- United States

- /

- Commercial Services

- /

- NYSE:WM

Waste Management (WM): Assessing Valuation After Recent Share Price Fluctuations

Reviewed by Simply Wall St

See our latest analysis for Waste Management.

While Waste Management's share price has taken a slight step back recently, its year-to-date price return of over 7% hints at steady momentum. This is complemented by a solid 1-year total shareholder return of 3.28%. Long-term holders have seen the value compound, with a notable 110% total shareholder return over five years. Despite near-term volatility, the bigger performance story remains intact.

If you’re looking for inspiration beyond Waste Management, now’s a great time to discover fast growing stocks with high insider ownership.

With a moderate drop in recent weeks but strong long-term performance, the big question now is whether Waste Management’s current valuation points to an opportunity for buyers or if the market has already accounted for the company’s future growth prospects.

Most Popular Narrative: 14.9% Undervalued

Compared to the last close price of $214.89, the most widely followed narrative puts Waste Management’s fair value at $252.45. This creates a notable gap that investors will want to understand. The estimate reflects forward-looking expectations for growth and profitability, setting the scene for some optimistic assumptions about margin expansion and sector leadership.

The company's strategic investments in sustainability, particularly in the areas of recycling and renewable energy, are showing strong, high-return growth, which could drive future revenue increases. The integration and optimization of WM Healthcare Solutions are on track to deliver significant synergies, anticipated to reach $250 million annually by 2027, positively impacting earnings.

Curious how Waste Management’s ambitious investments might supercharge margins? This narrative reveals bold expectations on profit expansion, future earnings power, and the surprising growth engine hidden within recycling and healthcare. The real secret? It’s all baked into a financial blueprint you probably wouldn’t associate with a traditional waste company.

Result: Fair Value of $252.45 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifts in economic conditions or unexpected changes in regulations could quickly change the outlook and challenge even the most optimistic forecasts for Waste Management.

Find out about the key risks to this Waste Management narrative.

Another View: What Does Our DCF Model Say?

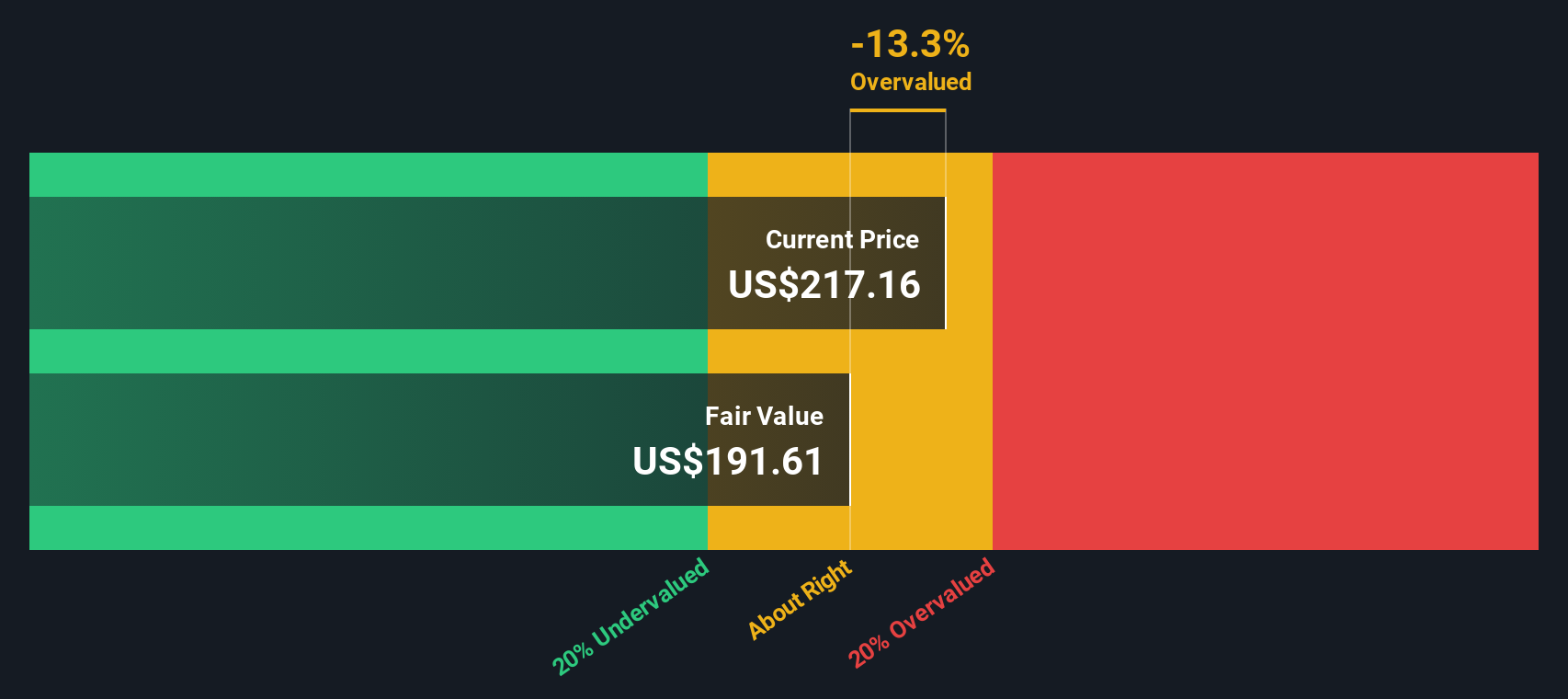

While analysts see Waste Management as undervalued relative to consensus price targets, our SWS DCF model suggests a different story. According to this approach, Waste Management is actually trading above its estimated fair value. This raises a new question: Is the market factoring in future growth too optimistically?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Waste Management for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Waste Management Narrative

If you see things differently or want to dig into the numbers yourself, you can quickly shape your own take in just a few minutes with Do it your way.

A great starting point for your Waste Management research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunities slip by when the next big winner could be just a click away. Use these expert-curated shortlists to jumpstart your search for standout stocks today.

- Amplify your portfolio’s momentum and target unrivaled returns by checking out these 3574 penny stocks with strong financials making waves in untapped market corners.

- Tap into the unstoppable force of artificial intelligence by exploring these 24 AI penny stocks reshaping entire industries and unlocking new growth frontiers.

- Power up your quest for reliable yield with these 17 dividend stocks with yields > 3% offering strong payouts and the potential for long-term wealth building.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Waste Management might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WM

Waste Management

Through its subsidiaries, provides environmental solutions to residential, commercial, industrial, and municipal customers in the United States, Canada, Western Europe, and internationally.

Established dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives