- United States

- /

- Commercial Services

- /

- NYSE:WM

Waste Management (WM): Evaluating Current Valuation After Recent Momentum Shift

Reviewed by Kshitija Bhandaru

See our latest analysis for Waste Management.

Even with the recent dip, Waste Management’s share price has tracked upward over the past year, and its long-term total shareholder returns suggest steady performance remains intact. Momentum has cooled a bit lately, which could signal a pause as the market reassesses growth prospects or risk levels.

If you’re open to discovering what else is catching investor interest, consider broadening your search and uncovering fast growing stocks with high insider ownership.

With shares now trading about 18% below analyst price targets and showing healthy growth in revenue and income, the question arises: is there untapped value in Waste Management, or has the market already accounted for its future potential?

Most Popular Narrative: 15.7% Undervalued

Waste Management's current share price sits below the most widely followed fair value estimate, creating a notable gap between recent market weakness and longer-term expectations.

The implementation of technology to supplement the workforce and optimize cost structures is expected to be a significant differentiator for Waste Management, potentially leading to improved net margins. The company's strategic investments in sustainability, particularly in the areas of recycling and renewable energy, are showing strong, high-return growth, which could drive future revenue increases.

Curious what turbocharges that price target? The narrative leans heavily on a three-part story: accelerating profit margins, aggressive revenue expansion, and a bold reliance on automation. Find out the surprising figures and projections that power this fair value and see if the rally has only just begun.

Result: Fair Value of $257.3 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing economic pressures and potential regulatory changes could challenge Waste Management's growth story and may temper expectations for its future profitability.

Find out about the key risks to this Waste Management narrative.

Another View: Mixed Signals From Earnings Multiples

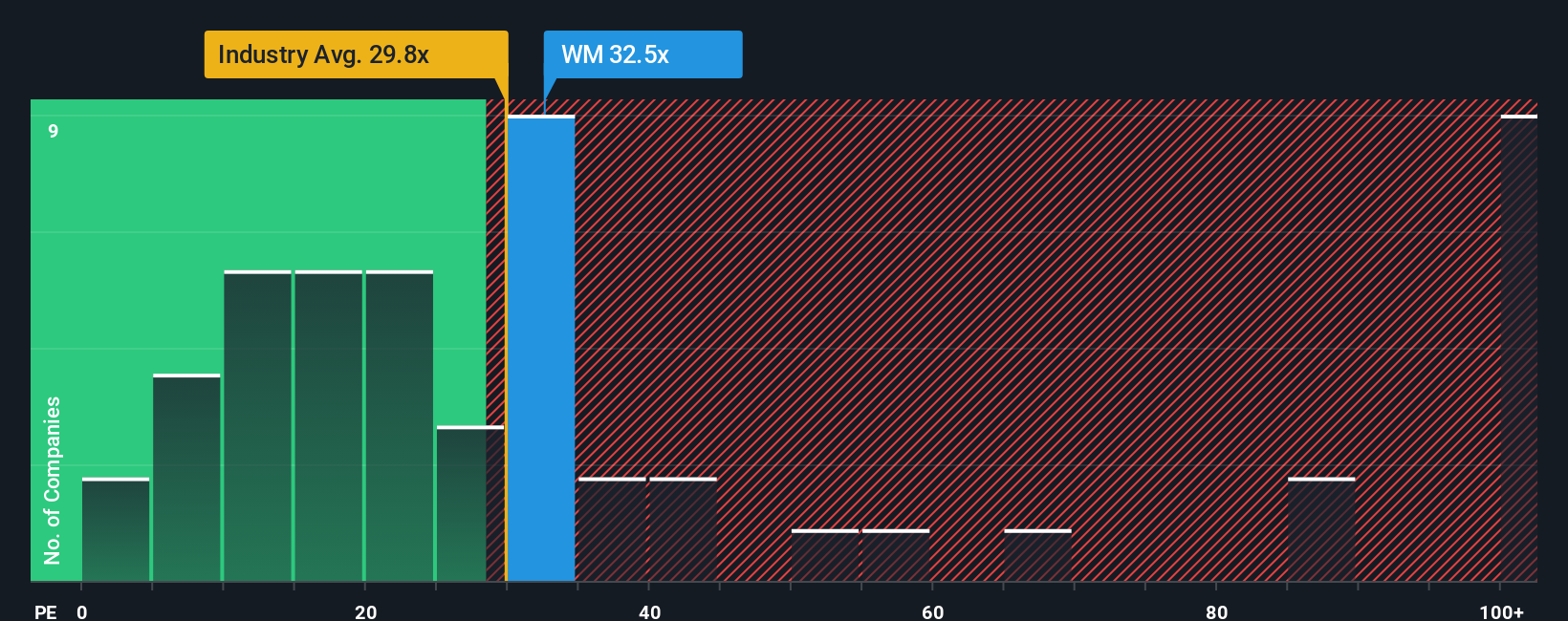

While the fair value narrative points to Waste Management being undervalued, a look at its current earnings multiple tells a more complex story. The company's price-to-earnings ratio of 32.1 is higher than the US Commercial Services industry average of 29.6. However, it remains below peers at 47.3 and is shy of its fair ratio of 34.4. This creates both opportunity and risk for investors. Could the market close the gap, or is there more room for caution?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Waste Management for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Waste Management Narrative

If you see the story unfolding differently or want to dig into the numbers on your own terms, it only takes a few minutes to craft your own perspective. Do it your way.

A great starting point for your Waste Management research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t settle for the obvious picks when smarter investment opportunities are just a click away. The right trend could be exactly what your portfolio needs now.

- Supercharge your income by reviewing these 19 dividend stocks with yields > 3%, offering yields above 3 percent for reliable cash flow and market-beating growth potential.

- Capitalize on AI breakthroughs by targeting innovation with these 24 AI penny stocks before the crowd catches on and these game-changers surge ahead.

- Lock in strong value moves by seizing these 900 undervalued stocks based on cash flows, currently priced below their potential based on real cash flows and fundamental strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Waste Management might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WM

Waste Management

Through its subsidiaries, provides environmental solutions to residential, commercial, industrial, and municipal customers in the United States, Canada, Western Europe, and internationally.

Established dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives