- United States

- /

- Commercial Services

- /

- NYSE:VLTO

Veralto (NYSE:VLTO) Reports First Quarter 2025 Earnings Of US$1,332 Million

Reviewed by Simply Wall St

Veralto (NYSE:VLTO) recently announced its earnings for the first quarter of 2025, reporting sales of $1,332 million, up from $1,246 million in the previous year, and a net income increase to $225 million. This financial performance likely bolstered investor confidence, reflected in the company’s 12% share price increase over the past month. This rise outpaced the market's 4% gain over the last week. The earnings announcement appears to have added positive momentum to Veralto's share price amidst a broader market trend expected to see earnings grow by 14% annually in the coming years.

Every company has risks, and we've spotted 2 risks for Veralto you should know about.

Veralto’s recent financial announcements, highlighting a sales increase to $1,332 million and net income climbing to $225 million, suggest strengthened investor confidence. This optimism seems to have propelled a 12% share price increase in the last month, outstripping the market’s 4% gain over the last week. However, over the past year, Veralto's total shareholder return, including dividends, reached only 3.82%, indicating more modest long-term gains.

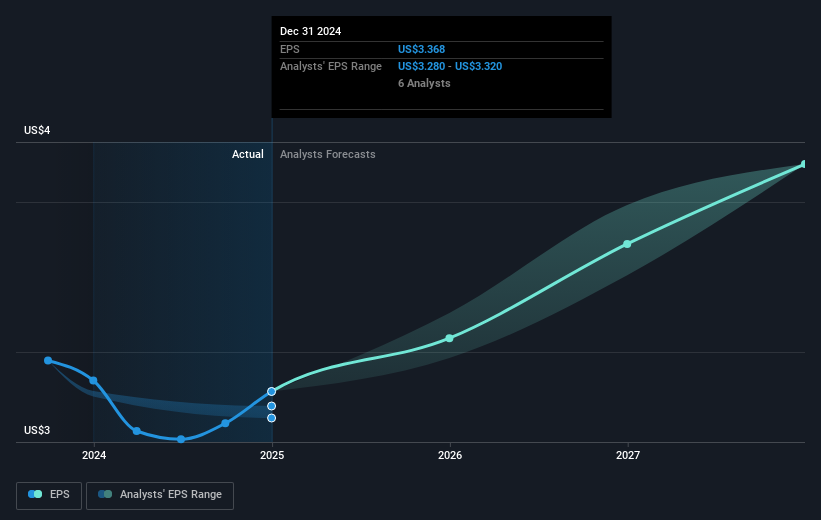

The company's recent acquisitions, notably in the water quality sector, are expected to fortify its revenue and earnings potential. Analysts forecast Veralto's revenue to grow at 5.3% annually, with earnings projected to hit $1.1 billion by 2028. However, these forecasts hinge on effective integration of acquisitions and successful countering of macroeconomic risks. The share price’s climb to $95.36, still short of the $109.15 analyst consensus price target, signals potential valuation upside if forecasts materialize. Despite its shorter-term performance lagging behind the broader US Commercial Services industry’s 14.8% return over the past year, Veralto’s growth drivers and ambitious expansion plans could reshape future shareholder returns.

Our valuation report unveils the possibility Veralto's shares may be trading at a premium.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VLTO

Veralto

Provides water analytics, water treatment, marking and coding, and packaging and color solutions worldwide.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives