- United States

- /

- Commercial Services

- /

- NYSE:WM

Waste Management (NYSE:WM) Q1 2025 Sales Rise to US$6 Billion, Net Income Falls

Reviewed by Simply Wall St

Waste Management (NYSE:WM) recently reported a mixed performance for Q1 2025 with a 17% increase in sales but a 10% decline in net income compared to the previous year. Despite these results, the company's share price rose by 7.22% last quarter. This movement coincides with Waste Management's ambitious sustainability initiatives, including the opening of new recycling and renewable natural gas facilities, as part of a significant growth strategy. Meanwhile, broader market trends show a general uptrend, with the Dow and S&P 500 extending winning streaks, suggesting Waste Management's performance aligned with overall market sentiment.

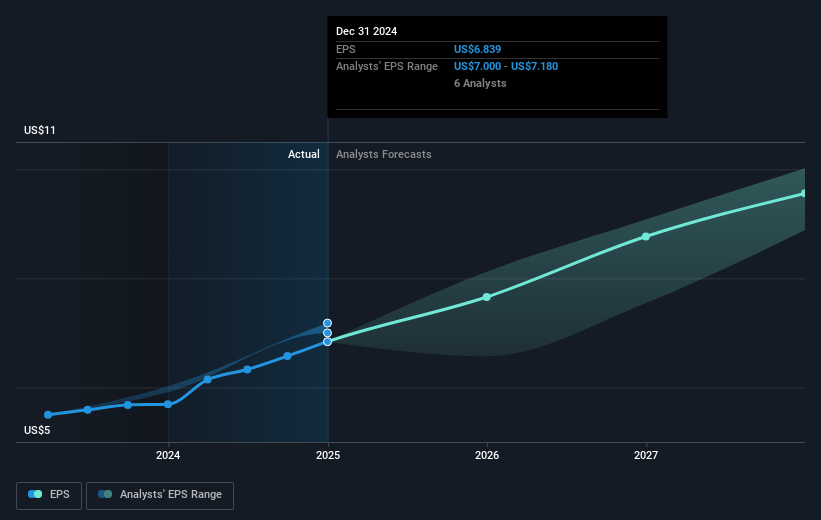

The recent developments surrounding Waste Management (NYSE:WM), including its sustainability initiatives and improved Q1 sales, provide a promising outlook for the company, despite a recent decline in net income. The focus on recycling automation and renewable energy projects is expected to enhance operational efficiencies, potentially influencing future revenue and earnings positively. Analysts project these initiatives could increase revenue significantly by 2027, which may bolster the long-term growth trajectory of the company.

Over the past five years, Waste Management's total return, including dividends, was 149.76%, reflecting substantial growth. This contrasts with its more recent one-year performance where it fell short of the US Commercial Services industry, earning 7.7% versus the industry's 13.2%. Such long-term gains underscore the company's resilience and operational efficacy over an extended period.

Today's analyst consensus places the company's fair value price target at US$239.47, which is higher than its current share price of US$229.96, suggesting modest room for appreciation. The recent share price increase aligns with market trends, but the gap to the price target indicates cautious optimism among analysts regarding future growth prospects driven by the company's strategic activities.

Upon reviewing our latest valuation report, Waste Management's share price might be too optimistic.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Waste Management, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Waste Management might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WM

Waste Management

Through its subsidiaries, provides environmental solutions to residential, commercial, industrial, and municipal customers in the United States, Canada, Western Europe, and internationally.

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives