- United States

- /

- Professional Services

- /

- NYSE:ULS

UL Solutions (ULS) Is Up 7.3% After Launching AI Safety Certification and Posting Q3 Earnings Beat - Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- UL Solutions Inc. reported third-quarter 2025 results with sales of US$783 million and net income of US$100 million, both up from the prior year, and introduced new AI safety certification services that set a framework for assessing the safety of AI-powered products.

- An interesting insight is that UL Solutions is expanding its sustainability leadership not only through financial performance but also by establishing itself as an early provider of third-party safety certification for AI innovations.

- We'll examine how the launch of AI safety certification services could influence UL Solutions' future growth prospects and overall investment narrative.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 38 companies in the world exploring or producing it. Find the list for free.

UL Solutions Investment Narrative Recap

To be a shareholder in UL Solutions, you’ll need to believe in the company’s ability to sustain steady growth in certification services as global product innovation becomes more complex. The recent launch of AI safety certification represents a potential short-term catalyst, aiming to address a growing demand and reinforce UL Solutions’ positioning, though the most significant near-term risk remains macroeconomic uncertainty and its possible impact on customer innovation cycles; the announcement does not materially change that risk.

The company’s introduction of AI safety certification services is especially relevant, as it aligns with increased interest in the reliability and safety of AI-powered products. This announcement enhances UL Solutions’ role in certification for emerging technologies, potentially supporting future business growth by meeting the evolving needs of clients developing AI-enabled products.

Yet, despite this momentum, investors should also remain aware that unexpected shifts in economic or geopolitical conditions could...

Read the full narrative on UL Solutions (it's free!)

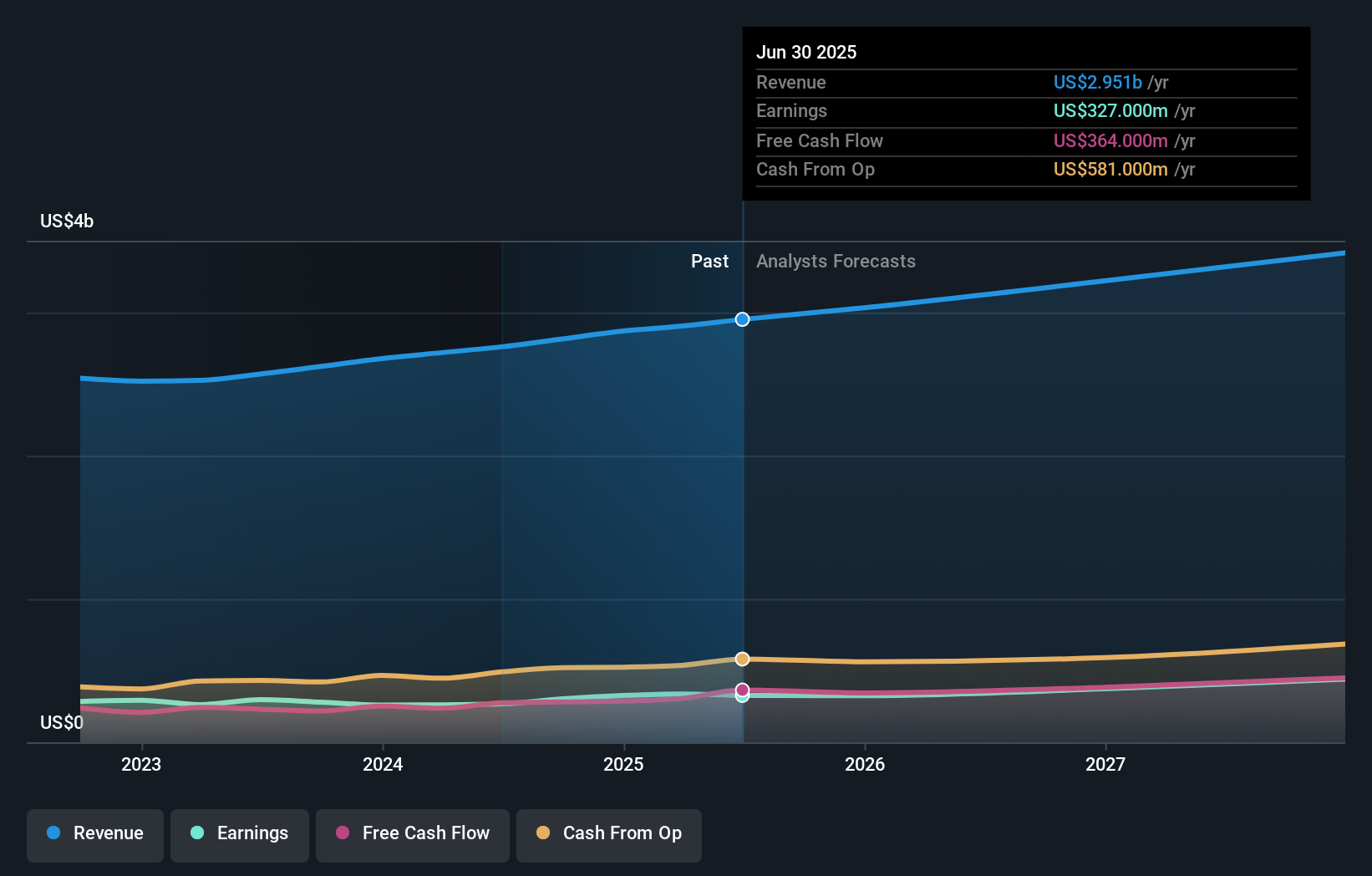

UL Solutions' outlook envisions $3.5 billion in revenue and $477.8 million in earnings by 2028. Achieving this would require a 6.1% annual revenue growth rate and a $150.8 million increase in earnings from the current $327.0 million.

Uncover how UL Solutions' forecasts yield a $71.27 fair value, a 18% downside to its current price.

Exploring Other Perspectives

Fair value estimates for UL Solutions from the Simply Wall St Community range narrowly from US$68.87 to US$71.27, based on 2 distinct viewpoints. While optimism surrounds new AI service offerings, global macro risks could still shape outcomes and market reactions, explore more perspectives for a wider view.

Explore 2 other fair value estimates on UL Solutions - why the stock might be worth as much as $71.27!

Build Your Own UL Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UL Solutions research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free UL Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UL Solutions' overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ULS

UL Solutions

Provides testing, inspection and certification, and related software and advisory services worldwide.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives