- United States

- /

- Commercial Services

- /

- NYSE:WM

Is Waste Management Fairly Priced After a 9.6% Year-to-Date Gain in 2025?

Reviewed by Bailey Pemberton

If you’re thinking about what to do with Waste Management stock right now, you’re not alone. Steady growth, an essential service, and some recent fluctuations have many investors double-checking their next move. Over the last week, the stock nudged up by 0.5%. While there’s been hardly any change in the past month, Waste Management has put together an impressive 9.6% climb year-to-date. Looking over the past year, there is a 7.1% gain, and more than a doubling of its value over five years, with a 106.3% rise.

Behind these moves, the market has been paying attention to growing environmental regulations and the ongoing focus on sustainability. Both factors keep Waste Management front and center for municipalities and businesses that need reliable waste solutions. These developments help explain why risk perception has generally stayed positive in this space and may have contributed to the upward momentum seen across the multi-year horizon.

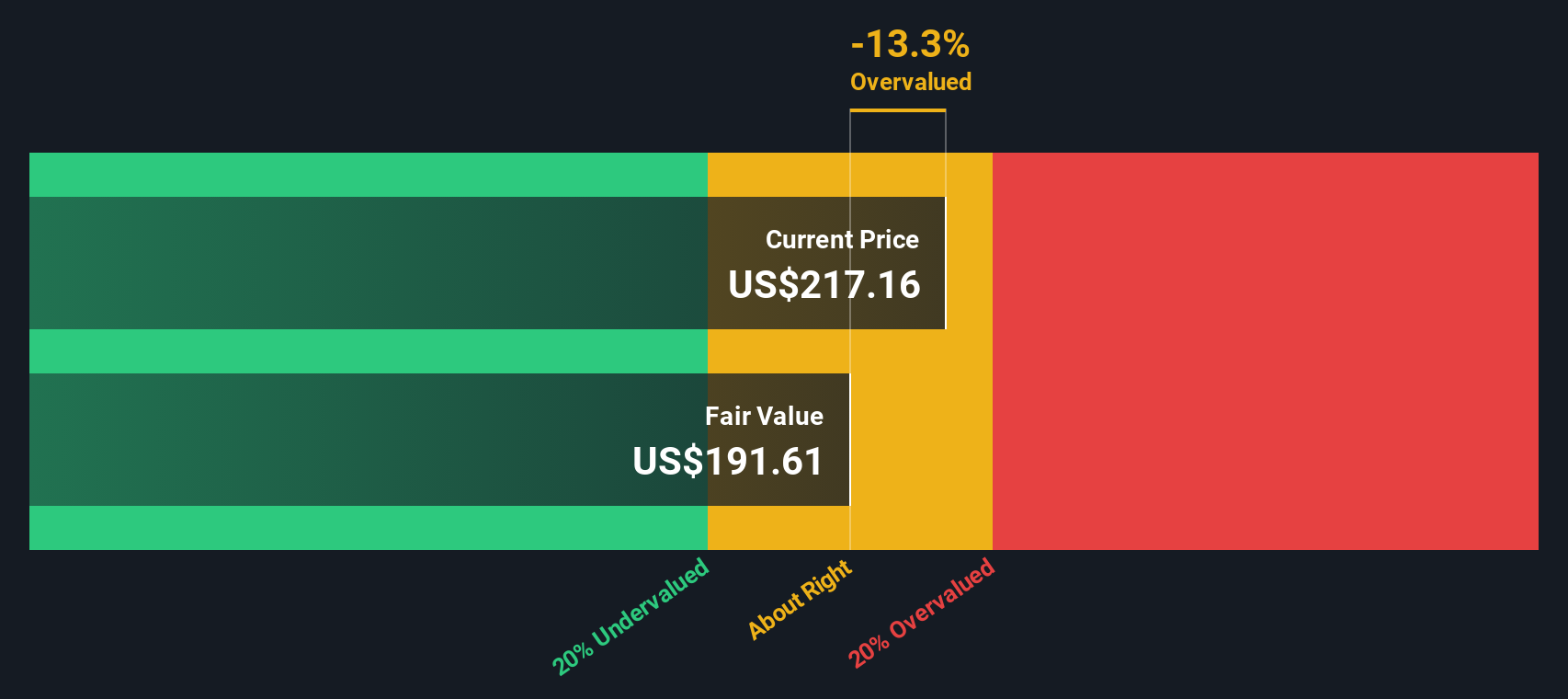

For all that performance, the big question is still about value. Using our multi-check valuation process, which scores one point for each area where Waste Management is considered undervalued (out of a total of six possible), the stock comes in at a valuation score of 2. That gives some clear signals, but it’s only part of the full picture. Next, we’ll dig into how standard valuation techniques stack up for Waste Management and why you might want to look beyond just the numbers for a smarter perspective.

Waste Management scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Waste Management Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a business is truly worth by projecting its future cash flows and then discounting those back to today's value. This method helps investors look beyond short-term market swings and focus on a company’s potential to generate cash over time.

For Waste Management, the current Free Cash Flow stands at $2.19 Billion. Analyst estimates, combined with Simply Wall St’s projections, see annual cash flow rising to $4.27 Billion by 2029, with expectations for continued growth to $4.51 Billion by 2035. The DCF model used here is the "2 Stage Free Cash Flow to Equity" approach, which balances both short-term analyst estimates and longer-term, extrapolated forecasts.

Based on these cash flow projections, Waste Management’s estimated intrinsic value comes out to $203.43 per share. When compared to today’s share price, this model finds Waste Management stock trading at a premium, roughly 8% above its calculated fair value. This analysis suggests the shares are about right, neither undervalued nor dramatically overpriced at current levels.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Waste Management's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Waste Management Price vs Earnings

