- United States

- /

- Professional Services

- /

- NYSE:TNET

Is TriNet Group's (TNET) Recent Options Surge Reflecting Uncertainty Around Its Earnings Outlook?

Reviewed by Simply Wall St

- Recent options market activity around TriNet Group has shown unusually high implied volatility in certain call options expiring September 19, 2025, reflecting heightened investor anticipation of significant movement in the stock.

- This surge in options trading is unfolding amid mixed analyst earnings estimates for TriNet, suggesting that expectations for volatility are being shaped by a combination of market speculation and differing outlooks on the company’s financial performance.

- Given this elevated options activity hinting at sizable stock moves, we’ll assess how it affects TriNet Group’s investment narrative and future outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

TriNet Group Investment Narrative Recap

To be a TriNet Group shareholder today generally means believing in the company's ability to drive recurring revenue through the growing complexity of HR compliance needs for small and midsize businesses. The recent surge in options market activity points to increased expectations for sharp stock moves, but it does not appear to materially affect the primary catalyst, rising demand for outsourced HR solutions, or the biggest near-term risk, which remains persistent pressures on client hiring and workforce growth.

Among recent developments, TriNet’s July announcement reaffirming its full-year 2025 revenue guidance stands out as the most relevant to this news. Consistent financial guidance, even amid fluctuations in quarterly earnings, can help reinforce market confidence in TriNet’s growth strategy, which is especially pertinent given the heightened volatility signaled by options trading activity.

However, looking past current excitement in the options market, investors should be mindful of the risk that persistently weak client hiring and muted worksite employee growth could restrict TriNet’s ability to accelerate revenue and earnings momentum over the coming quarters...

Read the full narrative on TriNet Group (it's free!)

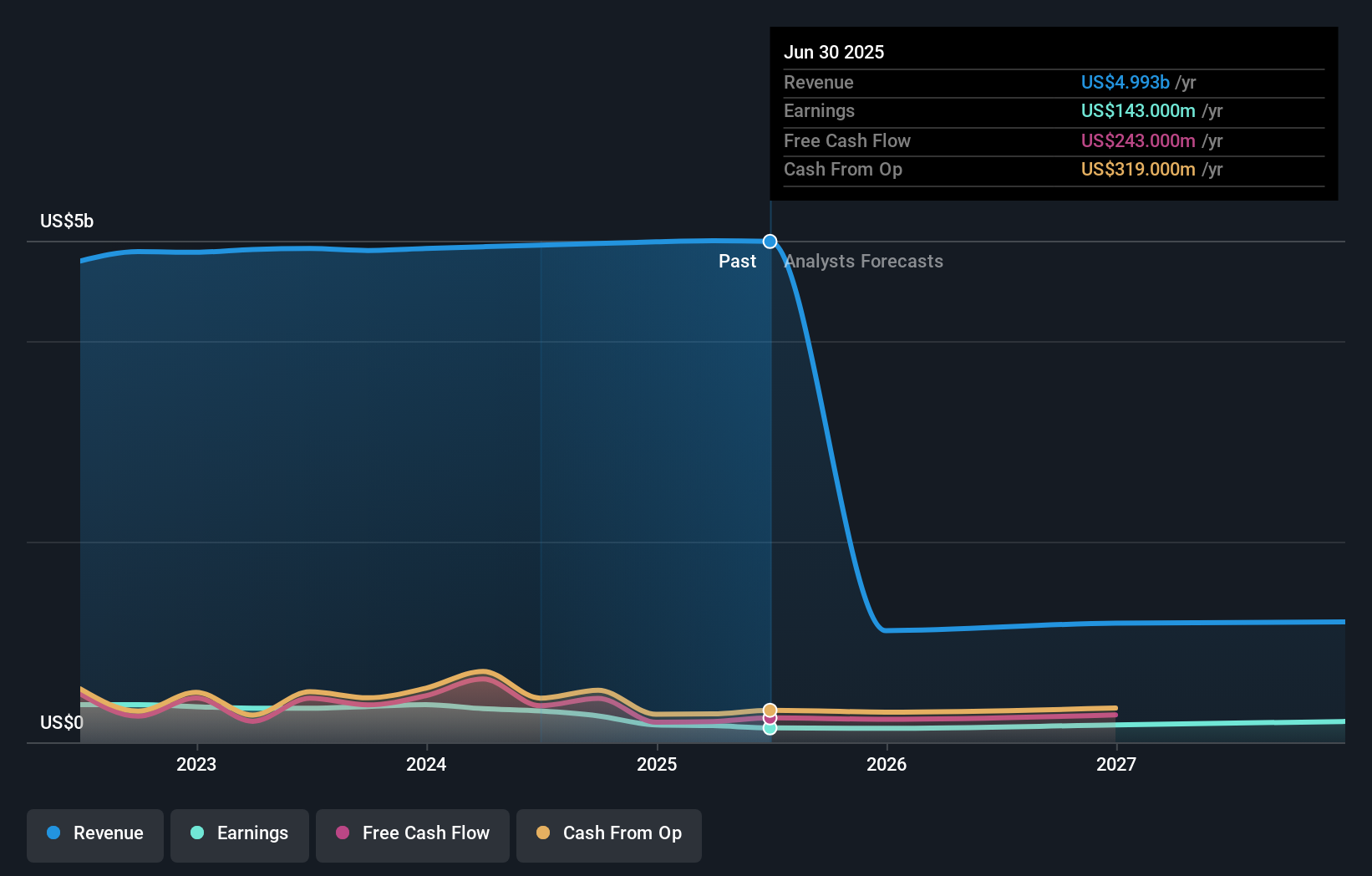

TriNet Group's narrative projects $408.0 million in revenue and $220.2 million in earnings by 2028. This requires a 56.6% yearly revenue decline and a $77.2 million increase in earnings from $143.0 million today.

Uncover how TriNet Group's forecasts yield a $78.00 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate TriNet's fair value between US$62.68 and US$78, across two contrasting independent perspectives. While some see upside for recurring revenue growth, the ongoing softness in client hiring remains a key challenge you should factor into your outlook.

Explore 2 other fair value estimates on TriNet Group - why the stock might be worth as much as 13% more than the current price!

Build Your Own TriNet Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TriNet Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free TriNet Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TriNet Group's overall financial health at a glance.

No Opportunity In TriNet Group?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TriNet Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TNET

TriNet Group

Provides comprehensive and flexible human capital management services for small and medium size businesses in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives