price-to-earnings ratio of 32.1x is above the industry average of 29.6x but still below the peer average of 47.3x. The fair ratio is estimated at 34.4x, suggesting the current valuation is reasonable but not especially cheap. This premium could signal higher expectations or potentially limit future returns.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Waste Management Narrative

If the consensus story does not align with your perspective or you prefer to dig into the numbers yourself, you can easily build your own view in just a few minutes. Do it your way

A great starting point for your Waste Management research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Put your money to work with investment opportunities you might be missing. Let Simply Wall Street’s screeners help you spot the next big winner before the crowd.

- Capitalize on rising yields by checking out these 19 dividend stocks with yields > 3%, which offers attractive income backed by strong fundamentals.

- Catch groundbreaking tech trends when you scan these 24 AI penny stocks, harnessing artificial intelligence for rapid growth and disruption.

- Unlock potential bargains and secure value by targeting these 909 undervalued stocks based on cash flows, trading below what their cash flows suggest they are worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Waste Management might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WM

Waste Management

Through its subsidiaries, provides environmental solutions to residential, commercial, industrial, and municipal customers in the United States, Canada, Western Europe, and internationally.

Established dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives