- United States

- /

- Commercial Services

- /

- NYSE:UNF

Can UniFirst's (UNF) Slower Sales Growth Reshape Its Long-Term Expansion Strategy?

Reviewed by Sasha Jovanovic

- Recently, UniFirst was the subject of analysis raising concerns about slowing estimated sales growth to 1% and below-average returns on capital, questioning the company's ability to generate new growth opportunities.

- This development highlights management's challenges in identifying meaningful areas for expansion at a time when sales momentum appears limited.

- We'll explore how the prospect of weaker sales growth could influence UniFirst's evolving investment narrative and long-term outlook.

Find companies with promising cash flow potential yet trading below their fair value.

UniFirst Investment Narrative Recap

To be a UniFirst shareholder, you need to trust in the company’s ability to reignite growth beyond its current pace and leverage operational improvements for long-term value. Recent concerns about slowing estimated sales growth to just 1% and below-average returns on capital may influence near-term sentiment, but do not appear to materially affect the most immediate catalysts tied to efficiency and cost management. The biggest risk to watch now remains softness in net wearer levels and customer demand.

Among recent announcements, the expansion of UniFirst’s Owensboro, Kentucky Distribution and Fulfillment Center stands out. This US$28 million investment aims to boost direct sales efficiency and could help offset slower top-line growth by strengthening core operations, aligning with ongoing efforts to improve margins and capacity.

But while efficiencies are being targeted, some investors may be unaware that, in contrast, pressure on net wearer volumes could...

Read the full narrative on UniFirst (it's free!)

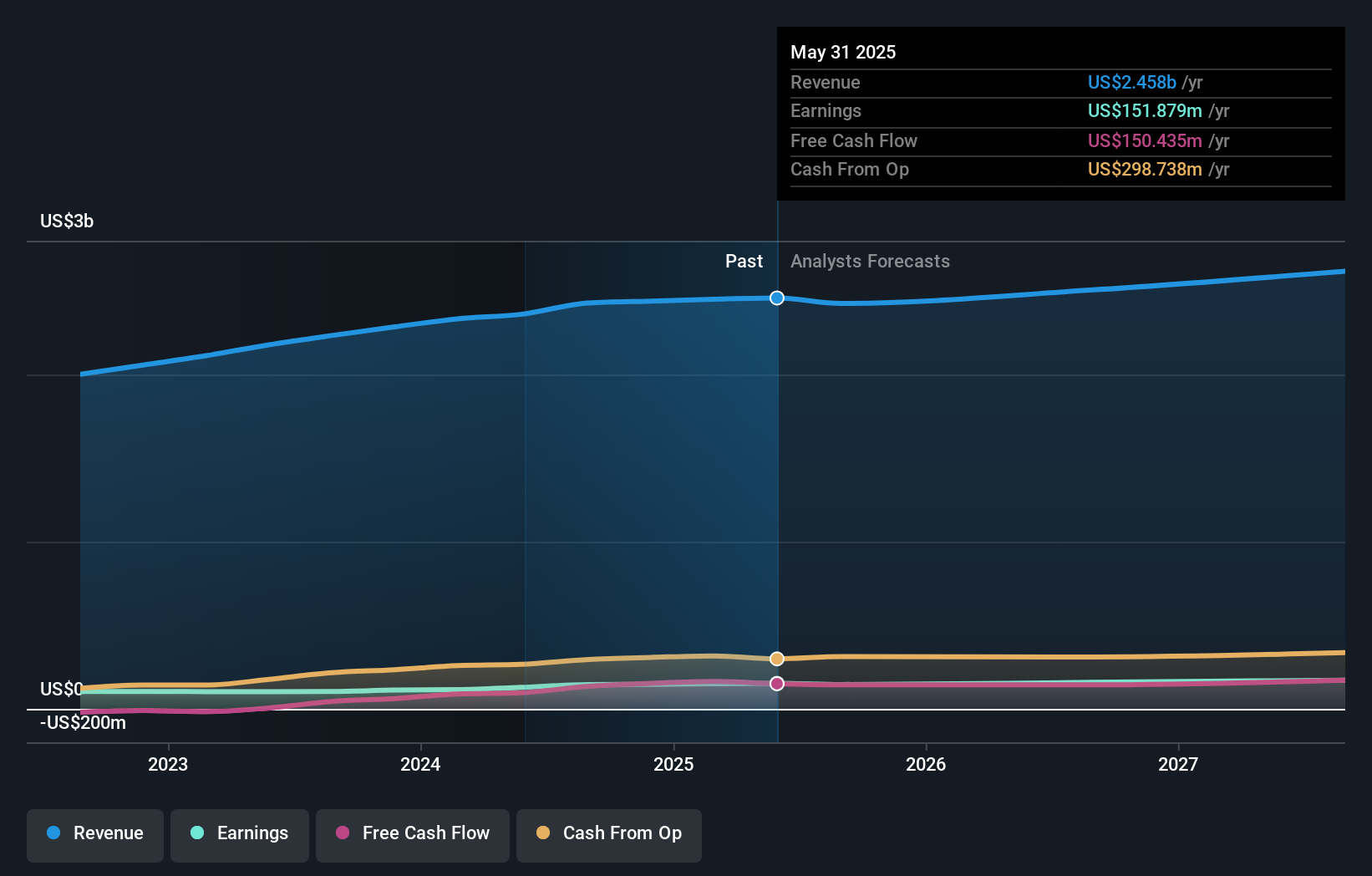

UniFirst's outlook anticipates $2.7 billion in revenue and $179.2 million in earnings by 2028. This implies a 2.7% annual revenue growth rate and a $27.3 million increase in earnings from the current figure of $151.9 million.

Uncover how UniFirst's forecasts yield a $178.25 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community span from US$178.25 to US$278.33 across two analyses, underlining very different outlooks. With concerns mounting around customer demand, now is the time to see how others interpret UniFirst’s prospects.

Explore 2 other fair value estimates on UniFirst - why the stock might be worth just $178.25!

Build Your Own UniFirst Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- Our free UniFirst research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UniFirst's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UNF

UniFirst

Provides workplace uniforms and protective work wear clothing in the United States, Europe, and Canada.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives