- United States

- /

- Professional Services

- /

- NYSE:ULS

Did the Fujitsu Partnership Just Redefine UL Solutions' (ULS) ESG Compliance Growth Story in Japan?

Reviewed by Simply Wall St

- Earlier this month, UL Solutions Inc. announced a collaboration with Fujitsu to assist Japanese companies in meeting the country’s new climate reporting standards, combining their ULTRUS software with Fujitsu’s local market expertise and client network.

- This development highlights UL Solutions’ strengthened position in the expanding sustainability and ESG compliance market in Japan, supported by industry recognition of its platforms.

- We’ll now examine how the Fujitsu partnership may influence UL Solutions’ investment narrative, particularly regarding growth prospects in ESG compliance services.

Find companies with promising cash flow potential yet trading below their fair value.

UL Solutions Investment Narrative Recap

To see UL Solutions as a compelling holding, investors need to believe that demand for sustainability and ESG compliance will remain resilient, with software and services scaling effectively in new regulatory environments. The Fujitsu partnership spotlights UL Solutions' ambition in Japan’s expanding ESG market, and while it amplifies short-term growth potential in compliance services, the biggest risk continues to be macroeconomic uncertainty affecting client budgets and innovation timelines.

Of the recent updates, the July 9 launch of enhanced PFAS and Scope 3 emissions modules in the ULTRUS software platform stands out as most relevant, it strengthens UL Solutions’ competitive edge in ESG data management, adding further momentum to partnerships like the one with Fujitsu, and aligning closely with the catalysts driving interest in global sustainability regulation.

Yet, investors should be aware that despite growing demand for ESG compliance, changes in global economic conditions may still...

Read the full narrative on UL Solutions (it's free!)

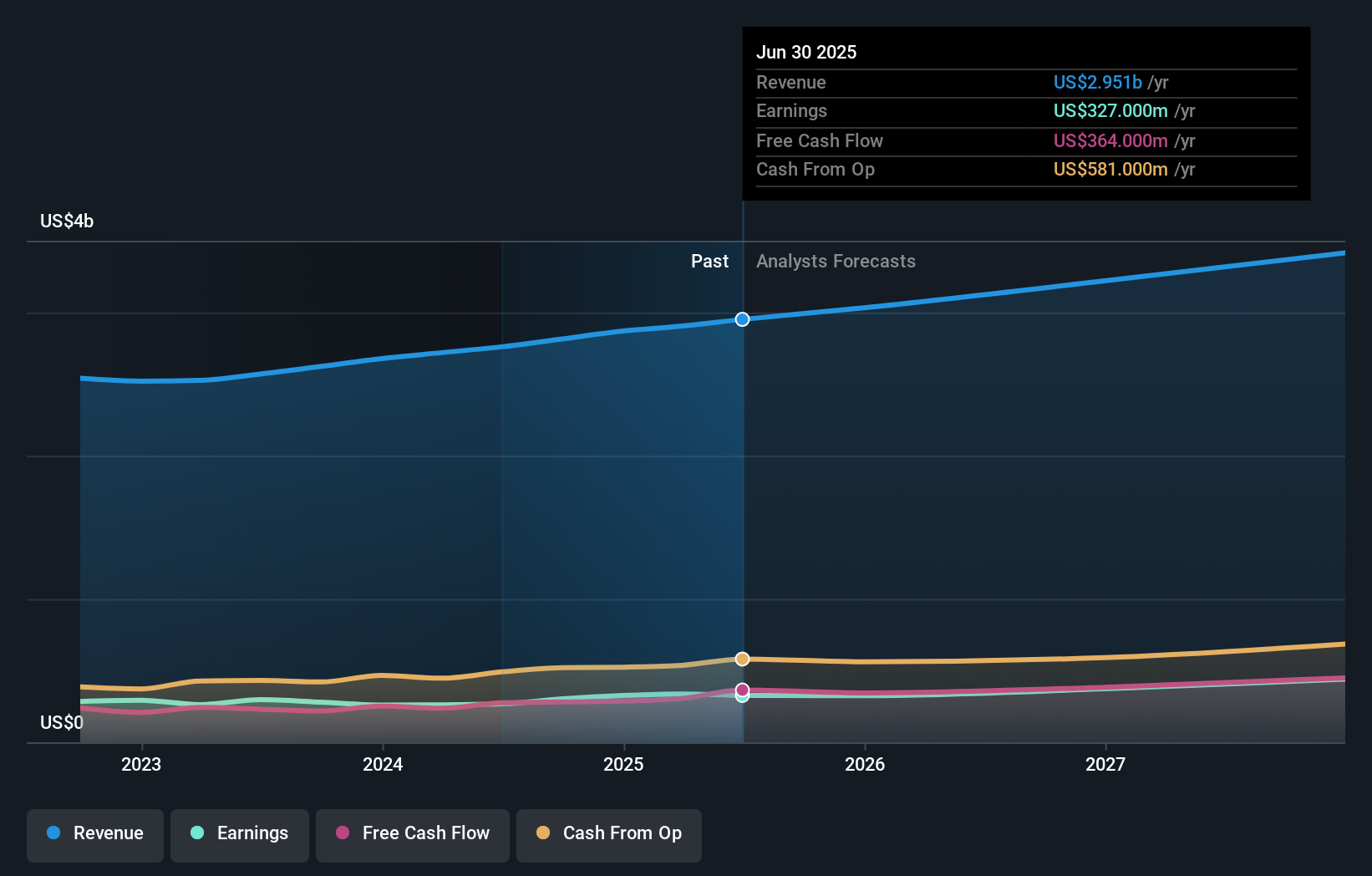

UL Solutions' outlook anticipates $3.5 billion in revenue and $447.0 million in earnings by 2028. This is based on a 6.1% annual revenue growth rate and a $110.0 million increase in earnings from the current $337.0 million.

Uncover how UL Solutions' forecasts yield a $70.60 fair value, in line with its current price.

Exploring Other Perspectives

One fair value estimate from the Simply Wall St Community sets UL Solutions at US$70.60 per share. With planned facility and software expansions widely discussed, community members may weigh the possible impact of capital spending on future free cash flow differently, explore the range of opinions to shape your own view.

Explore another fair value estimate on UL Solutions - why the stock might be worth just $70.60!

Build Your Own UL Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UL Solutions research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free UL Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UL Solutions' overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ULS

UL Solutions

Provides testing, inspection and certification, and related software and advisory services worldwide.

Outstanding track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives