- United States

- /

- Commercial Services

- /

- NYSE:WM

Waste Management, Inc.'s (NYSE:WM) Positive Expectations are Priced In

- Waste services do well in the bear market

- Waste Management has those expectations priced in

- The stock is a good relative value for those who must be invested in that sector.

Considering the yearly trajectory of the US dollar compared to the stock market, not many would argue that the cash is trash.

However, when the stock market turns sour, trash can be cash – as evident from garbage operators such as Waste Management, Inc. (NYSE: WM) outperforming in such an environment.

Waste Management – Company Profile

Waste Management, Inc provides waste management environmental services to customers in North America. It operates 260 landfills, 96 material recovery facilities (MRF), 5 secure hazardous waste landfills, and 340 transfer stations.

The company is vertically integrated to handle everything from collection to disposal and runs 15,500 collection routes. Alongside Republic Services (NYSE: RSG), the company is the leader in the solid waste management sector, running half of the largest landfills in the US.

In recent times, Waste Management grew through several acquisitions – the most prominent one being Advanced Disposal, for which the company paid US$4.9b in 2019. Currently, the company is set to acquire a controlling interest in Avangard Innovetive's US business, adding an estimated 400 million pounds per year of postconsumer resin and expanding its operation in the Midwest.

Waste Management vs. Republic Services

Waste is a co-product of any growth. Thus these 2 companies grew along with the economy. Although environmental pressures have been growing over the years, a growing economy finds it hard to reduce the amount of waste it produces. Instead, it has to improve its management, providing opportunities for specialized companies like those 2.

|

| Waste Management | Republic Services |

| Net Profit Margin | 11.27% | 11.32% |

| Growth Forecast | 9.6% | 7.5% |

| Returns on Capital | 12% | 9.1% |

| Debt/Equity | 176% | 126% |

| Div. vs. Industry (1.4%) | 1.6% | 1.41% |

While their net profit margins are similar, both companies enjoy an advantage over the rest of the sector due to their moat and scale of operations. WM scores an advantage in the current growth forecast, as well as in higher returns on capital.

Operating in the capital-intensive industry, both companies carry considerable debt, but it seems it doesn't hinder their growth so far. Scratching below the surface, we see that WM looks ahead with better cash flow coverage (33.1% vs. 24.5%) and better EBIT coverage (9.1x vs. 6.9x).

Both companies are paying a dividend that isn't notable, but it is higher than average in this sector. These dividends are growing steadily and have a modest payout ratio.

Valuation – The Elephant in the Room

Warren Buffett famously said, „Price is what you pay. Value is what you get.“ According to him, the greatest danger might not be buying a company with poor prospects but rather overpaying for a company with good prospects.

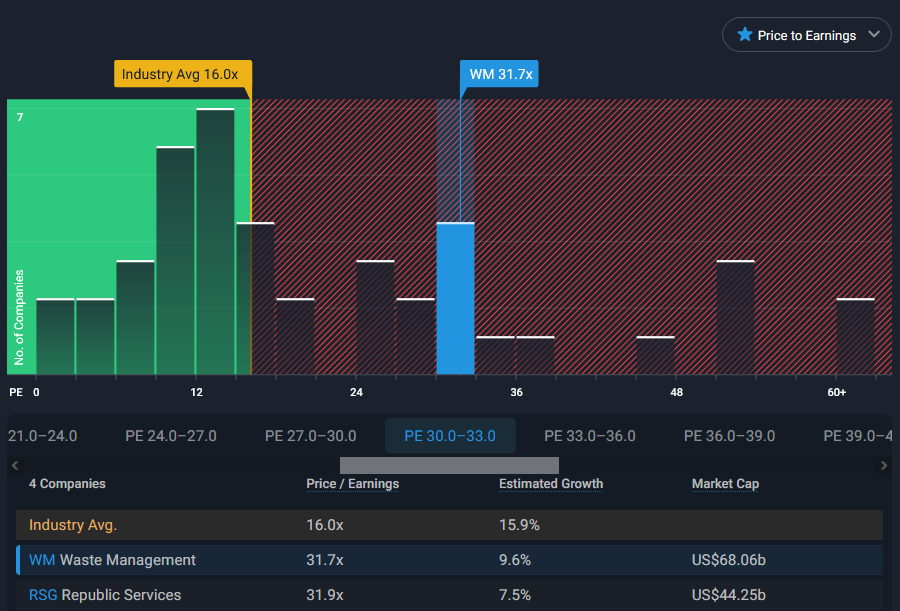

Both companies trade at a significant premium to the industry and broad market in general. Their valuation is at the point where it seems like its relative advantage in the ongoing market condition is priced in. Although our discounted cash flow (DCF) analysis points to some upside, WM still has a high price sticker – albeit at a better relative value to its biggest competitor, RSG.

If you're unsure about the strength of Waste Management's business, you might want to explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade Waste Management, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Waste Management might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:WM

Waste Management

Through its subsidiaries, provides environmental solutions to residential, commercial, industrial, and municipal customers in the United States, Canada, Western Europe, and internationally.

Average dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives