- United States

- /

- Commercial Services

- /

- NYSE:WCN

A Fresh Look at Waste Connections (WCN) Valuation Following Analyst Optimism on Free Cash Flow Prospects

Reviewed by Simply Wall St

Waste Connections (WCN) is drawing attention after several analysts, including Stifel, Goldman Sachs, and Bernstein, expressed confidence in its ongoing strategy. The focus is on stronger free cash flow in 2026, supported by lower project spending and progress on its renewable natural gas initiatives.

See our latest analysis for Waste Connections.

Waste Connections has seen a modest rebound recently, with a 4.8% jump in its share price over the last month as investors responded to progress on renewables and better cash flow prospects. That said, the one-year total shareholder return remains in negative territory, reflecting earlier weakness. Over the longer term, returns are still robust and suggest momentum could build if fundamentals keep improving.

If you’re interested in broadening your search, now is a great time to discover fast growing stocks with high insider ownership

With shares rebounding but long-term returns still commanding attention, the key question now is whether Waste Connections remains undervalued compared to its growth prospects, or if the market has already priced in the possibility of future gains.

Most Popular Narrative: 13.9% Undervalued

The narrative consensus now sees Waste Connections trading nearly $28 below its fair value estimate, with the discount rate holding at 6.89%. This gap highlights growing confidence in forward revenue and margin expansion, even as the stock rebounds from a choppy period.

Robust acquisition activity, with annualized revenues closed already over $125 million, and a strong balance sheet position Waste Connections well for continued growth and successful integration of acquisitions. This supports future revenue and earnings growth.

Could the pace of buybacks and a unique blend of acquisitions be the key to the story? Find out what’s projected for revenue, profit margins, and future share decline, all hidden in the numbers behind this narrative’s value math.

Result: Fair Value of $204.96 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing margin pressures and unpredictable commodity prices could still pose significant headwinds for Waste Connections as it pursues sustained earnings growth.

Find out about the key risks to this Waste Connections narrative.

Another View: What Do the Market Ratios Say?

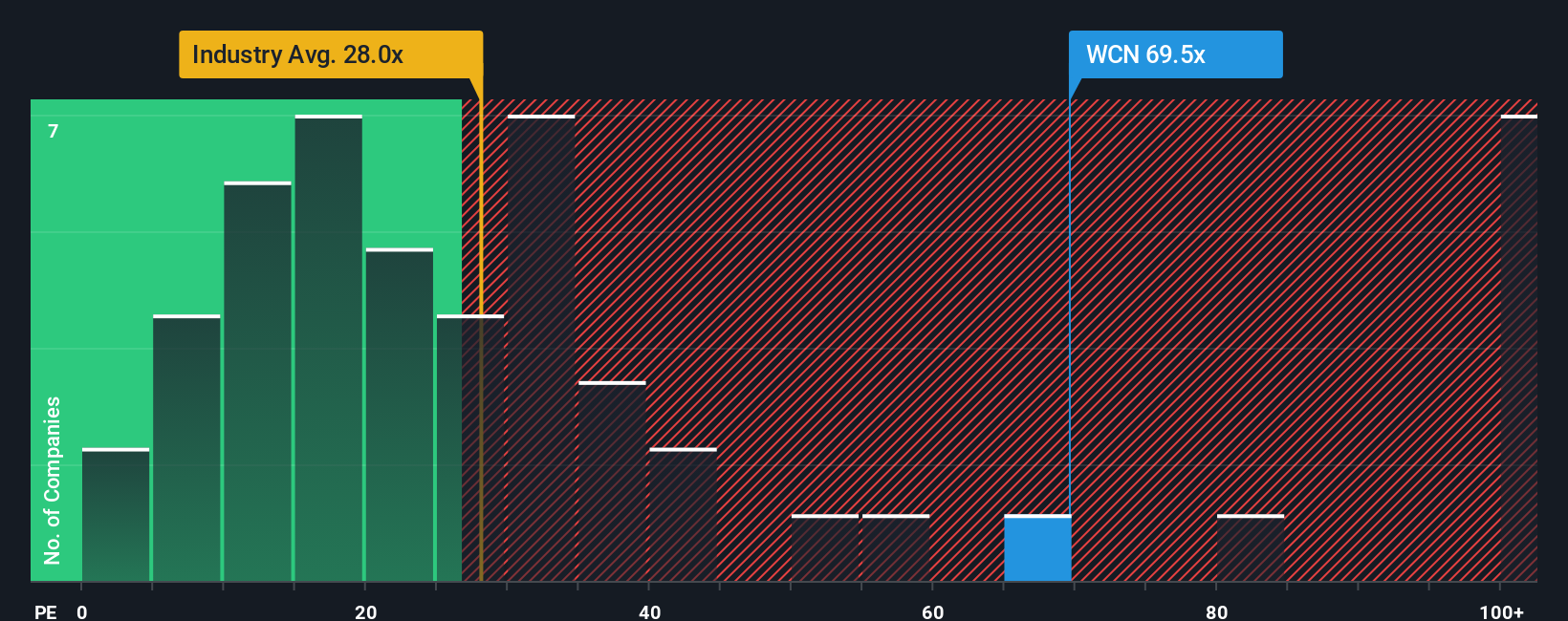

Taking a look at the company's price-to-earnings ratio, Waste Connections trades at 72.7 times earnings, which is much higher than the industry average of 22.6 and the peer average of 37.7. The fair ratio is estimated at 33.5. This large disparity suggests investors might be assuming stronger growth or lower risk. The high valuation may indicate heightened expectations or potential downside if those expectations are not met.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Waste Connections Narrative

If you want to take a different angle or dig deeper into the details, you can generate your own view in just a few minutes. Do it your way

A great starting point for your Waste Connections research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let incredible opportunities pass you by. Smart investors uncover market trends early using powerful tools. Open the door to fresh stock ideas and take action today.

- Capture attractive yields and stability by reviewing these 15 dividend stocks with yields > 3%, which offers above-average income potential from companies with robust fundamentals.

- Capitalize on innovative disruption by targeting these 25 AI penny stocks, which are changing the landscape of automation, analytics, and productivity.

- Tap into the next generation of wealth builders by finding undervalued gems with significant upside potential through these 921 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Waste Connections might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WCN

Waste Connections

Provides non-hazardous waste collection, transfer, disposal, and resource recovery services in the United States and Canada.

Low risk with limited growth.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.