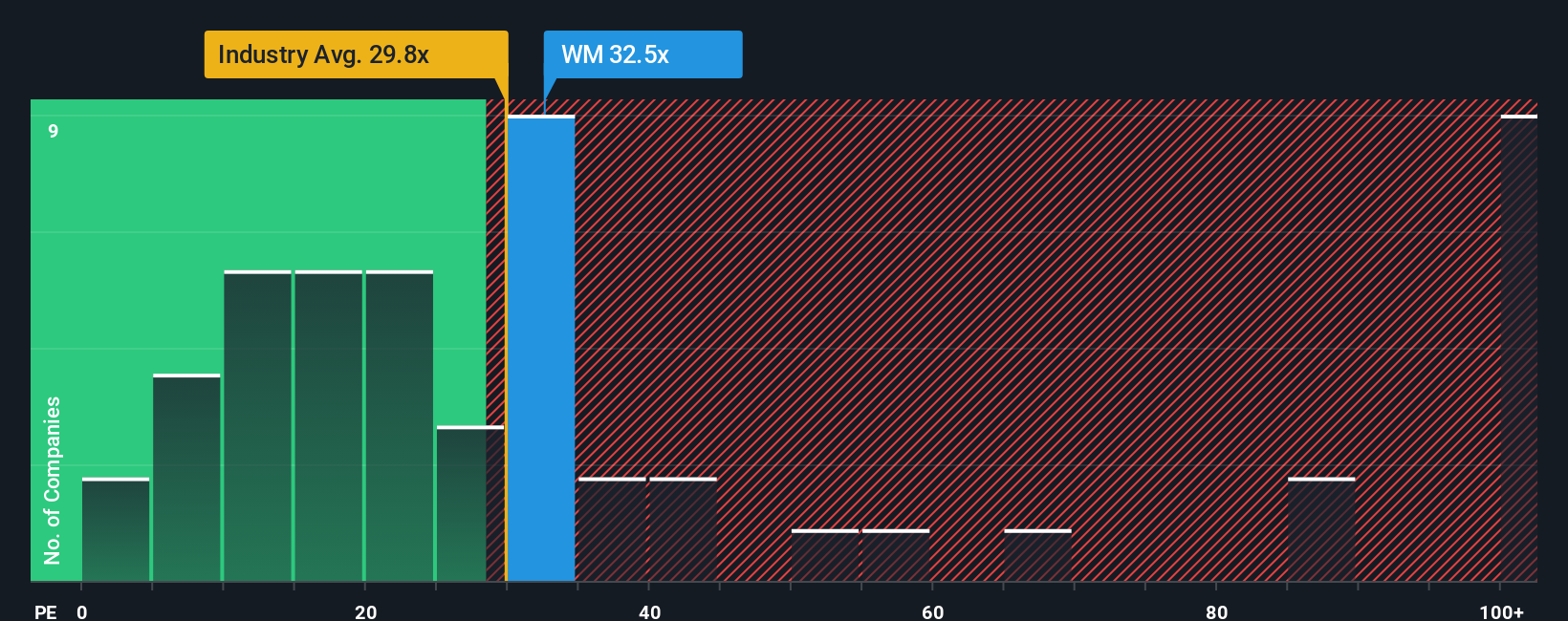

The Price-to-Earnings (PE) ratio is a classic and widely trusted metric for valuing profitable companies like Waste Management because it directly relates the company’s share price to its earnings. PE ratios are especially meaningful for firms with steady profits, as they help investors gauge how much they are paying for each dollar of earnings.

Interpreting what counts as a “normal” or “fair” PE ratio, however, depends on expectations for future growth and the company’s risk profile. Businesses with strong anticipated earnings growth or lower perceived risks typically trade at higher PE ratios, while those with slower growth or higher risk command lower multiples.

Waste Management currently trades at a PE ratio of 32.5x. For perspective, this sits above the average for the Commercial Services industry, which is 29.8x, but below the average among close peers at 47.6x. This suggests the market values Waste Management’s earnings at a premium to the broader industry, though not as highly as some of its competitors.

To provide a more tailored benchmark, Simply Wall St calculates a proprietary “Fair Ratio,” which refines the comparison by accounting for many nuances such as the company’s expected earnings growth, profit margins, industry conditions, company size, and unique risk factors. Unlike basic comparisons with peers or the industry, the Fair Ratio incorporates these attributes to deliver a more accurate estimate of what the market should reasonably pay for the company’s earnings.

For Waste Management, the Fair PE Ratio is estimated at 34.4x. Comparing this to the company’s current PE of 32.5x, the difference is modest, suggesting the stock is trading just about where you would expect based on its fundamentals and outlook.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Waste Management Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. Narratives are a simple, powerful tool that lets you set your own story for a company, explaining not only what numbers you expect (like fair value or future earnings), but why you think those outcomes are possible. This bridges the gap between financial forecasts and the real-world trends or risks shaping a business, helping you connect your perspective about Waste Management’s future to an actual share price estimate.

On Simply Wall St, Narratives are easily accessible on every company’s Community page and used by millions of investors. They help you decide when to buy or sell by directly comparing your calculated Fair Value against the current Price, all in real time. Whenever news, new forecasts, or earnings are released, Narratives update automatically so your investment decision is always based on up-to-date information.

- For example, some investors believe automation and renewable energy will power strong future growth for Waste Management and have set a fair value as high as $277.0.

- Others, who see potential risks from regulatory or cost pressures, have estimated a fair value as low as $198.0.

With Narratives, you get a flexible, dynamic way to see your view reflected in actionable insights, making smarter, more confident investing much easier.

Do you think there's more to the story for Waste Management? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Waste Management might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WM

Waste Management

Through its subsidiaries, provides environmental solutions to residential, commercial, industrial, and municipal customers in the United States, Canada, Western Europe, and internationally.

Established dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives