- United States

- /

- Commercial Services

- /

- NYSE:WCN

Waste Connections (WCN): Revisiting Valuation After Quarterly Outperformance and Margin Growth

Reviewed by Kshitija Bhandaru

Waste Connections (WCN) recently delivered quarterly results that topped analyst expectations on both revenue and operating income. The company highlighted margin expansion as a result of pricing gains and stronger employee retention.

See our latest analysis for Waste Connections.

Despite a challenging year for the sector, Waste Connections’ latest share price of $172.97 reflects a stable finish to 2024, while momentum has been more subdued. Its one-year total shareholder return slipped 4.6%, though three- and five-year total returns remain robustly positive. The recent margin expansion and solid results hint that investors may be reassessing long-term potential or pricing in reduced risk after outperforming some industry peers.

If you’re looking for other compelling opportunities beyond Waste Connections, consider broadening your search and discover fast growing stocks with high insider ownership.

With the stock trading nearly 20 percent below analyst targets while delivering steady results quarter after quarter, investors are left to consider whether Waste Connections is undervalued or if the market has already factored in the company’s next wave of growth.

Most Popular Narrative: 17.1% Undervalued

Waste Connections’ most-watched narrative places its fair value well above the recent closing price, spotlighting significant upside based on foundational growth drivers and operational momentum.

Effective pricing and acquisition strategies, along with strong employee retention, position Waste Connections for robust revenue and margin growth. Enhanced safety performance and strategic recycling facility integration contribute to cost savings and expanded service capabilities. These factors support future growth.

Want to know what powers this bullish outlook? The valuation hinges on heavyweight future growth assumptions, anticipated profit margin surges, and a bold multiple that is usually reserved for fast-expanding sectors. Which numbers truly drive the narrative’s fair value? Dig in and discover the levers that analysts believe could redefine the company’s worth.

Result: Fair Value of $208.59 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weather disruptions and a heavy reliance on acquisitions could challenge Waste Connections’ margin growth and stability in the coming quarters.

Find out about the key risks to this Waste Connections narrative.

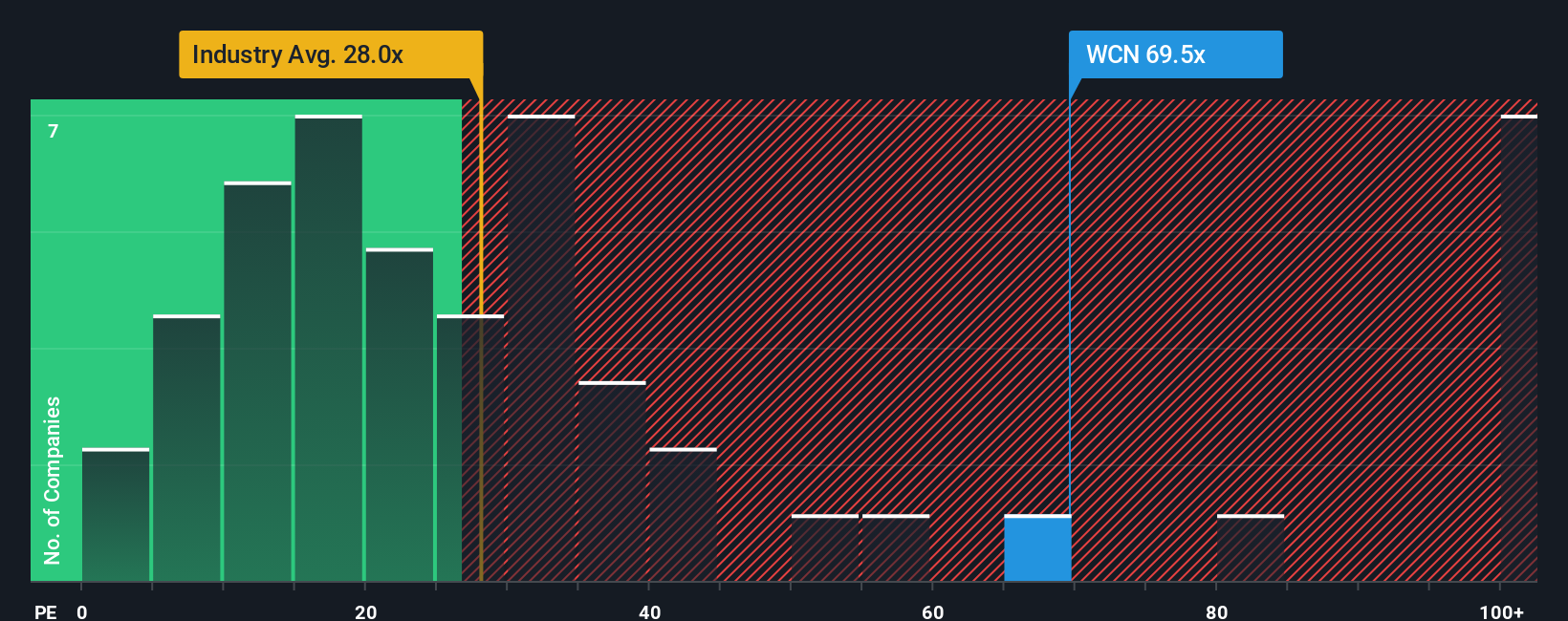

Another View: High Multiple Signals a Caution Flag

Taking a look through a different lens, Waste Connections is currently trading at a price-to-earnings ratio that is nearly double the average of its peers and far above the industry norm. With a P/E of 69.1x versus 37x for peers and a fair ratio of 36.9x, this gap could mean more downside risk if growth expectations are not met. Are expectations now too high, or is the premium justified by long-term potential?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Waste Connections Narrative

If you want to dive deeper and shape your own view, the data is at your fingertips. This lets you build a personalized narrative in minutes, so why not Do it your way?

A great starting point for your Waste Connections research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors keep winning by always seeking fresh perspectives. Don’t miss your chance to act. These top strategies may hold the growth or returns you're aiming for.

- Tap into market-defining innovation by checking out these 24 AI penny stocks poised to accelerate the adoption of artificial intelligence across industries.

- Boost your passive income with these 18 dividend stocks with yields > 3% offering yields above 3 percent and strong payout histories for income-focused investors.

- Catch early upside with these 3596 penny stocks with strong financials that combine strong fundamentals and high potential at entry-level prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Waste Connections might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WCN

Waste Connections

Provides non-hazardous waste collection, transfer, disposal, and resource recovery services in the United States and Canada.

Moderate growth potential with low risk.

Similar Companies

Market Insights

Community Narratives