- United States

- /

- Commercial Services

- /

- NYSE:WCN

Will Strong Quarterly Results and Efficiency Gains Change Waste Connections' (WCN) Investment Narrative?

Reviewed by Sasha Jovanovic

- Waste Connections recently reported quarterly results that exceeded analyst revenue expectations, posting solid operating income and strong performance across key financial metrics.

- The company's ability to outperform forecasts in a competitive sector highlights its operational resilience and ongoing focus on efficiency and expansion.

- We'll explore how Waste Connections' revenue and operating income outperformance could influence its broader investment narrative and growth outlook.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Waste Connections Investment Narrative Recap

Owning Waste Connections means believing in the ongoing stability of the North American solid waste and recycling industry, and the company’s ability to drive growth through pricing, efficiency, and acquisitions. While the recent results surpassed revenue expectations and demonstrated strong operating performance, they do not have a material impact on the most immediate catalyst, consistently strong pricing execution, or the main risk, which continues to be exposure to acquisition integration challenges.

Among recent announcements, Waste Connections’ updated full-year guidance projecting US$9.45 billion in revenue stands out for its alignment with the company’s above-consensus quarterly results. This guidance, reinforcing robust top-line growth expectations, remains a key factor underpinning confidence in both the near-term revenue outlook and the company’s ability to fund additional acquisitions through strong cash generation.

By contrast, investors should be aware of the continued potential for acquisition integration to affect profit margins if...

Read the full narrative on Waste Connections (it's free!)

Waste Connections is projected to achieve $11.3 billion in revenue and $1.7 billion in earnings by 2028. This outlook is based on a 7.1% annual revenue growth rate and an earnings increase of $1.1 billion from the current $643.8 million level.

Uncover how Waste Connections' forecasts yield a $208.59 fair value, a 22% upside to its current price.

Exploring Other Perspectives

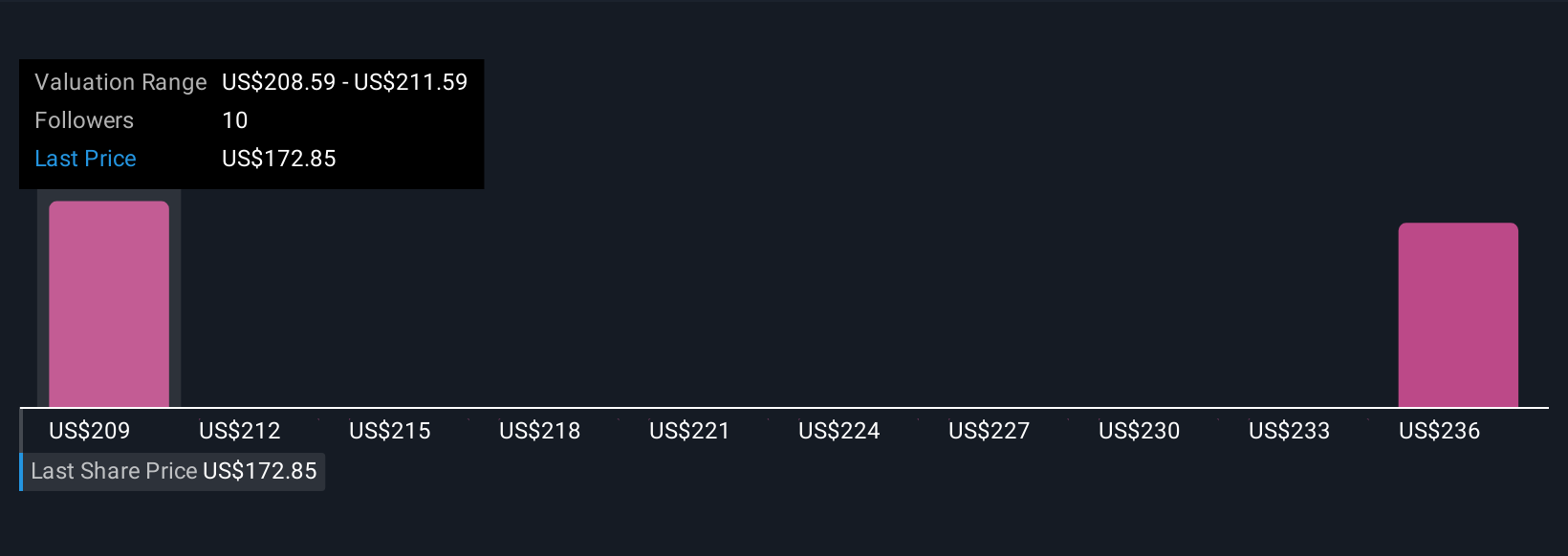

Simply Wall St Community members provided two fair value estimates for Waste Connections ranging from US$208.59 to US$238.17 per share. Some see persistent growth and pricing catalysts supporting optimism, but views differ widely, explore several perspectives to see how they might shape your outlook.

Explore 2 other fair value estimates on Waste Connections - why the stock might be worth as much as 39% more than the current price!

Build Your Own Waste Connections Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Waste Connections research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Waste Connections research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Waste Connections' overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Waste Connections might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WCN

Waste Connections

Provides non-hazardous waste collection, transfer, disposal, and resource recovery services in the United States and Canada.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives