- United States

- /

- Professional Services

- /

- NYSE:ULS

Will UL Solutions’ (ULS) Saudi Partnership Shift Its Competitive Position in Global Safety Certification?

Reviewed by Sasha Jovanovic

- UL Solutions and GCC Technical Services Company (TS Co.) recently enhanced their partnership to enable locally delivered fire safety testing and certification services in Dammam, Saudi Arabia, under the UL Witness Test Data Program.

- This collaboration directly supports the Gulf region’s accelerating demand for world-class safety standards as large-scale projects under Saudi Arabia’s Vision 2030 unfold.

- We'll explore how UL Solutions' strengthened regional certification capabilities could influence its long-term growth prospects and industry positioning.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

UL Solutions Investment Narrative Recap

To be a shareholder in UL Solutions, you need confidence in the enduring global demand for testing, inspection, and certification, especially as safety standards tighten in fast-growing markets. The expanded partnership in Saudi Arabia, which brings local fire safety certifications to the Gulf region, supports the company's ambition to capture these growth opportunities. However, this makes the short-term catalyst, the company’s ability to expand high-value services in emerging geographies, more visible, while macroeconomic uncertainty remains the principal risk and is unlikely to be materially affected by this single deal.

One relevant company announcement is the August 2025 construction launch of the new Global Fire Science Center in Illinois. This project, coupled with the Saudi partnership, signals a focused push to address fire safety on a global scale, targeting both matured and rapidly developing markets. As UL Solutions broadens these services, execution risk from expansion and fluctuating project timelines becomes a focal point for those tracking near-term progress.

Yet, despite impressive global expansion, investors should be aware that macroeconomic pressure and shifting manufacturer priorities could still pose a risk to short-term revenue stability, especially if...

Read the full narrative on UL Solutions (it's free!)

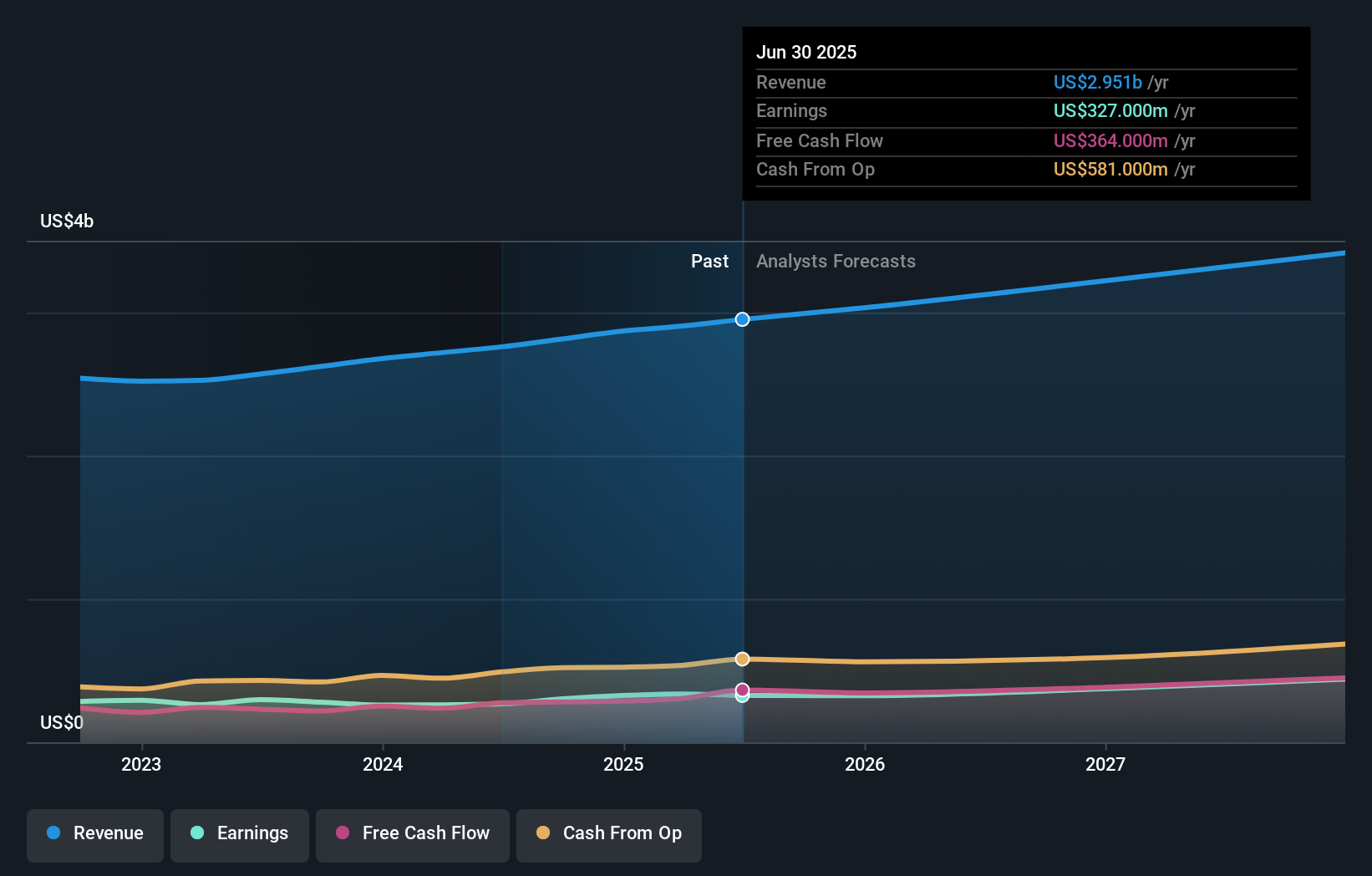

UL Solutions’ outlook anticipates $3.5 billion in revenue and $477.8 million in earnings by 2028. This is based on a 6.1% annual revenue growth rate and a $150.8 million increase in earnings from the current $327.0 million.

Uncover how UL Solutions' forecasts yield a $71.27 fair value, a 10% downside to its current price.

Exploring Other Perspectives

The Simply Wall St Community's fair value estimates for UL Solutions range from US$68.88 to US$71.27 based on two perspectives. While some see stable demand for product testing as a catalyst, macroeconomic headwinds could still impact company earnings, so consider multiple viewpoints before you decide.

Explore 2 other fair value estimates on UL Solutions - why the stock might be worth 13% less than the current price!

Build Your Own UL Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UL Solutions research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free UL Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UL Solutions' overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ULS

UL Solutions

Provides testing, inspection and certification, and related software and advisory services worldwide.

Outstanding track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives