- United States

- /

- Professional Services

- /

- NYSE:SOS

Slammed 26% SOS Limited (NYSE:SOS) Screens Well Here But There Might Be A Catch

SOS Limited (NYSE:SOS) shares have retraced a considerable 26% in the last month, reversing a fair amount of their solid recent performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 47% share price drop.

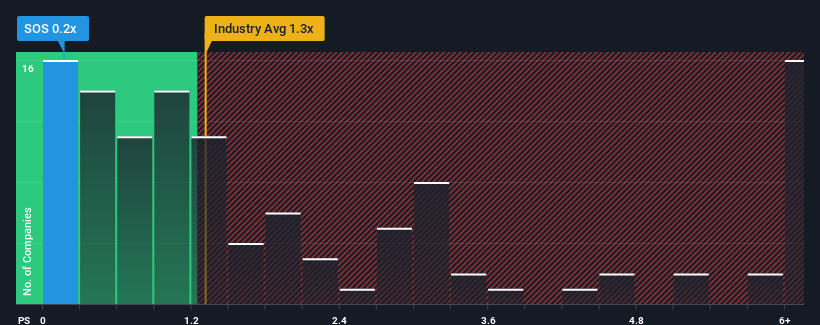

Following the heavy fall in price, SOS may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.2x, since almost half of all companies in the Professional Services industry in the United States have P/S ratios greater than 1.3x and even P/S higher than 4x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for SOS

What Does SOS' P/S Mean For Shareholders?

The revenue growth achieved at SOS over the last year would be more than acceptable for most companies. One possibility is that the P/S is low because investors think this respectable revenue growth might actually underperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on SOS' earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For SOS?

There's an inherent assumption that a company should underperform the industry for P/S ratios like SOS' to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 14% last year. The latest three year period has seen an incredible overall rise in revenue, even though the last 12 month performance was only fair. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 6.9%, the most recent medium-term revenue trajectory is noticeably more alluring

With this in mind, we find it intriguing that SOS' P/S isn't as high compared to that of its industry peers. It looks like most investors are not convinced the company can maintain its recent growth rates.

What Does SOS' P/S Mean For Investors?

SOS' P/S has taken a dip along with its share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We're very surprised to see SOS currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for SOS (1 doesn't sit too well with us) you should be aware of.

If these risks are making you reconsider your opinion on SOS, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade SOS, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:SOS

SOS

Provides data mining and analysis services to corporate and individual members in the People’s Republic of China.

Adequate balance sheet slight.

Similar Companies

Market Insights

Community Narratives