- United States

- /

- Professional Services

- /

- NYSE:TIXT

Why We're Not Concerned Yet About TELUS International (Cda) Inc.'s (NYSE:TIXT) 27% Share Price Plunge

The TELUS International (Cda) Inc. (NYSE:TIXT) share price has softened a substantial 27% over the previous 30 days, handing back much of the gains the stock has made lately. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 60% loss during that time.

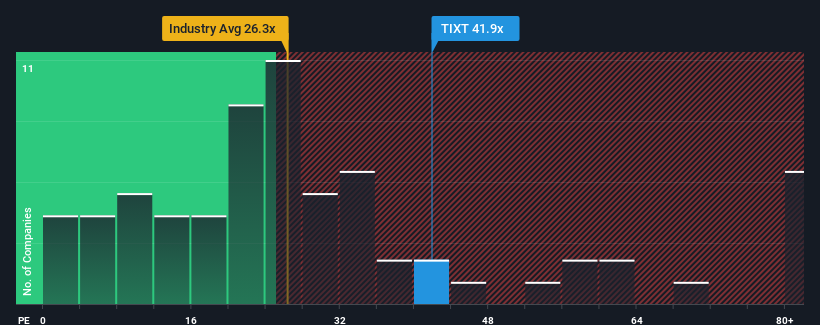

Although its price has dipped substantially, TELUS International (Cda)'s price-to-earnings (or "P/E") ratio of 41.9x might still make it look like a strong sell right now compared to the market in the United States, where around half of the companies have P/E ratios below 16x and even P/E's below 9x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

TELUS International (Cda) has been struggling lately as its earnings have declined faster than most other companies. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

See our latest analysis for TELUS International (Cda)

Does Growth Match The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like TELUS International (Cda)'s to be considered reasonable.

Retrospectively, the last year delivered a frustrating 71% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 57% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to climb by 59% per annum during the coming three years according to the analysts following the company. With the market only predicted to deliver 10% per year, the company is positioned for a stronger earnings result.

In light of this, it's understandable that TELUS International (Cda)'s P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On TELUS International (Cda)'s P/E

Even after such a strong price drop, TELUS International (Cda)'s P/E still exceeds the rest of the market significantly. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of TELUS International (Cda)'s analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for TELUS International (Cda) (1 is concerning) you should be aware of.

Of course, you might also be able to find a better stock than TELUS International (Cda). So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if TELUS International (Cda) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:TIXT

TELUS International (Cda)

Offers digital customer experience and digital solutions in the Asia-Pacific, the Central America, Europe, Africa, North America, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives