- United States

- /

- Professional Services

- /

- NYSE:TNET

Risks To Shareholder Returns Are Elevated At These Prices For TriNet Group, Inc. (NYSE:TNET)

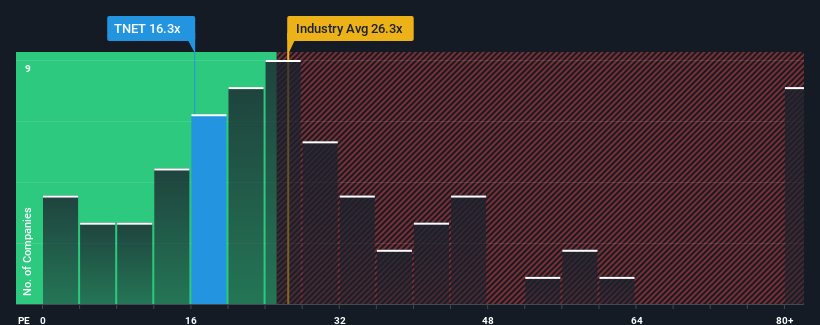

It's not a stretch to say that TriNet Group, Inc.'s (NYSE:TNET) price-to-earnings (or "P/E") ratio of 16.3x right now seems quite "middle-of-the-road" compared to the market in the United States, where the median P/E ratio is around 17x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

With its earnings growth in positive territory compared to the declining earnings of most other companies, TriNet Group has been doing quite well of late. One possibility is that the P/E is moderate because investors think the company's earnings will be less resilient moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for TriNet Group

Is There Some Growth For TriNet Group?

There's an inherent assumption that a company should be matching the market for P/E ratios like TriNet Group's to be considered reasonable.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. Still, the latest three year period has seen an excellent 62% overall rise in EPS, in spite of its uninspiring short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 4.0% each year as estimated by the five analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 12% per annum, which is noticeably more attractive.

With this information, we find it interesting that TriNet Group is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that TriNet Group currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It is also worth noting that we have found 1 warning sign for TriNet Group that you need to take into consideration.

You might be able to find a better investment than TriNet Group. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if TriNet Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:TNET

TriNet Group

Provides comprehensive and flexible human capital management services for small and medium size businesses in the United States.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026